- United States

- /

- Other Utilities

- /

- NYSE:AEE

Ameren (AEE): Examining Valuation After Leadership Change Prompts Speculation on Strategic Direction

Reviewed by Kshitija Bhandaru

See our latest analysis for Ameren.

Ameren shares have been steady lately, with a recent leadership shake-up adding a touch of uncertainty but having little immediate effect on the stock’s momentum. Over the past year, the total shareholder return has edged just above flat. This suggests that investors are still waiting for a clearer signal of future growth or renewed confidence in the utility’s strategy.

If you’re curious about what else could be on the move in today’s market, now is the perfect time to broaden your perspective and discover fast growing stocks with high insider ownership

With recent gains and modest analyst price targets, is Ameren still trading below its true value, or have markets already factored in expectations for future growth? Investors are left to wonder if a buying opportunity remains.

Most Popular Narrative: 1.8% Undervalued

Ameren's most closely watched valuation narrative puts fair value just above the latest closing price, hinting at only a modest discount to market levels. This suggests that current expectations are already high, with the market pricing in much of Ameren's perceived upside potential.

Ongoing and future investments in grid modernization, resilience (e.g., smart substations, composite poles, automation), and clean energy resources (wind, solar, batteries) are expected to expand Ameren's regulated rate base at a forecasted 9.2% CAGR, enabling higher allowed returns and improved net margins.

Curious what powers this valuation? One key lever is relentless expansion of grid-linked infrastructure, supported by growth, margin upgrades, and a future profit multiple that sets it apart from typical sector dynamics. Dive in to uncover the pivotal growth forecasts and see what makes this fair value so provocative.

Result: Fair Value of $106.85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Ameren's growth hinges on both robust data center demand and smooth regulatory approvals. Any setbacks in these areas could quickly undermine optimistic forecasts.

Find out about the key risks to this Ameren narrative.

Another View: Rethinking Ameren’s Valuation

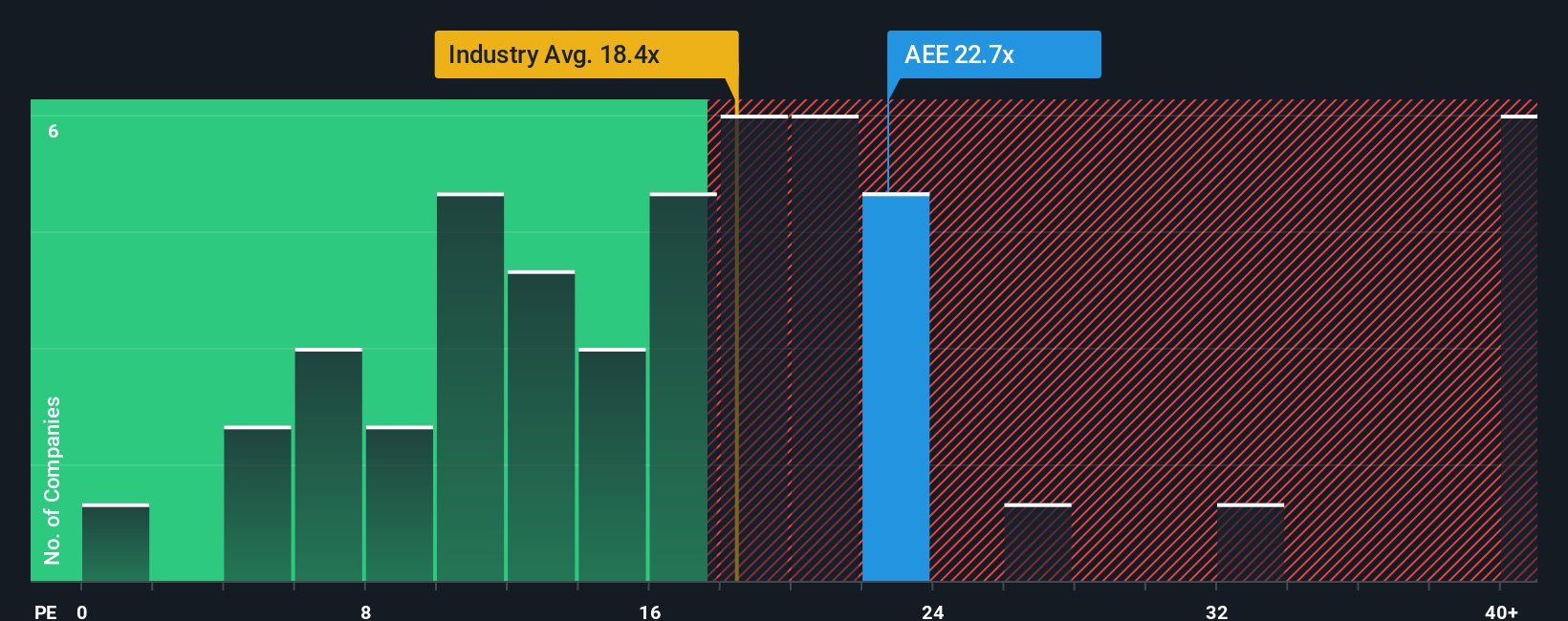

Looking solely at Ameren’s price-to-earnings ratio, the stock appears somewhat expensive right now. It trades at 23.1 times earnings, higher than both the global integrated utilities average (18.3x) and its peer group (22.9x). Even compared to the fair ratio of 21.4x, that is a premium.

If the market normalizes toward that fair ratio, there could be less upside than the narrative suggests. Is this a warning sign for value-focused investors, or could further growth still justify this trend?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ameren Narrative

If you think there is more to the story or want to uncover your own insights, you can research the numbers and craft your own take in just a few minutes. Do it your way

A great starting point for your Ameren research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Now is the moment to invest smarter by targeting trends that many overlook. Shift your strategy and get a jump on compelling stocks with these smart shortcuts:

- Uncover early-stage innovation by tracking these 3574 penny stocks with strong financials that are showing real financial strength and significant growth potential.

- Maximize your yield and create sustainable income streams by reviewing these 19 dividend stocks with yields > 3% with consistently strong dividend payouts above 3%.

- Spark your portfolio’s potential with these 25 AI penny stocks that are well positioned for rapid expansion in artificial intelligence-driven industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEE

Ameren

Operates as a public utility holding company in the United States.

Average dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives