- United States

- /

- Renewable Energy

- /

- NasdaqGS:TLN

Talen Energy (TLN): Evaluating Valuation After Strong Share Price Momentum

Reviewed by Kshitija Bhandaru

Talen Energy (TLN) is catching some attention after a recent move in its share price, which has outperformed the utilities sector over the past month. Investors may be curious about what could be driving this momentum.

See our latest analysis for Talen Energy.

Looking at the bigger picture, Talen Energy’s momentum stands out after such a strong run this year, with its 1-year total shareholder return soaring 159.33%. Even with a recent pullback, the stock has nearly doubled so far in 2024, which suggests that investors may see ongoing growth potential or an improving outlook for the company.

If Talen’s rapid rise has you wondering what else could be gaining traction, it’s a smart time to uncover fast growing stocks with high insider ownership.

The question now is whether Talen Energy's impressive gains leave room for further upside, or if investor optimism has already been fully reflected in the current valuation. This could potentially limit any near-term buying opportunity.

Most Popular Narrative: 4.8% Undervalued

Talen Energy’s latest fair value estimate stands modestly above the last close price, suggesting market participants see a bit of upside still on the table. The focus now shifts to what might be powering this valuation and which financial assumptions underpin the gap to the current price.

“Rapidly growing U.S. electricity demand, particularly from data centers and AI-driven digital infrastructure, is tightening power markets in Talen's core regions. This is leading to higher forward spark spreads, improved capacity pricing, and long-term tailwinds for wholesale power revenues and EBITDA.”

What’s driving the sharpest valuation debate? The surprise lies in dramatic upgrades to revenue, earnings, and profit margin forecasts that fuel this price target. Want to know the full story behind the numbers that analysts believe could lead Talen into an entirely new league? The inner workings of this valuation may shock even seasoned utility investors.

Result: Fair Value of $433.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Talen’s reliance on fossil fuel generation and elevated debt levels could challenge its margin story if energy transition or market conditions shift unexpectedly.

Find out about the key risks to this Talen Energy narrative.

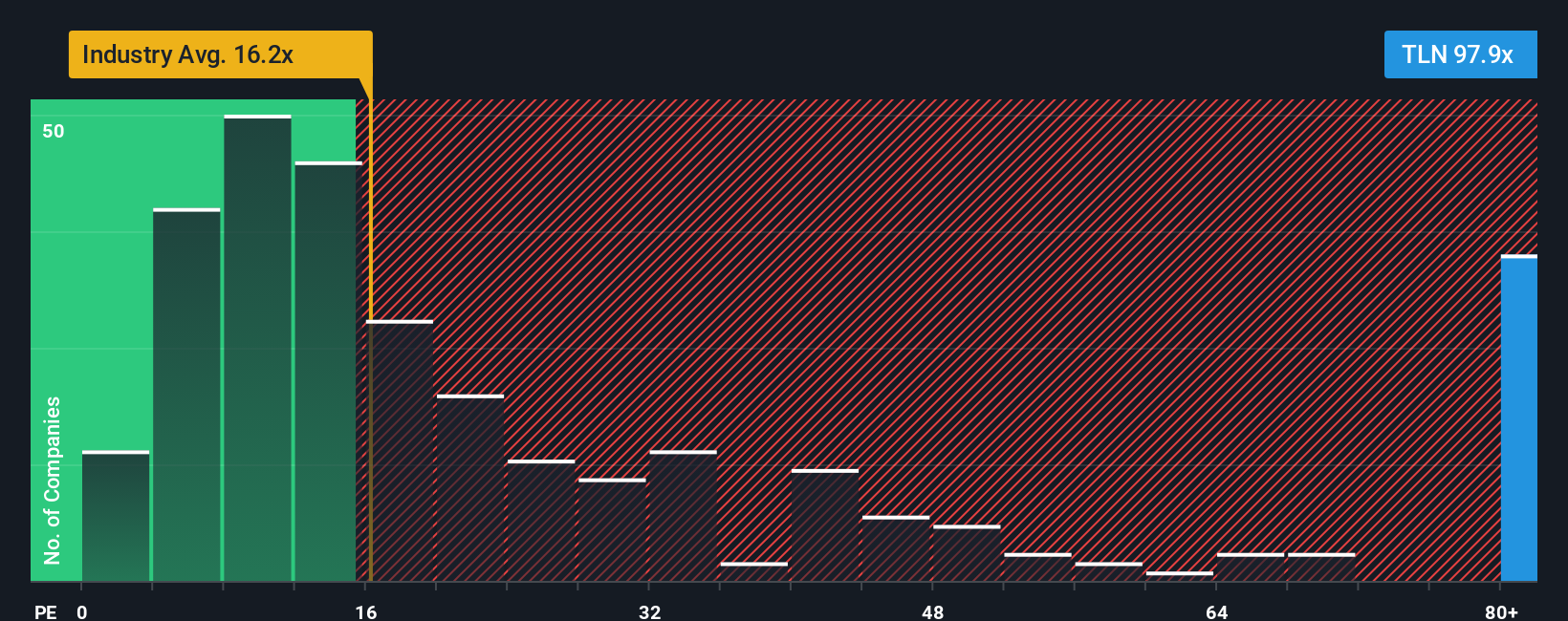

Another View: Multiples Suggest a Cautious Stance

While fair value estimates suggest Talen Energy is undervalued, a closer look at its price-to-earnings ratio tells a different story. The company's ratio of 100.9x is far higher than both the industry average of 16.3x and the peer group average of 17.9x. It also sits well above its fair ratio of 78.9x. This sizable gap points to a rich valuation and signals that investor optimism may be running ahead of fundamentals for now. Is today’s price a bet on future gains, or could it carry valuation risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Talen Energy Narrative

If you want to dig into the numbers and build out your own viewpoint, it’s easier and faster than you might expect. Most narratives are crafted in minutes. Do it your way

A great starting point for your Talen Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Use the Simply Wall Street Screener to find stocks with breakout potential and fresh momentum today.

- Capture passive income by tapping into these 19 dividend stocks with yields > 3% offering yields above 3% and steady returns, even when markets get choppy.

- Capitalize on the next tech surge by checking out these 24 AI penny stocks that are shaping the future of artificial intelligence and automation.

- Position your portfolio for tomorrow’s leaders through these 899 undervalued stocks based on cash flows based on cash flows. This highlights stocks that could be flying under the radar right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Talen Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TLN

Talen Energy

An independent power producer and infrastructure company, produces and sells electricity, capacity, and ancillary services into wholesale power markets in the United States.

High growth potential and slightly overvalued.

Market Insights

Community Narratives