- United States

- /

- Renewable Energy

- /

- NasdaqGS:TLN

Talen Energy (TLN): Assessing Valuation After $2 Billion Buyback Expansion and Extended Timeline

Reviewed by Kshitija Bhandaru

Talen Energy (TLN) got investors talking this week after it announced a substantial increase to its equity buyback program. The company has bumped its remaining buyback authorization up to $2,000 million and extended the timeline to the end of 2028. These moves usually send a message that management feels the company’s shares are worth backing and is willing to commit serious capital over the long term.

This announcement adds to an already attention-grabbing performance from Talen Energy. The stock has climbed sharply over the past year, gaining 130%, with nearly half that rally taking place in just the past three months. Strong annual growth in both revenue and net income are part of the story here, but the newly expanded buyback is what’s currently in focus, adding fuel to speculation about how the market sees the company’s future prospects.

Now the big question remains: is Talen Energy undervalued after this surge, or is the market already baking in brighter days ahead for the company?

Most Popular Narrative: 1.1% Undervalued

The current consensus among widely followed analysts is that Talen Energy is trading slightly below its fair value, with a modest margin suggesting room for upside. This perspective is built on specific forecasts for earnings growth, margins, and share count reductions over the coming years.

"Analysts expect earnings to reach $1.1 billion (and earnings per share of $23.78) by about September 2028, up from $187.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.3 billion in earnings, and the most bearish expecting $839 million."

Craving the real story behind those price targets? This widely accepted valuation premise rests on aggressive profit expansion and bold expectations for long-term financial transformation. What exactly are the assumptions behind these numbers, and which financial metric is doing the heavy lifting? Dive deeper to uncover the surprising details and see why Talen's future could defy expectations or face some serious headwinds.

Result: Fair Value of $428.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, there are real risks. Talen's ongoing reliance on fossil fuels and its high debt load could meaningfully hinder future profit and margin growth.

Find out about the key risks to this Talen Energy narrative.Another View: What Does the Multiple Suggest?

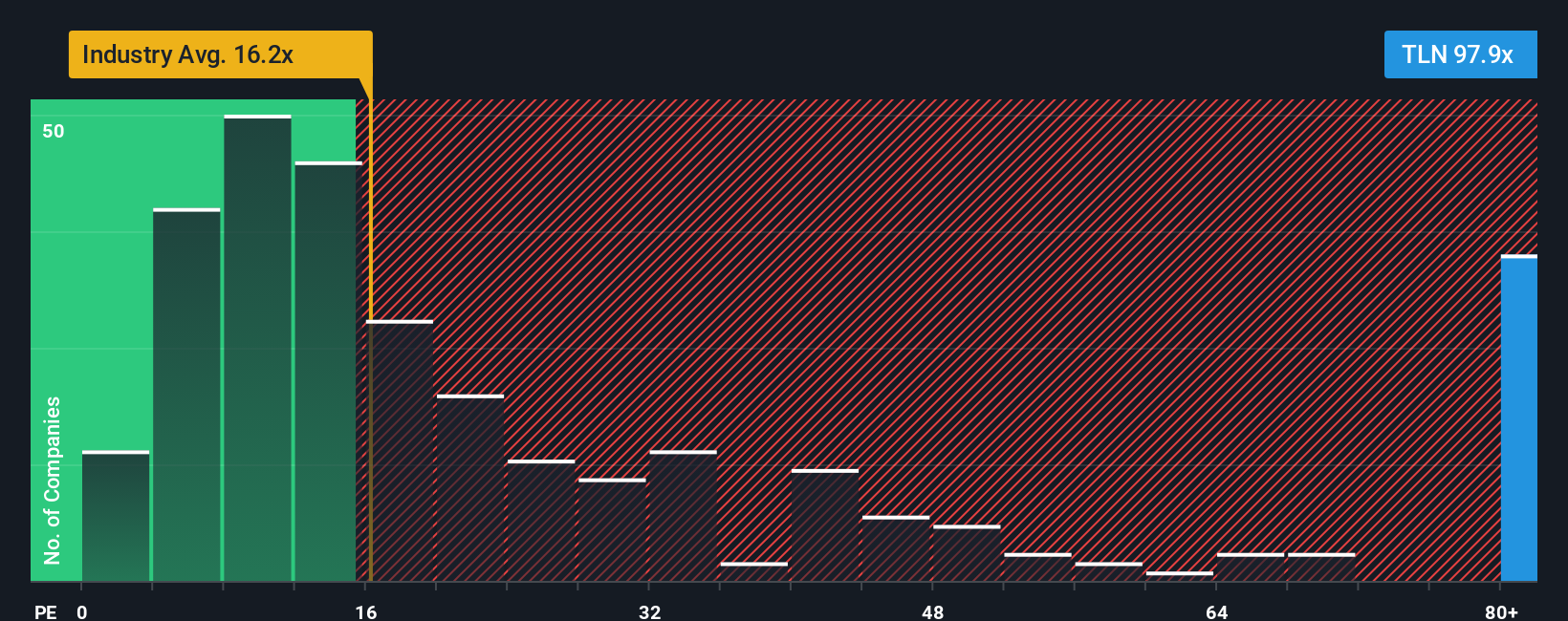

Looking through a different lens, market pricing tells a less optimistic story. Compared to the broader industry, the current earnings-based valuation looks stretched. This raises the question of whether growth hopes are already priced in.

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Talen Energy to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Talen Energy Narrative

If this analysis isn't quite your take, or if you're eager to dig into the numbers and shape your own outlook, you can build a personalized Talen Energy view in just a few minutes. Do it your way

A great starting point for your Talen Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't overlook the hottest opportunities popping up beyond Talen Energy. Tap into the Simply Wall Street screener and position yourself ahead of the trendsetters.

- Connect with the AI revolution by spotting companies poised to transform industries with AI penny stocks.

- Sharpen your strategy by zeroing in on undervalued stocks based on cash flows, which could be bargains hiding in plain sight.

- Secure growing income streams by targeting dividend stocks with yields > 3% with yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Talen Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TLN

Talen Energy

An independent power producer and infrastructure company, produces and sells electricity, capacity, and ancillary services into wholesale power markets in the United States.

High growth potential and slightly overvalued.

Market Insights

Community Narratives