- United States

- /

- Electric Utilities

- /

- NasdaqGS:EVRG

Does Rising Short Interest Challenge Analyst Optimism in Evergy’s (EVRG) Investment Story?

Reviewed by Sasha Jovanovic

- In recent days, Evergy emerged as the most shorted stock in the utilities sector, with 5.78% of its share float sold short, while continuing its seven-year streak of dividend increases and receiving positive analyst outlook upgrades from Barclays and Jefferies.

- This convergence of elevated investor skepticism and renewed analyst confidence highlights a significant tension between market sentiment and the company's ongoing fundamentals.

- With short interest at sector highs, we'll now examine how these shifting signals may impact Evergy's longer-term investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Evergy Investment Narrative Recap

If you’re considering Evergy as an investment, the key factor is belief in sustained electricity demand from large-scale data centers and manufacturing in the Midwest, along with the company’s ability to finance ambitious capital projects. The recent surge in short interest highlights investor uncertainty, but so far does not appear to have a material impact on Evergy’s largest short-term catalyst: securing and maintaining major customer load contracts. However, this skepticism may put a spotlight on risks tied to Evergy’s requirement for substantial external funding in the coming years.

Among the recent company announcements, the new memorandum of understanding with TerraPower to explore advanced nuclear and storage solutions stands out. This is directly relevant to the company’s growth catalysts as it could support long-term rate base expansion and reinforce Evergy’s transition to cleaner power, a factor that could influence regulatory outcomes and appeal to large commercial energy users.

By contrast, investors should also be aware of the ongoing risk that unfavorable market conditions could increase capital costs or dilute shareholders as Evergy pursues its planned equity raises over the next several years…

Read the full narrative on Evergy (it's free!)

Evergy's narrative projects $6.8 billion revenue and $1.2 billion earnings by 2028. This requires 5.0% yearly revenue growth and a $359.9 million earnings increase from $840.1 million today.

Uncover how Evergy's forecasts yield a $77.89 fair value, in line with its current price.

Exploring Other Perspectives

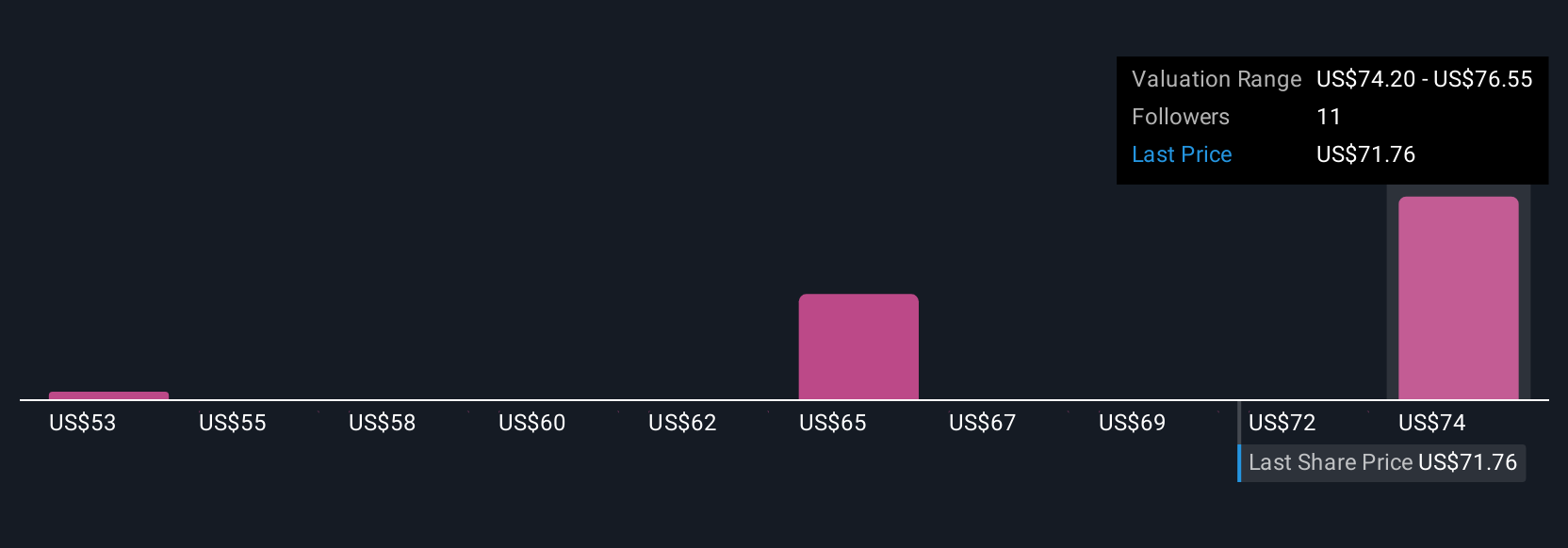

Simply Wall St Community members provided four fair value estimates for Evergy ranging from US$53.00 to US$77.89 per share ahead of recent news. With Evergy’s future capital needs under scrutiny by the broader market, these diverging viewpoints reveal how differently individual investors can assess risks and growth potential.

Explore 4 other fair value estimates on Evergy - why the stock might be worth 32% less than the current price!

Build Your Own Evergy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Evergy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Evergy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Evergy's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evergy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EVRG

Evergy

Engages in the generation, transmission, distribution, and sale of electricity in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives