- United States

- /

- Water Utilities

- /

- NYSE:AWK

Assessing American Water Works (AWK) Valuation After a Modest 4% Monthly Share Price Rebound

Reviewed by Simply Wall St

American Water Works Company (AWK) has been quietly grinding higher recently, with shares up about 4% over the past month even as the past 3 months remain slightly underwater.

See our latest analysis for American Water Works Company.

Zooming out, that steady 30 day share price return of nearly 4% looks more like a gentle rebound within a choppy year. The year to date share price return is modest and the 3 year total shareholder return is still negative, suggesting sentiment is improving but not yet fully convinced.

If American Water Works has you rethinking your defensives, it could be worth scanning other regulated names and discovering healthcare stocks as potential complements in a resilient portfolio mix.

With earnings still growing and the share price only modestly ahead of analyst targets, is American Water Works quietly trading below its long term potential, or is the market already pricing in years of regulated growth?

Most Popular Narrative: 8.9% Undervalued

With American Water Works last closing at $130.97 against a popular fair value of $143.78, the prevailing storyline sees more upside than the market is currently pricing.

Heightened regulatory and societal focus on water quality and infrastructure modernization is accelerating rate case approvals and driving significant capital investment (e.g., $3.3 billion capital spend in 2025, requests for $111 million cumulative rate increases in CA by 2029); these factors enable predictable, above inflation rate increases and support sustainable earnings expansion.

Curious how steady, regulated earnings and rising margins can still justify a richer future earnings multiple than today, even in a slow growth utility? The most followed narrative quietly stacks long term revenue expansion, higher profitability, and a premium valuation into one cohesive forecast. Want to see exactly how those assumptions combine to support that higher fair value per share? Read on and unpack the full story behind the numbers.

Result: Fair Value of $143.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost inflation and heavier debt financing could squeeze margins and blunt returns, especially if regulators are less receptive to future rate hikes.

Find out about the key risks to this American Water Works Company narrative.

Another Angle on Valuation

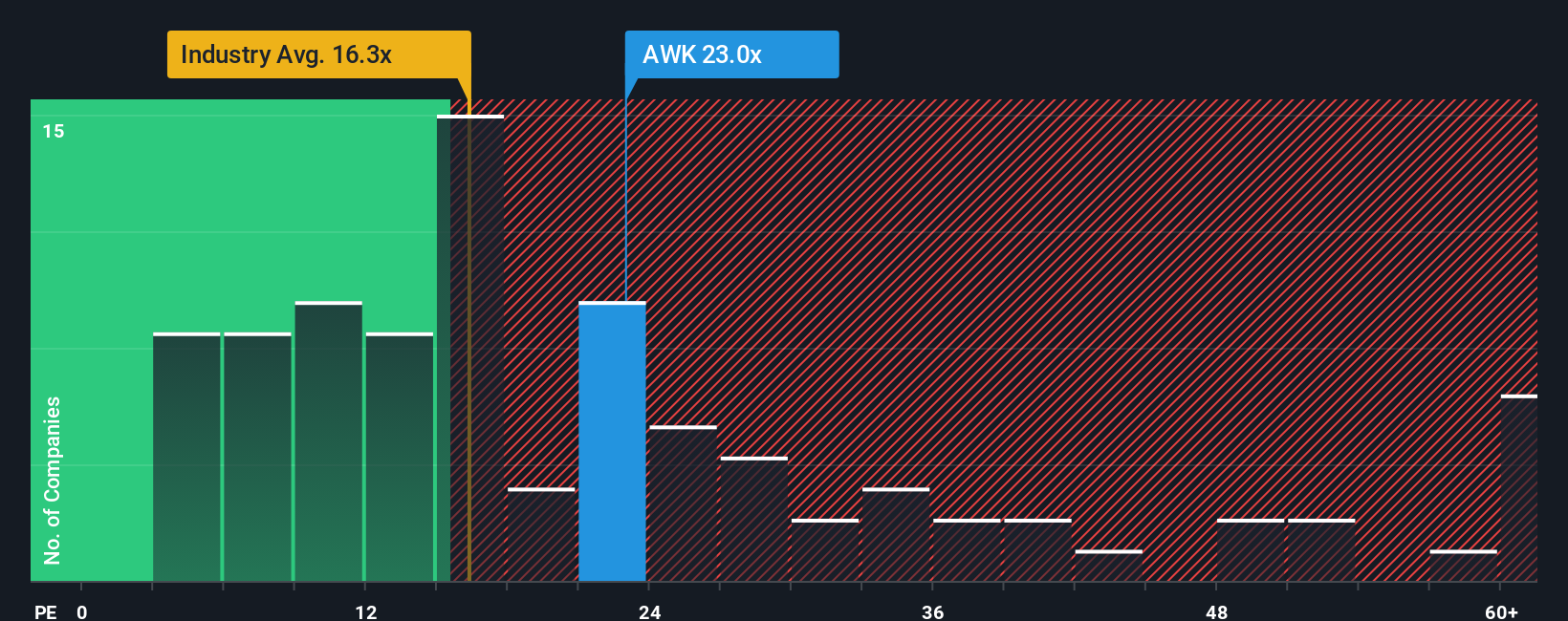

On earnings, the picture is less forgiving. AWK trades on about 23 times earnings, richer than both its global water utility peers at 16.1 times and many direct comparables at 18.4 times. Even versus a 23.6 times fair ratio, the margin for error looks slim rather than generous.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own American Water Works Company Narrative

If this perspective does not quite fit your view, or you prefer to dig into the figures yourself, you can build a tailored narrative in just a few minutes, starting with Do it your way.

A great starting point for your American Water Works Company research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, take a moment to line up your next opportunities with Simply Wall St's focused screeners so you are not leaving potential returns untouched.

- Target reliable income streams by reviewing these 14 dividend stocks with yields > 3% that could strengthen your portfolio with consistent cash payouts.

- Capitalize on market mispricings by scanning these 915 undervalued stocks based on cash flows where strong fundamentals may not yet be fully recognized in the share price.

- Lean into innovation by assessing these 30 healthcare AI stocks positioned at the intersection of medical breakthroughs and cutting edge technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AWK

American Water Works Company

Through its subsidiaries, provides water and wastewater services in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026