- United States

- /

- Other Utilities

- /

- NYSE:AVA

How Investors Are Reacting To Avista (AVA) Filing Its 2025 Clean Energy Implementation Plan

Reviewed by Sasha Jovanovic

- In the past week, Avista filed its 2025 Clean Energy Implementation Plan with the Washington Utilities and Transportation Commission, outlining a path to boost clean energy delivery from 66% in 2026 to 76.5% by 2029 and aiming for carbon-neutral electricity by 2030.

- An important part of the plan is the introduction of demand-response programs expected to reduce peak electricity load by up to 55 MW between 2026 and 2029, pending regulatory approval.

- We'll explore how Avista's push for carbon-neutral electricity could influence the company's long-term outlook and risk profile.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Avista Investment Narrative Recap

To own Avista stock, you need to be comfortable with its heavy reliance on constructive regulatory outcomes in the Pacific Northwest and the realities of rising capital needs for clean energy and grid upgrades. The new Clean Energy Implementation Plan lays out ambitious renewable goals, but its impact in the near-term largely depends on how regulators respond; the most pressing short-term catalyst remains large load growth from industrial demand, while regulatory risk continues to be the main business threat. For now, the filing does not materially shift that balance for investors tracking immediate earnings drivers or major valuation risks.

Among recent announcements, Avista’s leadership restructuring in August may prove relevant, as it aligns senior roles with the evolving requirements of energy policy, technology, and grid operations, areas that link directly to both the company's clean energy ambitions and its need to manage regulatory relationships effectively. As these changes unfold, they could influence the company’s ability to address the operational and cost pressures that stem from decarbonization plans and rising customer demand.

Yet, despite this progress, investors should be aware that if regulatory approvals for proposed rate recovery lag behind the rapid pace of capital spending…

Read the full narrative on Avista (it's free!)

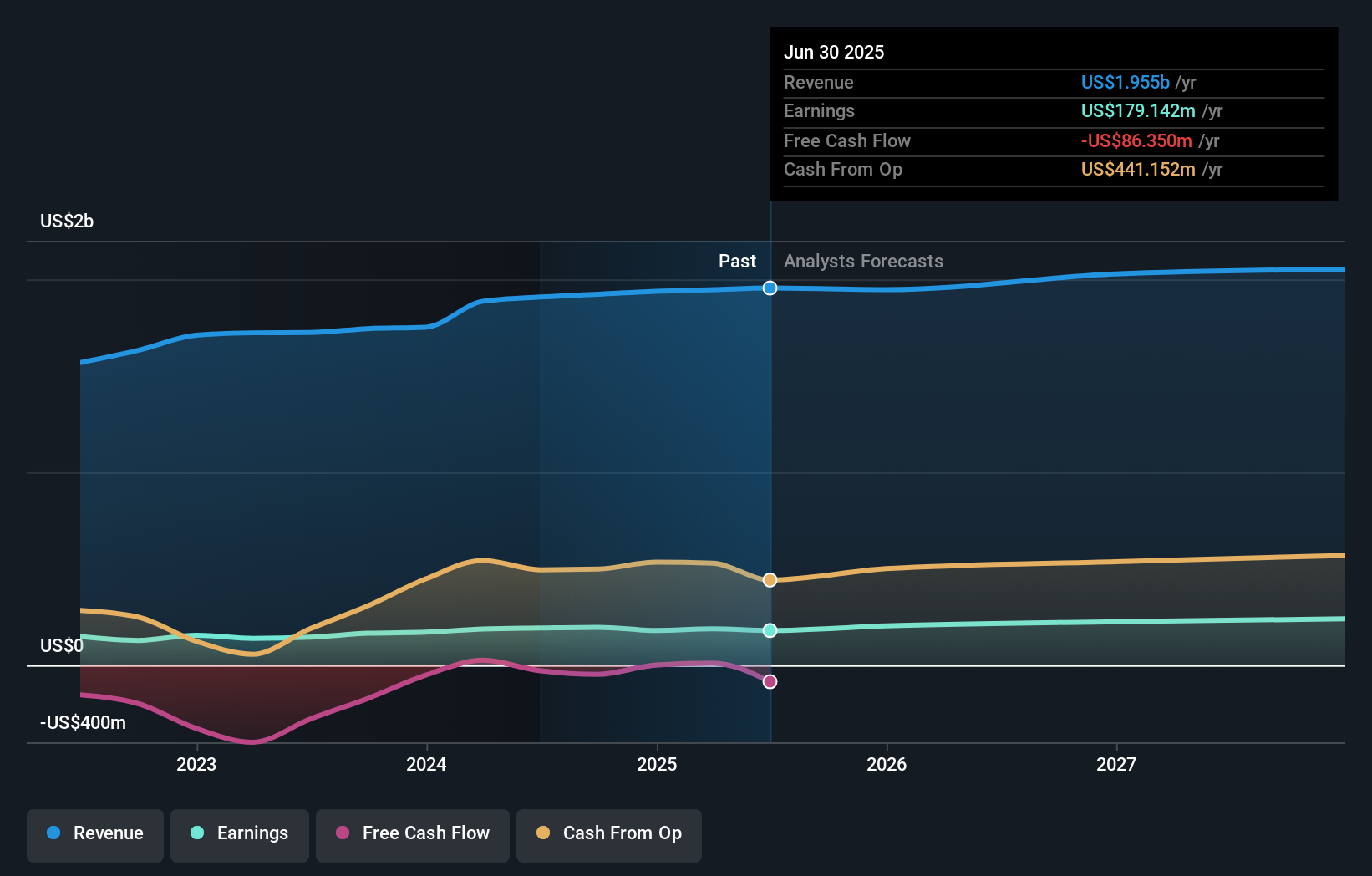

Avista's narrative projects $2.1 billion revenue and $245.2 million earnings by 2028. This requires 3.1% yearly revenue growth and a $66.2 million earnings increase from the current $179.0 million.

Uncover how Avista's forecasts yield a $41.00 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span from US$35 to US$41 per share. While clean energy initiatives support growth opportunities, unresolved regulatory risks mean opinions on Avista’s future performance can vary widely, check out how others view the potential reward and uncertainty.

Explore 3 other fair value estimates on Avista - why the stock might be worth 6% less than the current price!

Build Your Own Avista Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Avista research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Avista research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Avista's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AVA

Avista

Operates as an electric and natural gas utility company in the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)