- United States

- /

- Electric Utilities

- /

- NasdaqGS:EXC

Exelon (NasdaqGS:EXC) Declares US$0.40 Dividend And Appoints New Independent Board Chair

Reviewed by Simply Wall St

Exelon (NasdaqGS:EXC) recently announced a regular dividend of $0.40 per share and appointed W. Paul Bowers as the new Independent Board Chair. These events coincide with an 18% price move in the last quarter. In contrast to a broad market decline amid weak GDP reports and a shift in executive roles across several firms, Exelon's consistent earnings growth and stable dividend may have provided some level of investor confidence. The share appreciation appears consistent with broader market trends, as the market had rallied before a recent downturn, suggesting these developments might have supplemented broader movements.

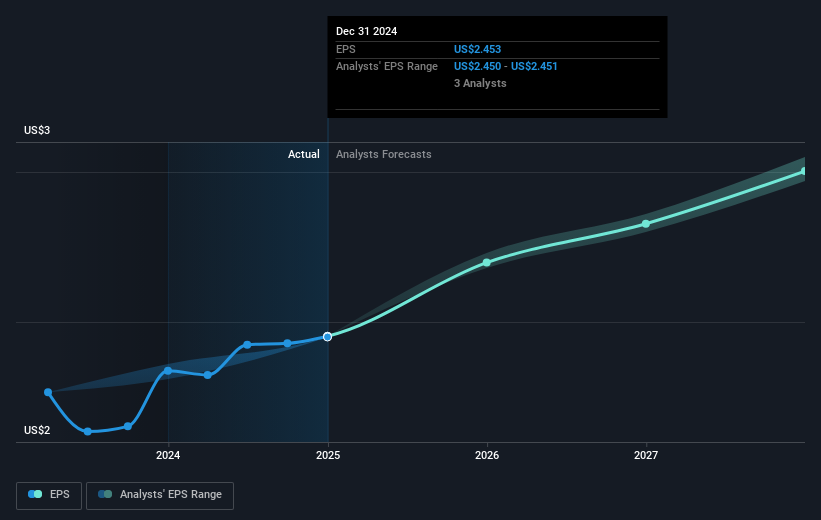

The recent news of Exelon's regular dividend announcement and leadership change could positively influence investor sentiment, potentially reinforcing the narrative of stable governance and continued earnings growth. With Exelon preparing for substantial energy transformation investments, these developments might bolster confidence in the company's ability to sustain its payout while strategically expanding its transmission capabilities. The commitment to investing US$38 billion from 2025 to 2028 aims to drive revenue and improve earnings potential, aligning with existing forecasts of a 5% to 7% annual earnings increase through 2028.

Over a five-year period, Exelon has delivered a total return of 119.34%, a testament to its capacity for creating shareholder value. This long-term performance provides context to the company's current state, indicating a strong track record of growth and capital appreciation. In comparison, Exelon's one-year performance has outpaced the broader US Electric Utilities industry, which returned 15.8%, further exemplifying its recent momentum.

Despite recent fluctuations and a current share price of US$47.37, Exelon's stock remains close to the analysts' consensus price target of US$45.97. This minimal difference suggests that the market perceives Exelon to be fairly valued according to projections. With revenue expected to grow at 3.4% annually, slightly lagging the US market's 8.2% growth rate, and earnings forecasted to reach US$3.1 billion by 2028, the company appears positioned for moderate, steady growth. The future revenue growth, supported by favorable regulatory conditions and significant project wins, looks poised to strengthen Exelon's operational and financial outlook amid potential external challenges.

Unlock comprehensive insights into our analysis of Exelon stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exelon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXC

Exelon

A utility services holding company, engages in the energy distribution and transmission businesses.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives