- United States

- /

- Renewable Energy

- /

- NasdaqGS:TLN

What Talen Energy (TLN)'s Addition to Several S&P Indices Means For Shareholders

Reviewed by Simply Wall St

- Talen Energy Corporation (NasdaqGS:TLN) was recently added to several major S&P indices, including the S&P 1000, S&P 400, S&P 400 Utilities, and S&P Composite 1500, following official announcements made in late August 2025.

- This series of index inclusions stands out because it typically triggers increased demand from passive investors and funds that track these indices, often influencing trading activity.

- With Talen Energy's entry into prominent S&P indices, we will assess what this broader benchmark exposure means for the company's investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Talen Energy Investment Narrative Recap

At the heart of the Talen Energy investment story is a belief in the company’s ability to capture value from rapidly growing electricity demand, particularly among large data and cloud players, while navigating heightened regulatory and decarbonization risks tied to its fossil-fuel dependent asset base. The recent inclusion in several S&P indices may temporarily support trading activity, but does not fundamentally alter the near-term catalysts, such as rising contracted nuclear supply and margin expansion, or reduce the company’s exposure to evolving policy, commodity price swings, or interest expense pressures.

The expanded long-term nuclear power agreement with Amazon Web Services, finalized in June 2025, remains the most directly relevant announcement here. This provides the stability of an inflation-protected, blue-chip revenue stream that is central to Talen’s cash flow visibility and its ability to deleverage, especially as index inclusion draws new eyes to the stock but doesn’t resolve the company’s reliance on commodity-sensitive fossil generation.

In contrast, investors still need to keep a close eye on how policy shifts or commodity price volatility could threaten margins and long-term value...

Read the full narrative on Talen Energy (it's free!)

Talen Energy's narrative projects $4.2 billion revenue and $1.8 billion earnings by 2028. This requires 25.2% yearly revenue growth and a $1.61 billion increase in earnings from the current $187.0 million.

Uncover how Talen Energy's forecasts yield a $398.66 fair value, a 6% upside to its current price.

Exploring Other Perspectives

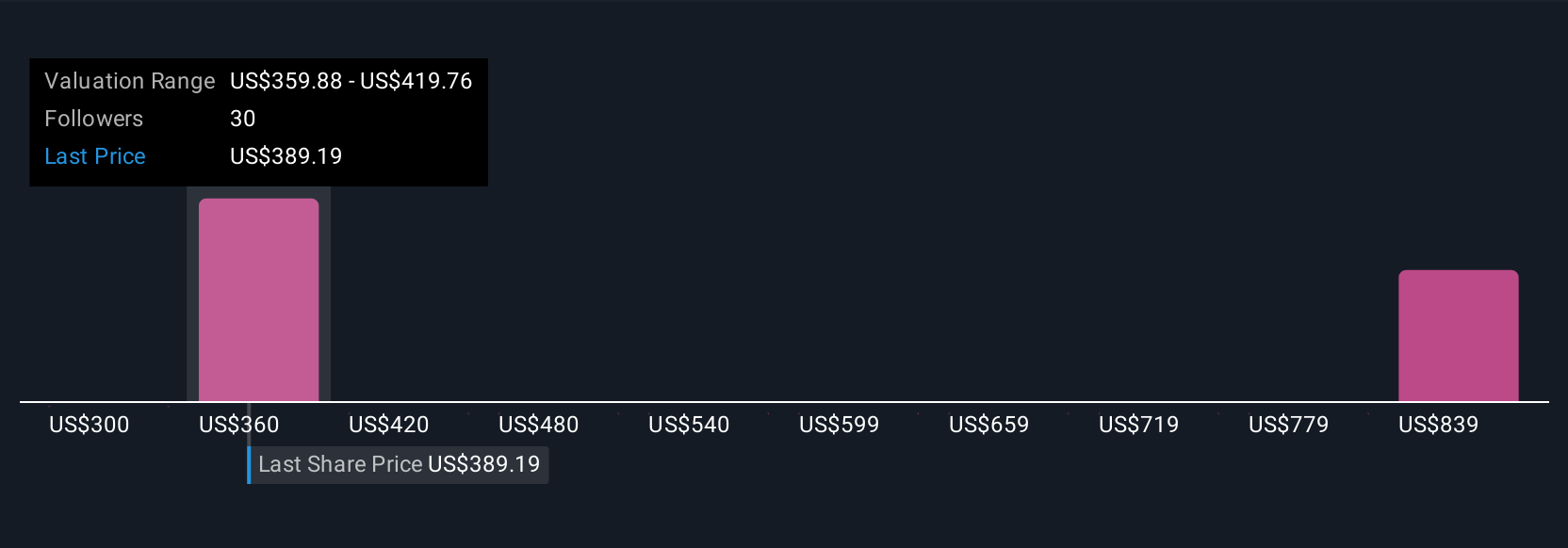

Four members of the Simply Wall St Community estimated Talen Energy’s fair value between US$300 and US$905, with the highest forecast tripling the lowest. As electricity market conditions and major contracts like AWS agreements shape outlooks, your interpretation of these risks and opportunities could differ significantly from others.

Explore 4 other fair value estimates on Talen Energy - why the stock might be worth 20% less than the current price!

Build Your Own Talen Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Talen Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Talen Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Talen Energy's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 29 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Talen Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TLN

Talen Energy

An independent power producer and infrastructure company, produces and sells electricity, capacity, and ancillary services into wholesale power markets in the United States.

High growth potential and fair value.

Market Insights

Community Narratives