- United States

- /

- Electric Utilities

- /

- NYSE:ALE

The Bull Case For ALLETE (ALE) Could Change Following $250M Private Bond Placement Completion – Learn Why

Reviewed by Simply Wall St

- On July 9, 2025, ALLETE, Inc. completed a US$250 million private bond placement with institutional investors, issuing non-convertible bonds across multiple maturities and fixed interest rates.

- This significant capital raise highlights ALLETE's approach to securing long-term funding through private markets and diversifying its financing sources.

- We'll explore how the company's successful multi-tranche bond placement reinforces its focus on long-term balance sheet strength and investment capacity.

What Is ALLETE's Investment Narrative?

ALLETE, Inc. continues to attract shareholders who believe in the strength of regulated utilities, consistent dividends, and infrastructure investment. The recent US$250 million multi-tranche bond placement, with maturities out as far as 2055, signals ALLETE’s commitment to funding future growth and shoring up its balance sheet. While this private funding provides new flexibility and may help address concerns about covering interest payments and future investments, the market’s muted response suggests the announcement is not a clear game-changer for short-term catalysts. The company is working through regulatory scrutiny related to its proposed buyout and ongoing project investments, with dividend sustainability and slower-than-market revenue growth as key discussion points. For now, major risks, such as limited free cash coverage for dividends, are unchanged, but ALLETE’s new funding improves its options heading into what's shaping up to be an eventful period.

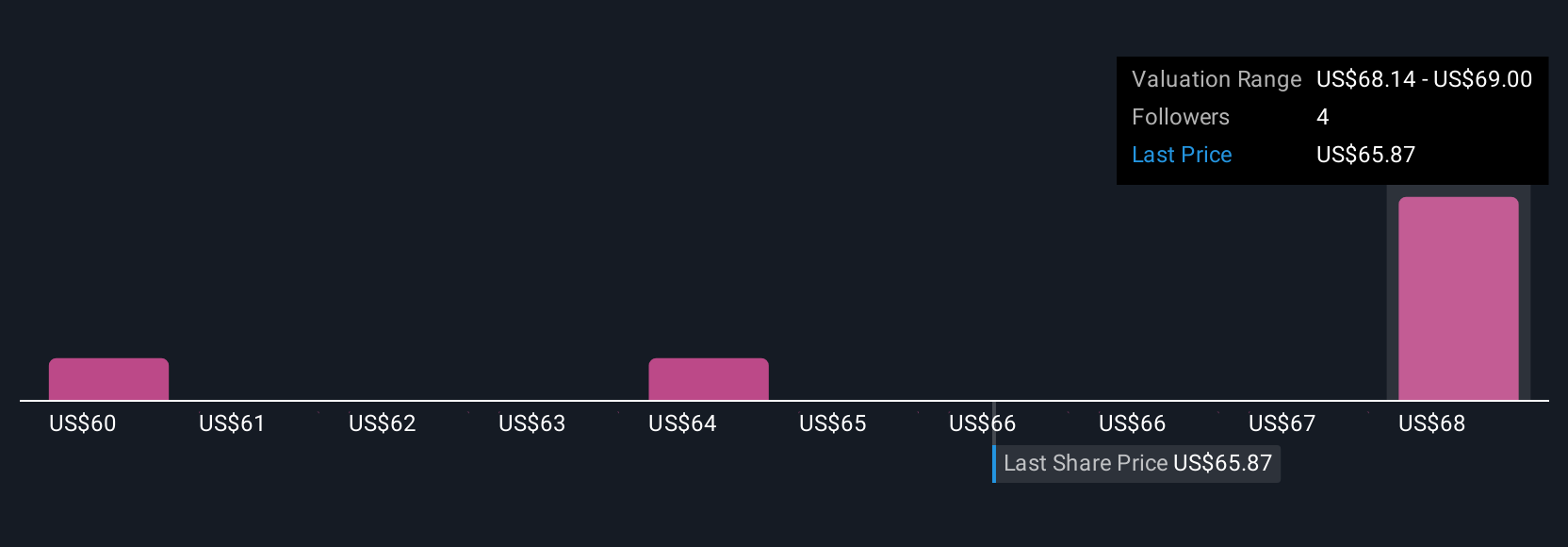

But dividend sustainability remains a risk that investors should keep front of mind. ALLETE's share price has been on the slide but might be up to 9% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Build Your Own ALLETE Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ALLETE research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ALLETE research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ALLETE's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALE

Reasonable growth potential second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion