- United States

- /

- Gas Utilities

- /

- NYSE:ATO

Atmos Energy (NYSE:ATO) Secures US$3 Billion Credit Extension Until 2030

Reviewed by Simply Wall St

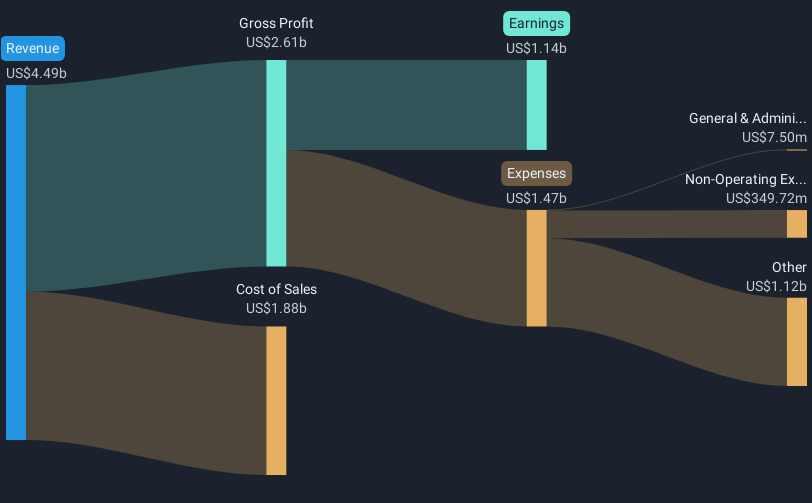

Atmos Energy (NYSE:ATO) has seen a price increase of nearly 12% over the last quarter, a noteworthy contrast to the broader market, which has recently experienced a decline of around 6%. The company's extension of its revolving credit facilities, each valued at $1.5 billion, with maturity dates extended up to 2030, played a crucial role. Additionally, Atmos Energy reported robust Q1 earnings, with net income climbing to $352 million. This performance is particularly impressive given the broader context of market volatility, largely driven by escalating tariff tensions impacting the Dow and Nasdaq indices.

Be aware that Atmos Energy is showing 2 risks in our investment analysis.

Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

Over the last five years, Atmos Energy has achieved a total shareholder return of 67.66%. This performance is noteworthy when compared to its recent outperformance against the US market over the past year. Several key factors may explain this long-term growth. The company has consistently improved its infrastructure and expanded its customer base, particularly in Texas, enhancing operational efficiency and supply reliability. Additionally, successful rate increases in multiple jurisdictions have supported earnings, despite regulatory uncertainties posing potential revenue risks.

Corporate actions such as the recent five-year, $1.5 billion revolving credit facility, with maturity extended to 2030, have bolstered financial stability. Furthermore, consistent earnings announcements have reinforced investor confidence, as reflected in the financial results for FY 2024 and Q1 2025, where net income reached close to US$352 million. These developments, along with a steady increase in dividends, underscore Atmos's commitment to driving shareholder value.

Take a closer look at Atmos Energy's potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Atmos Energy, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATO

Atmos Energy

Engages in the regulated natural gas distribution, and pipeline and storage businesses in the United States.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives