- United States

- /

- Water Utilities

- /

- NasdaqGS:HTO

Rising ROCE Amid Falling Shares Could Be a Game Changer for H2O America (HTO)

Reviewed by Sasha Jovanovic

- H2O America (NASDAQ:HTO) recently reported that its return on capital employed (ROCE) has risen substantially over the past five years, reaching 4.2%, with the company continuing to reinvest profits at improving rates of return.

- This operational improvement comes even as the stock price has declined in that period, highlighting potential efficiency gains not yet reflected in the market.

- We'll examine how the marked improvement in H2O America's ROCE could influence analysts' assumptions about the company's future earnings and profitability.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

H2O America Investment Narrative Recap

To be comfortable as a shareholder in H2O America, you likely need confidence in the company’s ability to turn rising operational efficiency, seen in its improving return on capital employed, into durable earnings, even though recent share price performance has been weak. While this progress signals better potential profitability ahead, it does not materially affect the main near-term catalyst, which remains the company’s ongoing infrastructure investments, nor does it significantly change the largest risk, which is expense pressure from rising water production costs.

Among recent announcements, the September amendment to H2O America’s credit agreement, increasing available borrowing capacity from US$300 million to US$350 million, stands out. This move is especially relevant with the ROCE news, as it reinforces the company’s access to funding for its major capital projects, considered a key short-term catalyst, since their returns will help determine whether operational improvements translate into stronger long-term performance.

However, investors should keep in mind the ongoing risk if wholesale water costs continue to rise faster than H2O America can adjust its revenues...

Read the full narrative on H2O America (it's free!)

H2O America's narrative projects $860.2 million revenue and $125.7 million earnings by 2028. This requires 2.9% yearly revenue growth and a $22.9 million earnings increase from $102.8 million today.

Uncover how H2O America's forecasts yield a $61.67 fair value, a 29% upside to its current price.

Exploring Other Perspectives

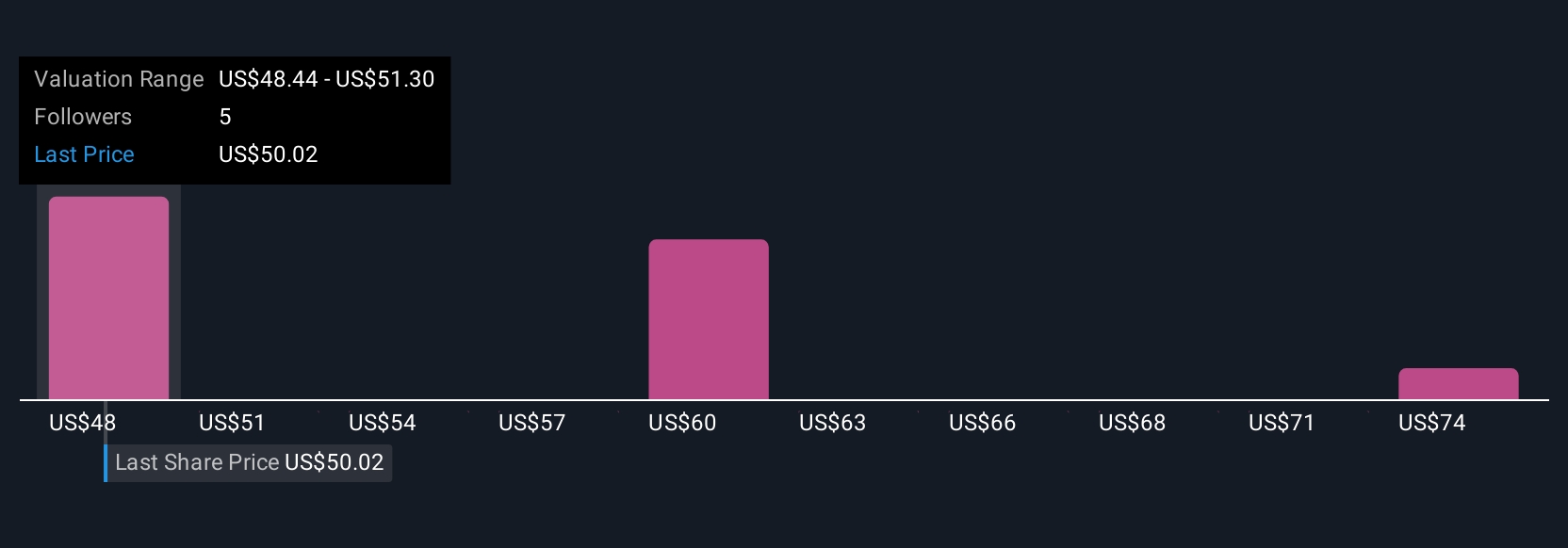

Simply Wall St Community contributors estimate H2O America’s fair value from US$48.44 up to US$77 based on three views. With infrastructure projects identified as a major driver, differences in outlooks reflect contrasting assumptions about the impact of capital deployment on future returns, explore several viewpoints to inform your own.

Explore 3 other fair value estimates on H2O America - why the stock might be worth just $48.44!

Build Your Own H2O America Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your H2O America research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free H2O America research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate H2O America's overall financial health at a glance.

No Opportunity In H2O America?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if H2O America might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HTO

H2O America

Through its subsidiaries, provides water utility and other related services in the United States.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives