- United States

- /

- Other Utilities

- /

- NYSE:AEE

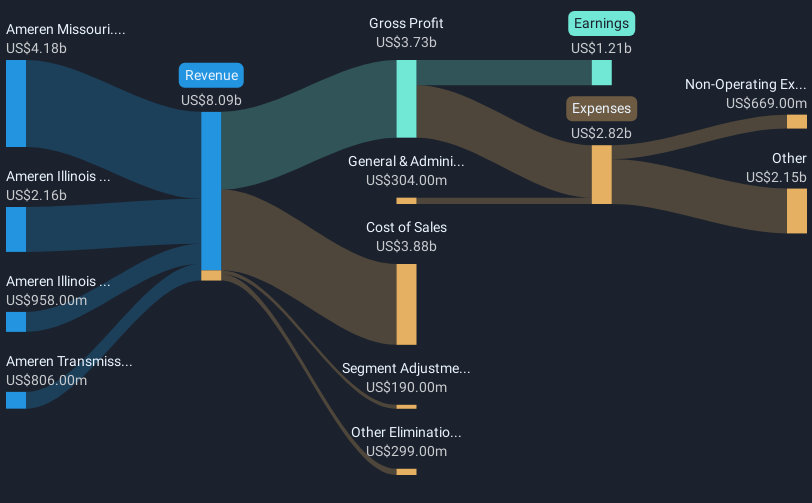

Ameren (NYSE:AEE) Reaffirms 2025 Earnings Guidance Amid Strong Q1 Results With US$2,097 Million Revenue

Reviewed by Simply Wall St

Ameren (NYSE:AEE) recently reaffirmed its earnings guidance for 2025 and reported robust first-quarter results, with sales and net income showing marked increases from the previous year. This, coupled with a solid earnings backdrop, aligns with their reported 4% price rise over the last quarter. Despite Kimberly J. Harris's resignation from the board, the company's operational outlook remains stable, which adds weight to the broader market's upswing. The strong market sentiment, as seen in the S&P 500's rally, complements Ameren's steady performance, indicating a favorable position within the industry.

Ameren's recent reaffirmation of earnings guidance and impressive first-quarter results could bolster investor confidence, aligning well with its 4% share price rise over the last quarter. However, the resignation of Kimberly J. Harris from the board presents challenges, although the company's operational stability suggests limited immediate effects. Over the past five years, Ameren's total shareholder return, including dividends, was 62.68%, providing a solid backdrop when considering its long-term performance.

The company's stock has recently outperformed the broader market, evident over the past year when the US Integrated Utilities industry returned 17.8%. This positions Ameren well as it strategically invests in Missouri energy projects and data centers, potentially enhancing future revenue streams. The reaffirmation of earnings guidance could further strengthen its revenue and earnings forecasts, assuming successful execution of its capital investment plans and regulatory improvements.

With a current share price of US$99.21 and an analyst consensus price target of US$101.21, the stock trades nearly in line with its expected value, suggesting limited upside but an indication of stability in analysts' outlook. Investors should consider these dynamics alongside the broader industry performance and future revenue potential, as the consensus target price suggests the company is fairly priced given its anticipated growth.

Our expertly prepared valuation report Ameren implies its share price may be too high.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Ameren, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEE

Ameren

Operates as a public utility holding company in the United States.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives