- United States

- /

- Renewable Energy

- /

- NasdaqGS:TLN

Talen Energy (TLN) Is Up 6.0% After Expanding Nuclear Power Supply Deal With Amazon – Has The Bull Case Changed?

Reviewed by Simply Wall St

- Amazon.com recently announced an expanded agreement with Talen Energy to supply its data centers with carbon-free nuclear energy through 2042, deepening their existing partnership.

- This move positions Talen Energy to benefit from the increasing demand for sustainable power solutions in the rapidly growing AI and data center sector.

- We'll examine how Talen's expanded supply of nuclear energy to Amazon may influence its investment narrative and long-term outlook.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Talen Energy Investment Narrative Recap

To be a shareholder in Talen Energy, you need to believe in sustained growth in electricity demand, especially from the AI and data center sectors, and in the company’s shift toward more sustainable power sources. The expanded nuclear power agreement with Amazon supports the critical near-term catalyst of securing stable, long-term revenue, but it does not fully address Talen’s continued reliance on fossil fuel assets, which remains the key risk as policy and market momentum accelerates toward decarbonization.

Among recent announcements, Talen’s increased share buyback authorization, to US$2,000 million through 2028, stands out. This move reflects management’s continued focus on capital returns and provides flexibility to support the stock if market volatility or earnings challenges materialize, complementing the revenue visibility secured by the Amazon deal.

However, investors should also be mindful that, despite these positive developments, risks around accelerated policy shifts or market changes that impact Talen’s gas-fired assets remain significant if...

Read the full narrative on Talen Energy (it's free!)

Talen Energy's outlook anticipates $4.2 billion in revenue and $1.1 billion in earnings by 2028. This reflects a 25.1% annual revenue growth rate and an $913 million earnings increase from current earnings of $187.0 million.

Uncover how Talen Energy's forecasts yield a $428.47 fair value, in line with its current price.

Exploring Other Perspectives

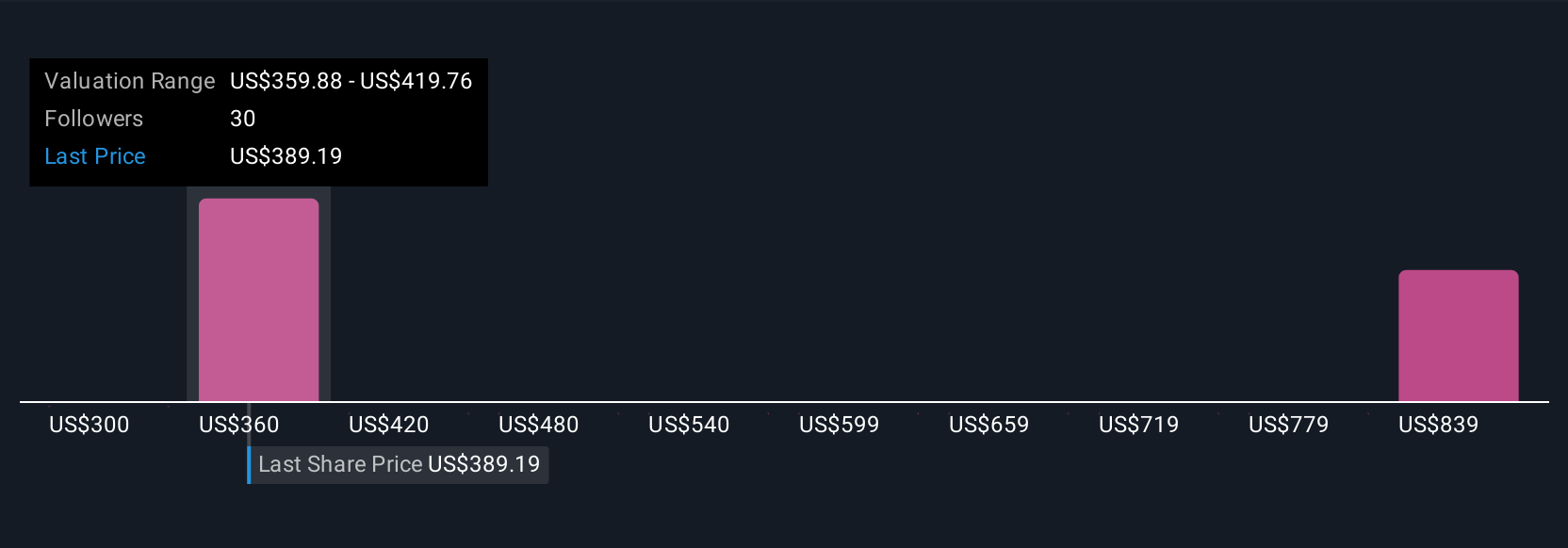

Four fair value estimates from the Simply Wall St Community put Talen shares between US$300 and US$999.87, with opinions spanning a wide range. While some see compelling upside, remember that policy or regulatory changes could quickly alter prospects for Talen’s fossil fuel assets, so consider multiple viewpoints before making any decisions.

Explore 4 other fair value estimates on Talen Energy - why the stock might be worth over 2x more than the current price!

Build Your Own Talen Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Talen Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Talen Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Talen Energy's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Talen Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TLN

Talen Energy

An independent power producer and infrastructure company, produces and sells electricity, capacity, and ancillary services into wholesale power markets in the United States.

High growth potential and slightly overvalued.

Market Insights

Community Narratives