- United States

- /

- Other Utilities

- /

- NYSE:AEE

Assessing Ameren (AEE) Valuation After Its Recent Pullback and Ongoing Grid Modernization Plans

Reviewed by Simply Wall St

Ameren (AEE) has quietly outperformed many utilities this year, and the recent pullback after its latest move has some investors wondering whether this is a chance to add a steady dividend name.

See our latest analysis for Ameren.

At around $99.86, Ameren’s recent 7 day share price return of minus 6.10 percent comes after a solid year to date share price gain of 12.21 percent. Its 5 year total shareholder return of 48.19 percent suggests longer term, compounding gains remain intact even as near term momentum cools.

If Ameren’s mix of stability and steady returns appeals to you, it could also be worth exploring other regulated utilities and infrastructure names, or even fast growing stocks with high insider ownership for ideas with more upside potential.

With earnings still growing and the share price now sitting below Wall Street targets, investors face a familiar puzzle: is Ameren quietly trading at a discount, or has the market already priced in its next leg of growth?

Most Popular Narrative Narrative: 11.3% Undervalued

With Ameren last closing at $99.86 against a narrative fair value of $112.57, the current pullback sits in the shadow of higher long term expectations.

Ongoing and future investments in grid modernization, resilience (e.g., smart substations, composite poles, automation), and clean energy resources (wind, solar, batteries) are expected to expand Ameren's regulated rate base at a forecasted 9.2% CAGR. This is expected to enable higher allowed returns and improved net margins. Strong, constructive regulatory relationships and approval of new rate structures (such as the proposed large-load rate for data centers) provide cost-recovery certainty, minimize earnings volatility, and support predictable long-term earnings and dividend growth.

Curious how moderate revenue growth, rising margins, and a rich future earnings multiple can still justify a premium fair value for a regulated utility? The full narrative lays out the math backing that stance, and the assumptions behind it, in surprising detail.

Result: Fair Value of $112.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this narrative could unravel if data center demand ramps more slowly than expected or if regulators push back on Ameren’s ambitious capital plans.

Find out about the key risks to this Ameren narrative.

Another Angle on Valuation

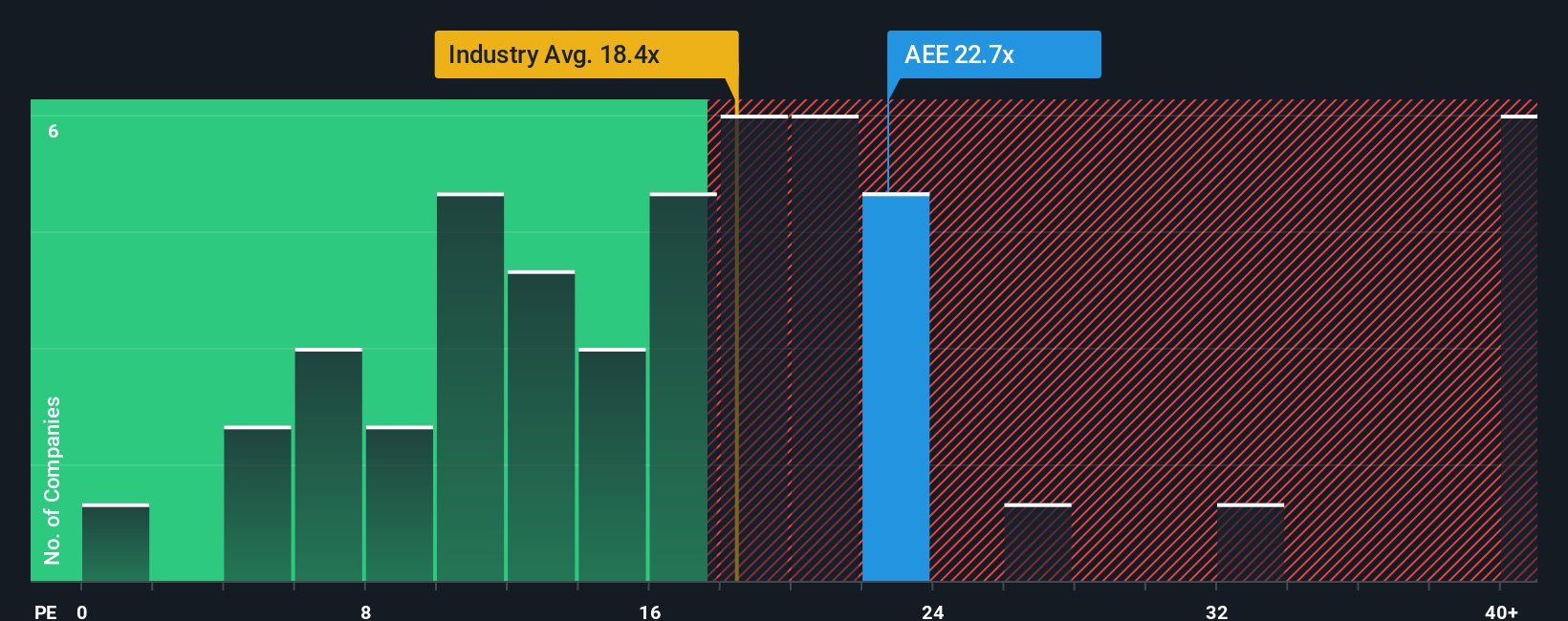

While the narrative suggests Ameren is undervalued, its 19.1 times earnings multiple actually sits above the global integrated utilities average of 17.8 times but below its 22.4 times fair ratio. That leaves a narrow margin of safety and raises the question: how much upside is really left?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ameren Narrative

If you see the story differently or would rather dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Ameren research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If Ameren looks interesting, do not stop there, use the Simply Wall Street Screener to uncover fresh, data driven ideas that other investors may overlook.

- Capture potential high yield income streams by scanning these 15 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow.

- Ride the next wave of innovation by targeting these 26 AI penny stocks positioned at the forefront of artificial intelligence.

- Capitalize on mispriced opportunities by filtering for these 908 undervalued stocks based on cash flows before the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEE

Ameren

Operates as a public utility holding company in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026