- United States

- /

- Electric Utilities

- /

- NasdaqGS:XEL

Xcel Energy (NasdaqGS:XEL) Declares Quarterly Dividend of US$0.57 Per Share

Reviewed by Simply Wall St

Xcel Energy (NasdaqGS:XEL) recently declared a quarterly dividend of 57 cents per share, with a record date set for June 13, 2025. Over the past week, the company's stock saw a modest gain of 1.63%. This move came in a period when major stock indexes slightly recovered from a previous sell-off, and the market overall dropped by 1%. The dividend affirmation could have provided a stabilizing influence on the company's share price amidst a generally volatile market, where broader concerns included rising bond yields and significant market adjustments.

The recent affirmation of Xcel Energy's dividend may bolster investor confidence amidst a volatile market environment influenced by rising bond yields and market adjustments. By ensuring a steady income stream for shareholders, the company may see a potential stabilization in its share price, supporting the narrative of long-term growth through strategic investments in new generation capacity and renewable projects. This dividend declaration coincides with Xcel's broader plans for growth, potentially facilitating revenue and earnings enhancement in the coming years.

Over the past five years, Xcel Energy's total shareholder return, including dividends, has amounted to 32.16%. In the shorter term, the company's stock has outpaced the broader market with a 1-year return above the US Electric Utilities industry, which saw a 12.9% return. Such performance may indicate resilience, even as broader economic and regulatory challenges persist.

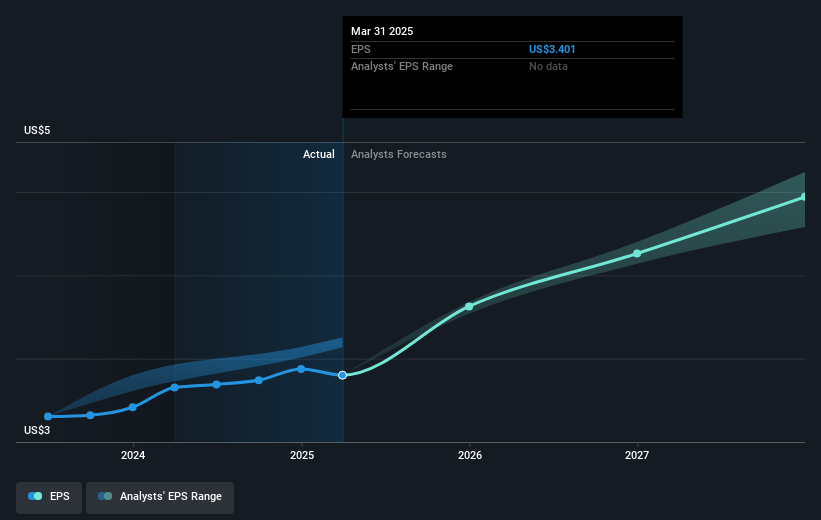

The dividend announcement may positively influence future revenue and earnings forecasts, as it underscores the company's commitment to maintaining shareholder value amidst plans for strategic expansion. Analysts project significant increases in revenue and earnings by 2028, with expectations of revenue reaching US$17.30 billion and earnings hitting US$2.80 billion. Given these forecasts, Xcel's current share price of US$71.06 remains close to the consensus price target of US$74.94, suggesting that the market may view the company as fairly valued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:XEL

Xcel Energy

Through its subsidiaries, engages in the generation, purchasing, transmission, distribution, and sale of electricity in the United States.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion