- United States

- /

- Other Utilities

- /

- NYSE:CNP

A Fresh Look at CenterPoint Energy’s (CNP) Valuation Following Recent Capital Investment Plans

Reviewed by Simply Wall St

CenterPoint Energy (CNP) has caught the eye of investors due to its upward trend over the past month, gaining nearly 5%. Compared to its peers in the utilities space, this movement stands out at a time of steady market conditions.

See our latest analysis for CenterPoint Energy.

CenterPoint Energy’s solid 5.3% share price return over the past month builds on the momentum it has been quietly gathering this year, with a robust 27.1% gain year-to-date. When you account for dividends, the total shareholder return climbs even higher, hitting 37.8% for the past 12 months. While recent weeks have seen the stock trending upward, it is part of a broader long-term pattern that has delivered strong returns for patient holders.

If steady gains like these have you rethinking your portfolio, consider broadening your search and discover fast growing stocks with high insider ownership

With such strong momentum, investors are now left wondering if CenterPoint Energy's impressive run is a signal that there's real value left to unlock, or if the market has already priced in all of its potential growth.

Most Popular Narrative: 3.7% Undervalued

CenterPoint Energy closed at $40.03, just below the most widely followed narrative's fair value of $41.57. With the market now within arm's reach of analyst expectations, all eyes are on the next catalysts.

The company announced a $1 billion increase to its capital investment plan through 2030, driven by significant load growth in the Houston Electric service territory. This is expected to bolster capital expenditures and, consequently, long-term revenue and earnings.

Wondering what bold forecasts are behind that price target? This narrative leans heavily on surging capital investments and the promise of bigger profits built on a margin makeover. Curious which financial leaps form the backbone of these projections? Uncover the full story and see which assumptions could change everything.

Result: Fair Value of $41.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory challenges and higher financing costs could slow CenterPoint Energy's earnings growth and affect the current momentum in its projections.

Find out about the key risks to this CenterPoint Energy narrative.

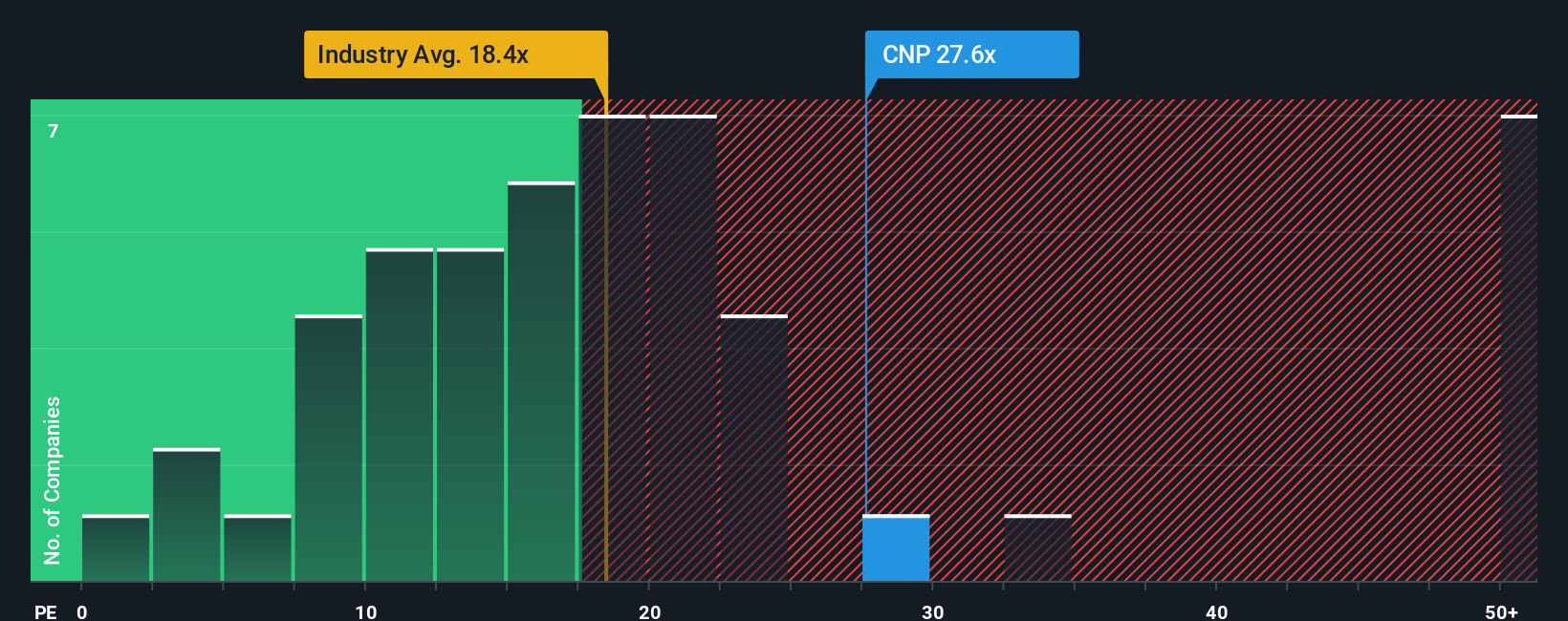

Another Perspective: Trading at a Premium

While the market sees CenterPoint Energy as undervalued based on analyst forecasts, our comparison with valuation yardsticks tells a different story. Its price-to-earnings ratio is 27.9x, far above the global industry average of 18.6x, its peers' 22.7x, and even the fair ratio of 23.5x. This premium suggests limited margin for error if growth expectations fall short. Is the stock's strong momentum justifiable?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CenterPoint Energy Narrative

If you have a different take or want to dig deeper into the numbers on your own, you can craft your version of the story in under three minutes with Do it your way.

A great starting point for your CenterPoint Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t hesitate when opportunity knocks. There are investment gems waiting that could match your strategy or spark a fresh approach in your portfolio right now.

- Unlock powerful earnings potential by reviewing these 17 dividend stocks with yields > 3% offering robust yields that could enhance your portfolio’s income stream.

- Tap into rapid innovation trends with these 24 AI penny stocks where artificial intelligence is positioned to transform entire industries and deliver strong growth for forward-thinking investors.

- Zero in on exceptional value by targeting these 879 undervalued stocks based on cash flows that are poised for future upside based on solid cash flows and attractive pricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNP

CenterPoint Energy

Operates as a public utility holding company in the United States.

Questionable track record unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives