- United States

- /

- Other Utilities

- /

- NYSE:CMS

Will CMS Energy's (CMS) Dividend Amid Storm Challenges Reveal Shifts in Capital Priorities?

Reviewed by Sasha Jovanovic

- The Board of Directors of CMS Energy recently declared a quarterly dividend of 54.25 cents per share, payable on November 26, 2025, to shareholders of record as of November 7, 2025.

- This announcement comes amid heightened regulatory scrutiny over Consumers Energy's response to extended outages following severe Michigan storms.

- We’ll examine how the company’s storm-related challenges and regulatory pressures could influence CMS Energy’s investment case moving forward.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

CMS Energy Investment Narrative Recap

To be a CMS Energy shareholder today is to believe in the company’s ability to execute on grid modernization and renewable investments while managing regulatory risks in Michigan. The recently declared quarterly dividend signals a continued commitment to shareholder returns, but does not materially offset the short-term uncertainty surrounding regulatory scrutiny related to storm outage responses, the most immediate risk to watch.

Among the company’s latest announcements, the steady payout of dividends stands out. This suggests operational stability remains intact despite reputational and cost pressures following severe weather events, though future regulatory decisions could factor into the company’s near-term outlook.

By contrast, it’s important for investors to consider the potential impact if Michigan’s regulatory environment becomes less supportive of prompt cost recovery for storm-related investments…

Read the full narrative on CMS Energy (it's free!)

CMS Energy's outlook forecasts $9.2 billion in revenue and $1.4 billion in earnings by 2028. This is based on a 4.6% annual revenue growth rate and a $0.4 billion increase in earnings from the current $1.0 billion.

Uncover how CMS Energy's forecasts yield a $77.58 fair value, a 3% upside to its current price.

Exploring Other Perspectives

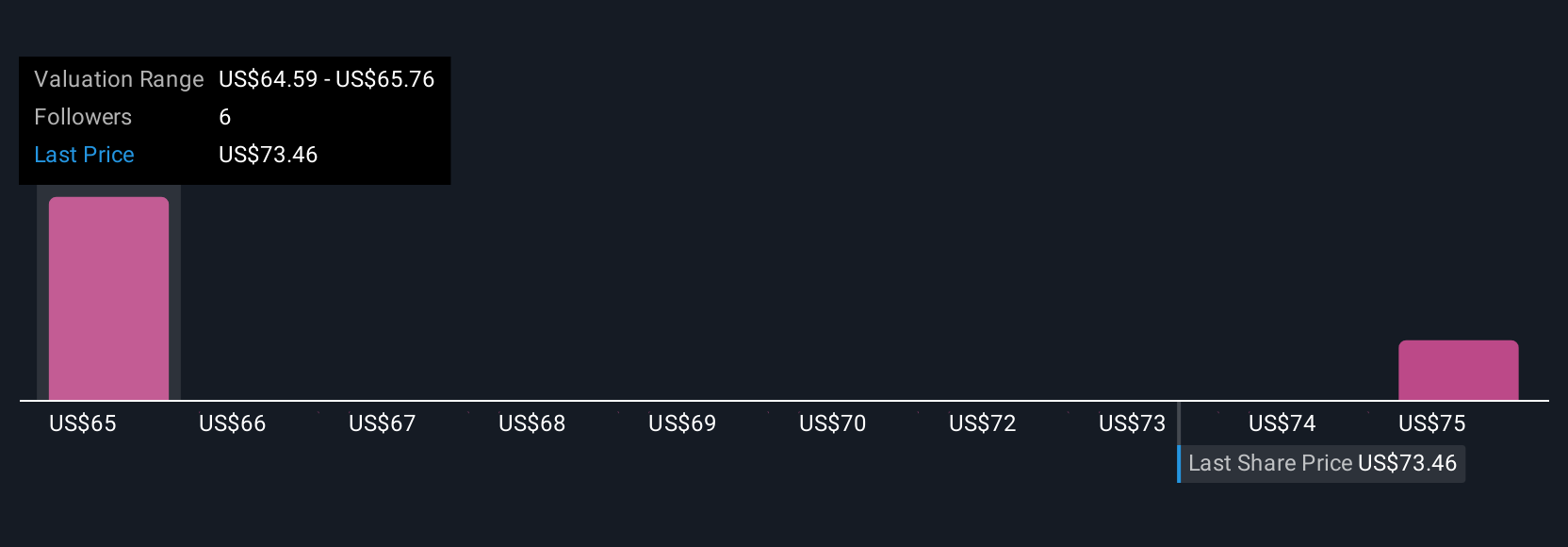

Simply Wall St Community fair value estimates for CMS Energy run from US$64.21 to US$77.58 across two individual forecasts. As recent outages intensify regulatory risks, it’s worth comparing how these community viewpoints stack up against shifting expectations for stable returns.

Explore 2 other fair value estimates on CMS Energy - why the stock might be worth as much as $77.58!

Build Your Own CMS Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CMS Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CMS Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CMS Energy's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMS

Average dividend payer and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)