- United States

- /

- Renewable Energy

- /

- NYSE:AMPS

Despite delivering investors losses of 11% over the past 1 year, Altus Power (NYSE:AMPS) has been growing its earnings

It's easy to match the overall market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. Investors in Altus Power, Inc. (NYSE:AMPS) have tasted that bitter downside in the last year, as the share price dropped 11%. That contrasts poorly with the market return of 2.6%. Altus Power hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. In the last ninety days we've seen the share price slide 36%.

While the stock has risen 8.1% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Check out our latest analysis for Altus Power

SWOT Analysis for Altus Power

- Earnings growth over the past year exceeded the industry.

- Interest payments on debt are not well covered.

- Shareholders have been diluted in the past year.

- Annual earnings are forecast to grow faster than the American market.

- Good value based on P/E ratio compared to estimated Fair P/E ratio.

- Debt is not well covered by operating cash flow.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Altus Power managed to increase earnings per share from a loss to a profit, over the last 12 months.

Earnings per share growth rates aren't particularly useful for comparing with the share price, when a company has moved from loss to profit. So it makes sense to check out some other factors.

Altus Power's revenue is actually up 41% over the last year. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

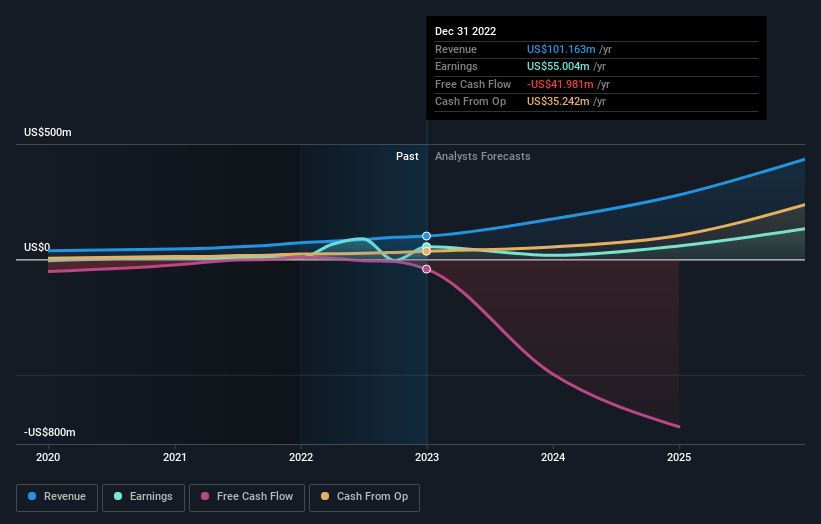

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that Altus Power has improved its bottom line lately, but what does the future have in store? So it makes a lot of sense to check out what analysts think Altus Power will earn in the future (free profit forecasts).

A Different Perspective

Given that the market gained 2.6% in the last year, Altus Power shareholders might be miffed that they lost 11%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Notably, the loss over the last year isn't as bad as the 36% drop in the last three months. So it seems like some holders have been dumping the stock of late - and that's not bullish. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 3 warning signs we've spotted with Altus Power (including 1 which doesn't sit too well with us) .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AMPS

Altus Power

A clean electrification company, develops, constructs, owns, and operates roof, ground, and carport-based photovoltaic solar energy generation and storage systems in the United States.

Slight with questionable track record.

Market Insights

Community Narratives