- United States

- /

- Other Utilities

- /

- NYSE:AEE

Ameren (NYSE:AEE) Director Resigns for Health Reasons; Shares Dip 1%

Reviewed by Simply Wall St

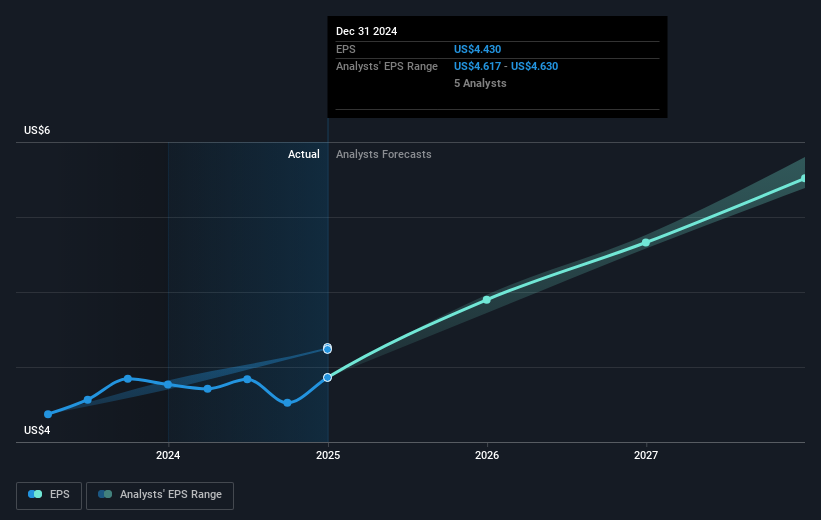

Ameren (NYSE:AEE) experienced a 9% price move last quarter amidst significant corporate events, notably the resignation of Board Director Kimberly J. Harris for health reasons. The company's stock performance paralleled Ameren's announcement of a quarterly dividend increase, reflecting commitment to returning value to shareholders. Financial results for 2024 showed growth in sales and income, supporting a positive market outlook. This occurred against a backdrop of fluctuating market conditions where broader indices such as the Dow Jones saw declines due to inflation concerns and weak consumer sentiment. Ameren’s strategic energy projects and affirmed earnings guidance may have bolstered investor confidence.

Ameren has 3 possible red flags (and 1 which is potentially serious) we think you should know about.

Find companies with promising cash flow potential yet trading below their fair value.

The last five years have seen Ameren's total shareholder return reach 58.97%, a performance underpinned by strategic investments in energy projects, regulatory advancements, and a growing rate base. Key developments include Ameren's substantial investment in Missouri energy projects and new data centers, aimed at attracting large industrial customers and bolstering earnings potential. Furthermore, the company secured critical energy infrastructure projects through MISO, estimated at an investment of US$1.3 billion, enhancing long-term revenue prospects. These efforts embraced improved regulatory frameworks and strategic resource planning for a cost-effective energy mix, positively impacting operational costs and earnings growth.

In the past year, Ameren's stock exceeded the US market and the Integrated Utilities industry returns, reflecting its solid financial strategies. The trajectory was partially supported by consistent earnings announcements showing growth in sales and income and affirming future earnings guidance. Additionally, the company's quarterly dividend increase from US$0.67 to US$0.71 also contributed to its attractive shareholder returns. These elements, amidst fluctuating broader market conditions, demonstrate Ameren’s resilience in advancing its financial stability and investor appeal.

The valuation report we've compiled suggests that Ameren's current price could be inflated.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEE

Ameren

Operates as a public utility holding company in the United States.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives