- United States

- /

- Electric Utilities

- /

- NYSE:ALE

How ALLETE’s Stock Rally Stacks Up After New Renewable Energy Investment

Reviewed by Bailey Pemberton

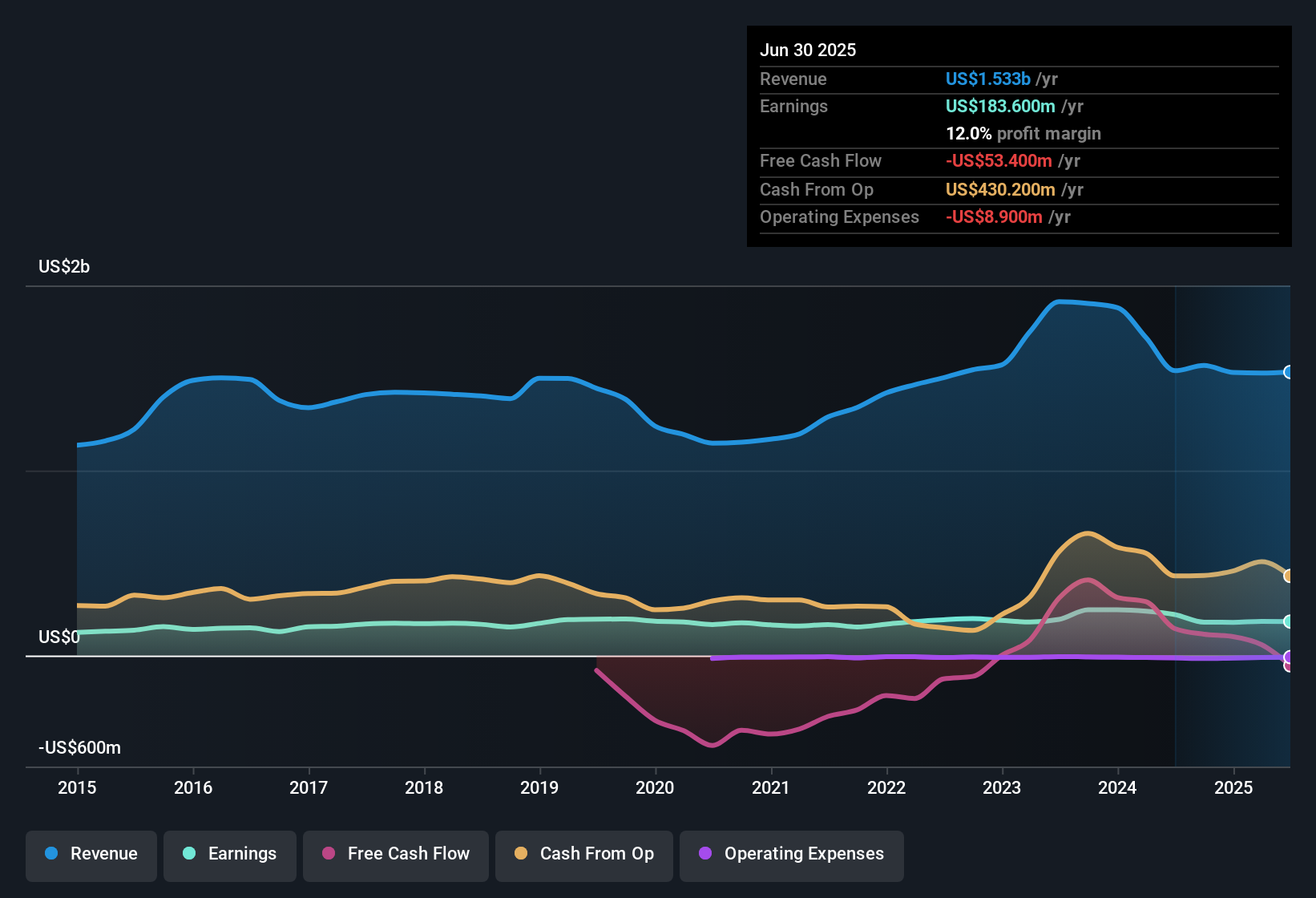

Trying to figure out whether to buy, sell, or hold ALLETE? You are not alone. Plenty of investors are taking a close look at the company's recent run. ALLETE’s stock price has posted some quietly impressive gains, up 5.5% over the last month and 9.4% in the past year. That solid uptrend hints at renewed investor optimism, possibly connected to ongoing shifts in the energy sector and investor confidence in utilities. Over longer timeframes, ALLETE’s performance stands out even more, with shares climbing more than 54% over five years. This is a compelling track record for a utility-focused firm.

Still, when it comes to value, the story is less clear-cut. Out of six major valuation checks, ALLETE earns a value score of just 1, suggesting there may be room for skepticism about whether the stock is truly undervalued at its current price of $67.3. Of course, numbers alone can be misleading, and valuation is as much about perspective as calculation. In the next section, we will dig into those different valuation approaches and see what each one says about ALLETE. As you will see, these may not always match up with the full picture. If you are after the most practical way to judge a stock’s worth, stick around for what could be an even better lens for valuation at the end of the article.

ALLETE scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: ALLETE Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) provides a framework to estimate a company’s intrinsic value by focusing on its dividend payments and expected dividend growth. In essence, the model projects future dividend payouts and discounts them back to their present value, reflecting both how sustainable and how likely those payments are to grow over time.

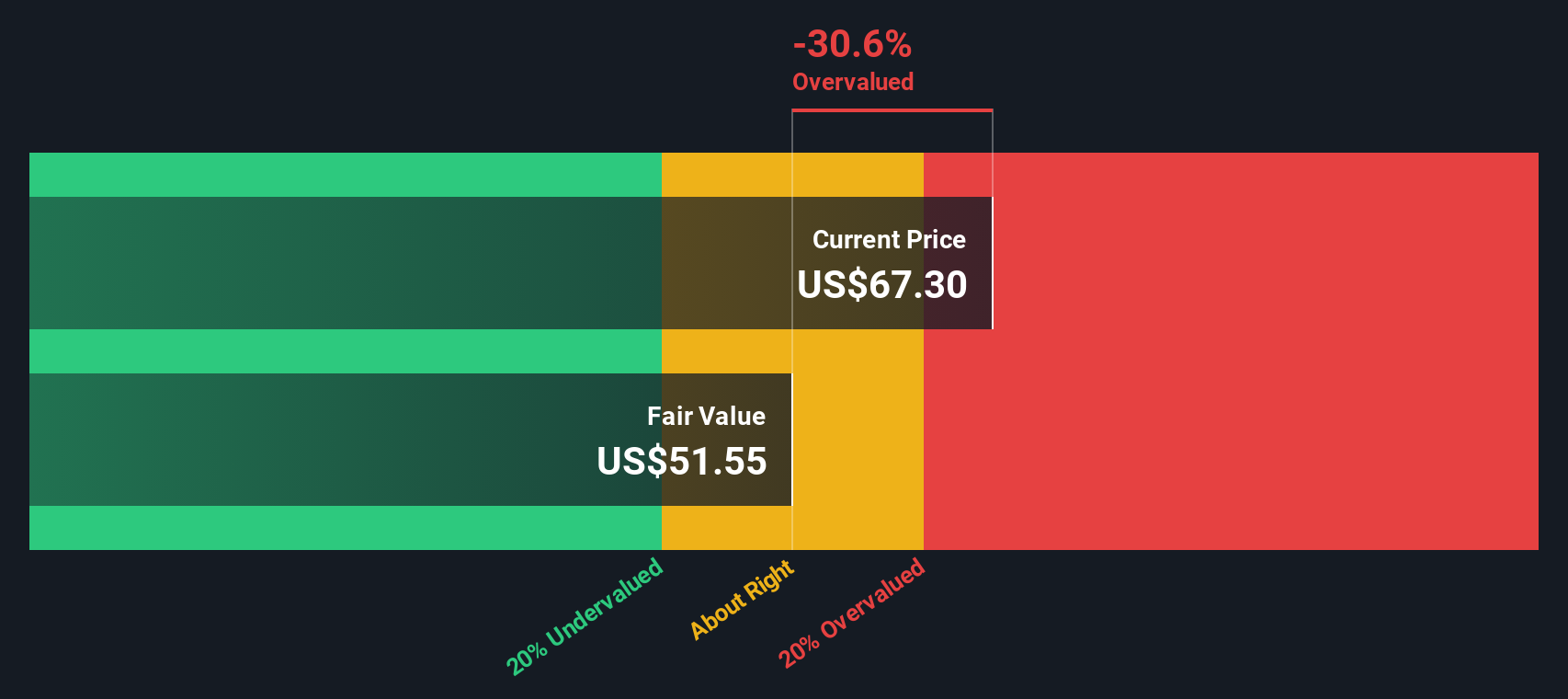

For ALLETE, the current dividend per share stands at $2.99 with a payout ratio of 77.1% and a return on equity of 4.2%. Applying the DDM formula, which assumes future dividend growth at just under 1% per year, we find that the model estimates ALLETE's fair value at $51.55. According to the methodology, this modest long-term growth implies that most of the company’s earnings are being distributed, which leaves limited room for accelerating future dividends.

Comparing the DDM-derived value to today’s share price of $67.30, the stock appears to be 30.6% overvalued. The takeaway is clear: strong dividend history aside, market expectations for growth are running ahead of what the company’s dividend profile supports at current levels.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests ALLETE may be overvalued by 30.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: ALLETE Price vs Earnings

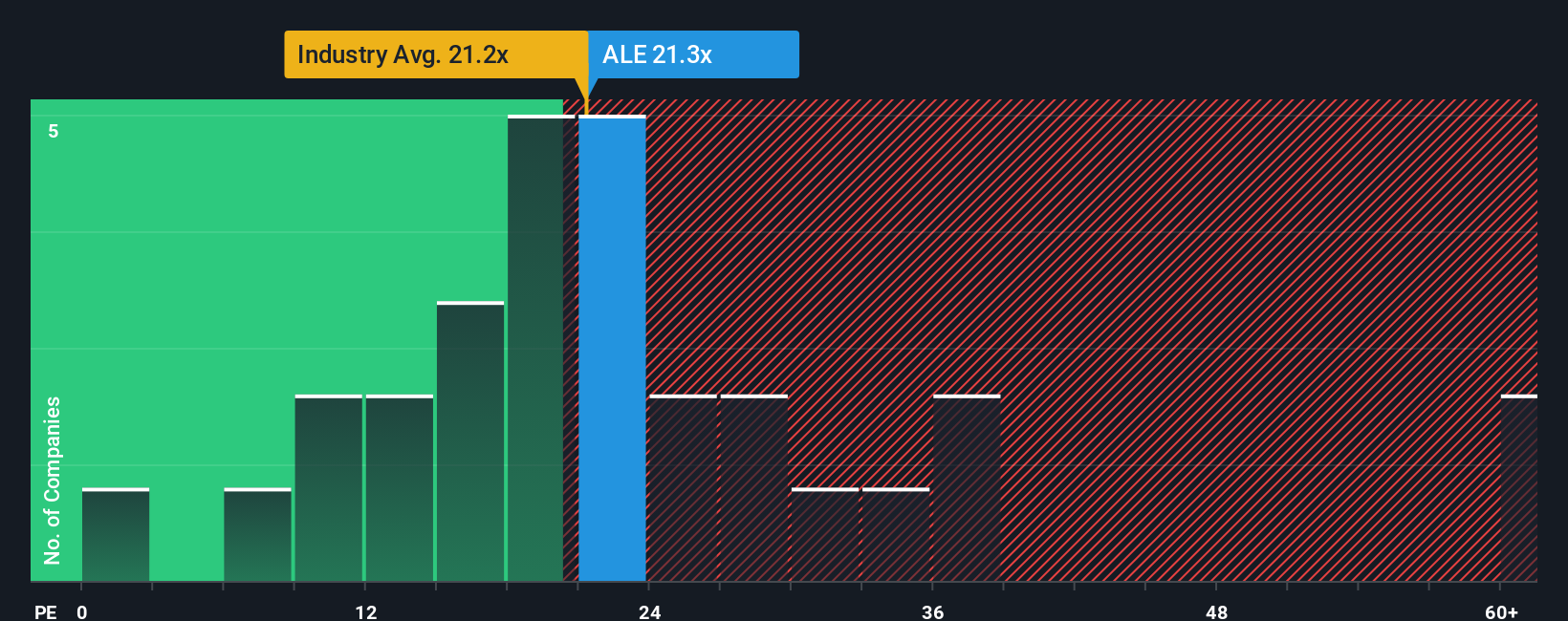

For profitable companies like ALLETE, the price-to-earnings (PE) ratio is a widely used and meaningful valuation tool because it shows how much investors are willing to pay for each dollar of earnings. The PE ratio also captures the market’s expectations for future growth and the perceived risk of a business. Higher growth prospects or strong stability typically justify a higher PE, while elevated risks or slower growth call for a lower multiple.

ALLETE currently trades at a PE ratio of 21.27x. To put this in context, the average PE for the Electric Utilities industry is 21.25x, with ALLETE’s listed peers averaging 21.11x. This means ALLETE’s multiple is right in line with its sector and peer group, suggesting that the market sees its prospects as typical for this space.

However, rather than just comparing simple averages, Simply Wall St’s proprietary “Fair Ratio” takes a more comprehensive view. It calculates what the company’s PE should be considering factors like future earnings growth, profit margins, business risks, industry dynamics, and ALLETE’s own market size. In this case, ALLETE’s Fair Ratio is 21.82x, slightly above its current PE ratio.

Since the difference between ALLETE’s Fair Ratio and its actual PE is less than 0.10x, the stock’s valuation appears fairly matched to its fundamentals and risk profile.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ALLETE Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple framework that allows you to share your perspective on a company like ALLETE by creating a story behind the numbers. With Narratives, you link your view of the company’s future to financial estimates such as fair value, expected revenues, earnings, and margins, building a complete picture in just a few clicks.

Narratives go beyond static models by connecting a company’s story directly to financial forecasts and then to what you believe is a fair value. They are easy and accessible and can be found on Simply Wall St’s platform in the Community page, where millions of investors share their insights. Narratives help you make smarter decisions by letting you compare your fair value with the current price and are updated automatically as important news and earnings releases come in.

For example, one investor might see ALLETE’s fair value at $75 with high growth hopes, while another believes $51 is more realistic with slower prospects. Narratives let you see and compare these different stories, making it easier to decide when to buy, sell or hold, based on both numbers and real-world context.

Do you think there's more to the story for ALLETE? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALE

Reasonable growth potential second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Thanks for sharing these. They really help when I pick what dividend stocks to invest in