- United States

- /

- Other Utilities

- /

- NYSE:CMS

These 4 Measures Indicate That CMS Energy (NYSE:CMS) Is Using Debt Extensively

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that CMS Energy Corporation (NYSE:CMS) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for CMS Energy

How Much Debt Does CMS Energy Carry?

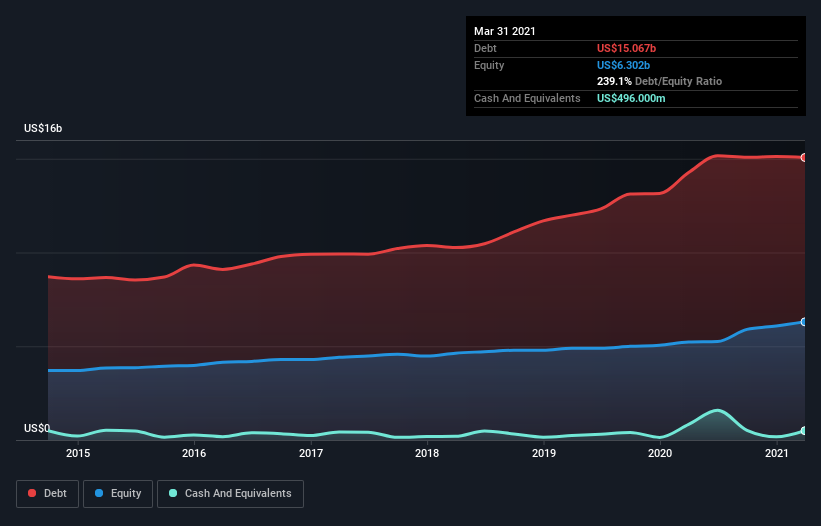

The image below, which you can click on for greater detail, shows that at March 2021 CMS Energy had debt of US$15.0b, up from US$14.3b in one year. However, it also had US$496.0m in cash, and so its net debt is US$14.5b.

A Look At CMS Energy's Liabilities

Zooming in on the latest balance sheet data, we can see that CMS Energy had liabilities of US$2.89b due within 12 months and liabilities of US$20.5b due beyond that. On the other hand, it had cash of US$496.0m and US$1.14b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$21.8b.

Given this deficit is actually higher than the company's massive market capitalization of US$17.9b, we think shareholders really should watch CMS Energy's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

CMS Energy has a rather high debt to EBITDA ratio of 5.7 which suggests a meaningful debt load. However, its interest coverage of 2.9 is reasonably strong, which is a good sign. However, one redeeming factor is that CMS Energy grew its EBIT at 19% over the last 12 months, boosting its ability to handle its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if CMS Energy can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, CMS Energy saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both CMS Energy's net debt to EBITDA and its track record of converting EBIT to free cash flow make us rather uncomfortable with its debt levels. But on the bright side, its EBIT growth rate is a good sign, and makes us more optimistic. We should also note that Integrated Utilities industry companies like CMS Energy commonly do use debt without problems. We're quite clear that we consider CMS Energy to be really rather risky, as a result of its balance sheet health. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 1 warning sign for CMS Energy that you should be aware of before investing here.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade CMS Energy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:CMS

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives