- United States

- /

- Other Utilities

- /

- NYSE:CMS

CMS Energy (CMS): Assessing Valuation After Regulatory Wins and Leadership Changes Fuel Growth Optimism

Reviewed by Kshitija Bhandaru

CMS Energy (CMS) is capturing investor attention after securing a significant gas rate increase from Michigan regulators, along with encouraging electric rate case recommendations and several new executive appointments. These developments are laying a strong foundation for steady growth and improved sentiment.

See our latest analysis for CMS Energy.

Momentum around CMS Energy is gathering pace, with its recent regulatory wins and leadership changes coinciding with a notable year-to-date share price return of 8.7%. This builds on a healthy 1-year total shareholder return of 4.7%, which points to improving confidence in the company’s growth outlook.

If these kinds of catalysts have you curious, now might be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares already rallying on the back of positive regulatory decisions and management changes, the key question now is whether CMS Energy’s recent momentum still leaves room for upside or if future growth is already priced in.

Most Popular Narrative: 5.5% Undervalued

At $72.34 per share, CMS Energy’s current price trails the most popular narrative’s fair value of $76.54. This setup spotlights a narrow window, hinting the market is not far off analyst-led projections and sparking debate about just how much upside may remain.

A robust $25+ billion pipeline in grid modernization and renewable investments, paired with supportive federal policies and tax credits, positions CMS Energy to capitalize on regulatory-approved projects and improve return on equity, supporting long-term earnings growth.

Want to uncover what is powering this narrative? The assumptions go beyond utility basics. There is a bold bet on investment scale, future profit margins, and sector-leading earnings. Curious what projections drive this surprisingly high fair value? Click through and see the full story, including what could make or break expectations for this Michigan powerhouse.

Result: Fair Value of $76.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected regulatory hurdles or slower than anticipated demand growth from large customers could still challenge CMS Energy’s high expectations and future performance.

Find out about the key risks to this CMS Energy narrative.

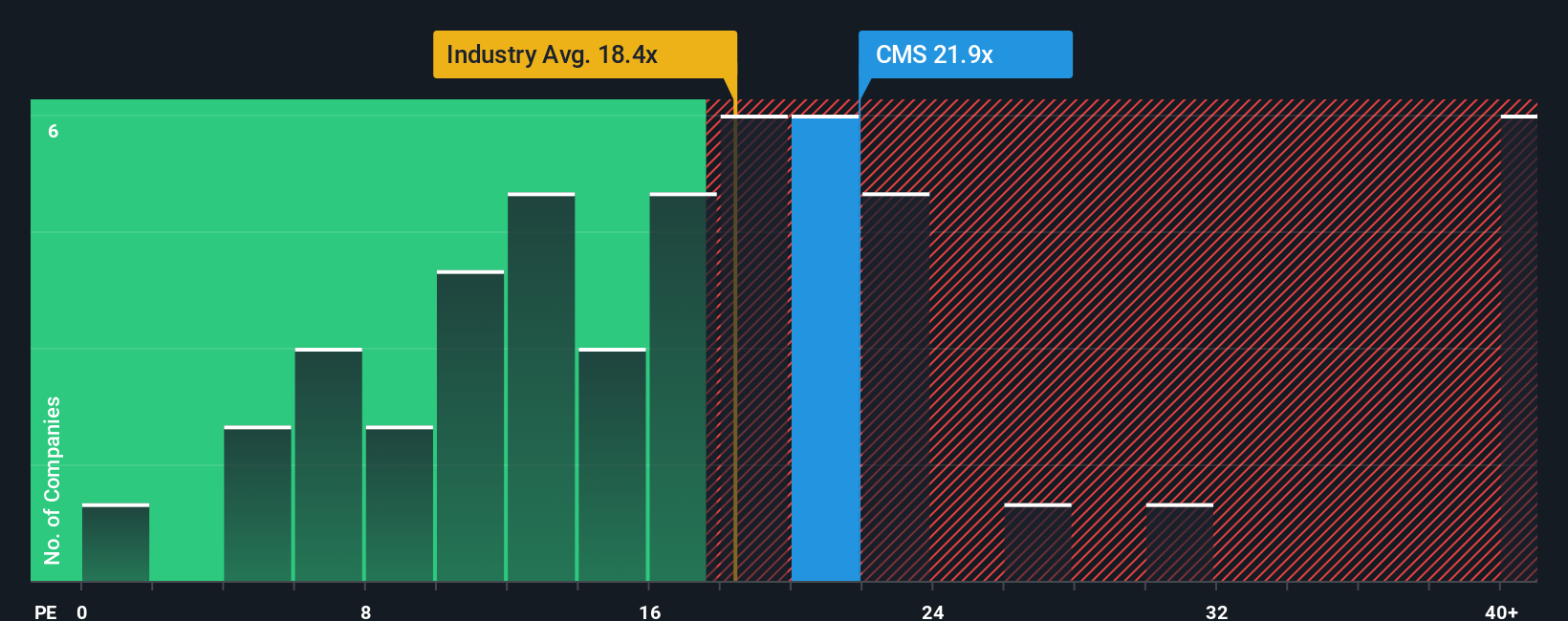

Another View: Price-to-Earnings Signals Richer Valuation

Taking a different angle, CMS Energy's price-to-earnings ratio sits at 21.4x, which is higher than both its industry peers (18.3x globally and 19.7x US average) and the estimated fair ratio of 20.6x. This suggests investors may already be paying a premium relative to future growth. Does the market see something more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CMS Energy Narrative

Prefer to chart your own course or dig deeper with your own research? Craft a narrative in just a few minutes: Do it your way

A great starting point for your CMS Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take charge of your investing journey by tapping into new opportunities that could set your portfolio apart. The right move now might change your returns for years to come.

- Grab the chance to spot high-potential bargains among remarkable businesses with these 896 undervalued stocks based on cash flows before the rest of the market catches up.

- Catch big yields by targeting strong, income-generating companies through these 19 dividend stocks with yields > 3% that deliver more than just steady growth.

- Step ahead of the next tech wave by seeking out promising markets in artificial intelligence with these 24 AI penny stocks and fuel your strategy for long-term gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMS

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives