- United States

- /

- Renewable Energy

- /

- NasdaqGS:RNW

ReNew Energy Global (NasdaqGS:RNW): Valuation Insights After $98M Rajasthan Asset Sale and Major Strategic Investment

Reviewed by Kshitija Bhandaru

ReNew Energy Global (NasdaqGS:RNW) recently sold its 300 MW solar project in Rajasthan to Sembcorp Green Infra. This move will generate about $98 million in cash and bolster the company’s liquidity. The sale is part of a broader strategic repositioning within the renewable energy sector.

See our latest analysis for ReNew Energy Global.

ReNew’s active dealmaking this year, from its $100 million strategic investment to the latest Rajasthan solar project sale, has fueled impressive momentum. The company’s share price has delivered a strong 19% return so far in 2024, and total shareholder return over the past twelve months reached 35%, reflecting growing investor confidence and highlighting real progress behind the scenes.

If sector growth stories like this interest you, it might be the right moment to broaden your search and discover fast growing stocks with high insider ownership

With shares already up 19% year to date and new cash unlocking future expansion, should investors see ReNew Energy Global as undervalued at current levels, or is the market now fully pricing in its growth potential?

Most Popular Narrative: 4.3% Undervalued

ReNew Energy Global's most widely followed narrative values the shares at $8.48, modestly higher than the last close of $8.11. This price target is built on a detailed view of future earnings, market positioning, and sector catalysts that analysts believe support the stock's potential upside.

Expansion and ramp-up of ReNew's manufacturing business, especially with marquee strategic investments (for example, from British International Investments) and a new 4 GW TOPCon facility under construction, diversify revenue streams and lower input costs. These initiatives improve earnings visibility and profitability. Continued cost optimization, disciplined project bidding, and AI-driven asset management are resulting in higher plant utilization and lower operations and maintenance costs. This is reflected in rising EBITDA margins and improved net margins.

Want to know the underlying math that justifies this premium price? The narrative’s engine is built on remarkably ambitious growth forecasts and a profit margin shift that could change how investors view the business. Curious which forecasted metrics drive the story? Tap in to see the financial leaps that back the value call.

Result: Fair Value of $8.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and project execution delays could quickly erode margins and make it more difficult for ReNew to achieve these growth forecasts.

Find out about the key risks to this ReNew Energy Global narrative.

Another View: Price Ratios Tell a Different Story

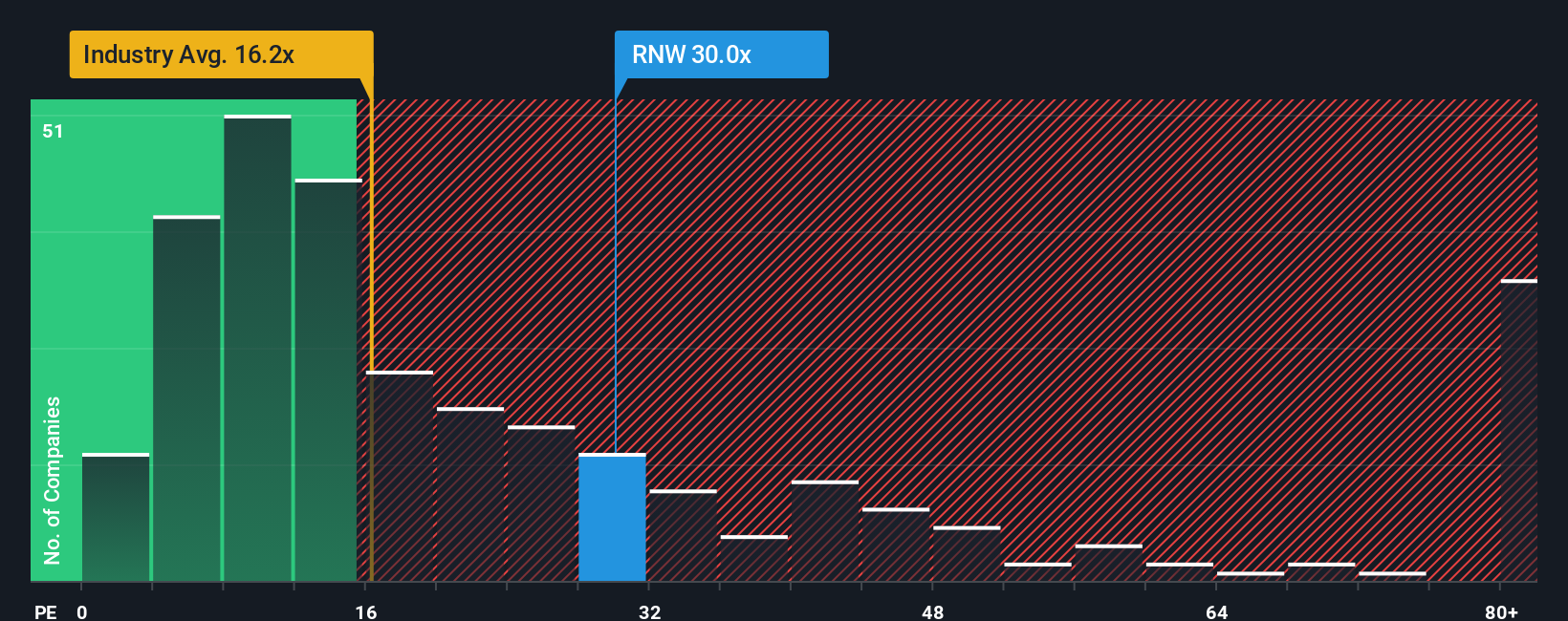

Looking beyond analyst forecasts, the current price-to-earnings ratio for ReNew Energy stands at 30x. That is nearly double the global renewable energy sector average (15.8x), yet much lower than the peer group’s steep 60.5x. The fair ratio also sits at 30x, suggesting little room for market re-rating. Is this premium justified by profit momentum, or does it raise red flags for valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ReNew Energy Global Narrative

If you think there's another angle or want to dig into the numbers yourself, you can build your own analysis and narrative in just minutes. Do it your way

A great starting point for your ReNew Energy Global research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Uncover new opportunities by targeting companies poised for rapid growth, disruptive innovation, and lasting value. There’s a world of smart investments waiting beyond the obvious. Don’t sit on the sidelines and miss your next winner.

- Access powerful growth potential when you check out these 25 AI penny stocks that are harnessing artificial intelligence to transform entire industries and outpace competitors.

- Capture attractive yield. Seize your chance with these 19 dividend stocks with yields > 3% featuring reliable payouts that bolster your income, even in unpredictable markets.

- Ride the wave of digital finance by tapping into these 78 cryptocurrency and blockchain stocks and find companies at the forefront of blockchain technology and cryptocurrency innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RNW

ReNew Energy Global

Engages in the generation of power through non-conventional and renewable energy sources in India.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives