- United States

- /

- Water Utilities

- /

- NYSE:AWK

American Water Works Company (NYSE:AWK) Announces CEO Change; Reports US$239M Net Income With 17% Sales Growth

Reviewed by Simply Wall St

American Water Works Company (NYSE:AWK) recorded a share price increase of 2.27% last week, potentially reflecting investor responses to its robust fourth-quarter earnings announcement, where both sales and net income saw significant year-over-year growth. The planned CEO transition from M. Susan Hardwick to John C. Griffith, effective in May, may also add stability, given Griffith's extensive financial management experience. The company's reaffirmed earnings guidance and long-term growth targets for 2025 could have provided additional investor confidence. Meanwhile, broader market trends saw a mixed week, with declines in major indices due to concerns over economic policies, though the market registered a 1.2% rise. While Walmart's disappointing outlook and Palantir's plunge influenced broader market sentiment negatively, AWK's specific developments presented investors with a more positive outlook, contributing to its weekly share price gain against a backdrop of fluctuating market conditions.

Unlock comprehensive insights into our analysis of American Water Works Company stock here.

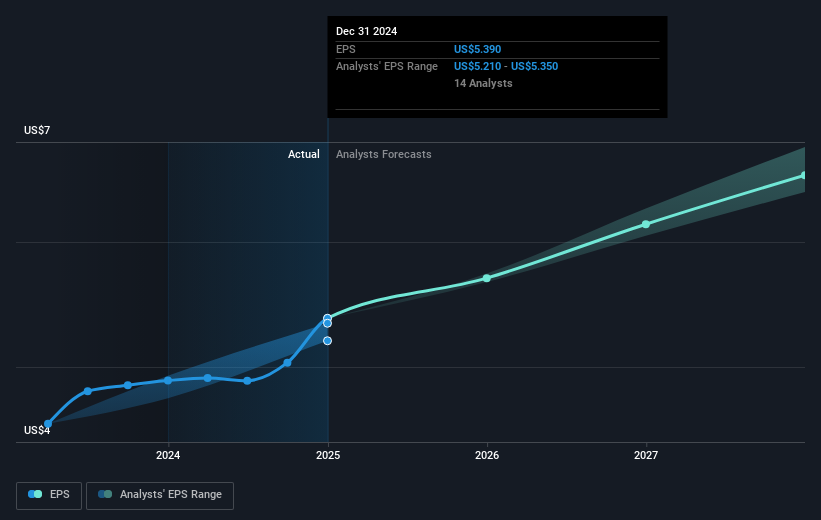

American Water Works Company achieved a total return of 7.47% over the past year, underperforming the broader US Market's 23.7% return but surpassing the 1.5% yield from the US Water Utilities industry. Key factors include a robust financial performance highlighted by increased sales and net income announced on February 19, 2025, and affirmed corporate guidance with long-term growth targets for earnings per share and dividends. These foundational elements have helped provide returns in a competitive market environment.

Throughout the year, American Water Works continued investing in infrastructure, such as completing a $31.5 million upgrade at the Jerseyville water treatment plant and a $4.5 million project in Bellflower. The company's consistent dividend payouts, most recently confirmed at $0.7650 per share in December, reflect a dedication to shareholder value. Although no shares were repurchased in the latest update, nearing five million shares have been bought back since 2015, signaling a commitment to supporting share performance.

- Unlock the insights behind American Water Works Company's valuation and discover its true investment potential

- Explore the potential challenges for American Water Works Company in our thorough risk analysis report.

- Shareholder in American Water Works Company? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AWK

American Water Works Company

Through its subsidiaries, provides water and wastewater services in the United States.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives