- United States

- /

- Electric Utilities

- /

- NasdaqGS:CEG

Will Alan Armstrong’s Board Appointment Shape Constellation Energy’s (CEG) Clean Power Ambitions?

Reviewed by Sasha Jovanovic

- Constellation Energy recently announced the election of Alan S. Armstrong, former president and CEO of Williams, to its board of directors effective January 1, 2026.

- Armstrong’s appointment brings extensive energy infrastructure and leadership experience, reinforcing Constellation’s efforts to expand its clean energy offerings amid rising industry demand.

- We'll explore how Constellation’s addition of a seasoned industry leader may influence its long-term clean energy growth strategy.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Constellation Energy Investment Narrative Recap

To be a Constellation Energy shareholder, you need to believe in the continued growth in demand for carbon-free, reliable power from hyperscale data centers and commercial customers, with regulatory and infrastructure tailwinds supporting long-term value. The recent appointment of Alan Armstrong to the board, while signaling future focus on energy infrastructure, is unlikely to materially impact the company's most immediate catalyst, the rollout of new, long-duration clean energy contracts, or address the company’s high exposure to nuclear cost risks in the near term.

Among Constellation’s recent announcements, the approval to acquire Calpine Corporation stands out for its potential to combine nuclear and low-emission natural gas assets, further supporting efforts to expand the clean energy portfolio. This business move could enhance both operational flexibility and revenue streams as demand from corporate power buyers continues to rise.

However, investors should be aware that in contrast to recent capacity gains, the company’s legacy nuclear assets still expose it to significant regulatory and cost challenges that...

Read the full narrative on Constellation Energy (it's free!)

Constellation Energy's narrative projects $26.7 billion revenue and $3.6 billion earnings by 2028. This requires 2.5% yearly revenue growth and a $0.6 billion earnings increase from $3.0 billion.

Uncover how Constellation Energy's forecasts yield a $355.25 fair value, in line with its current price.

Exploring Other Perspectives

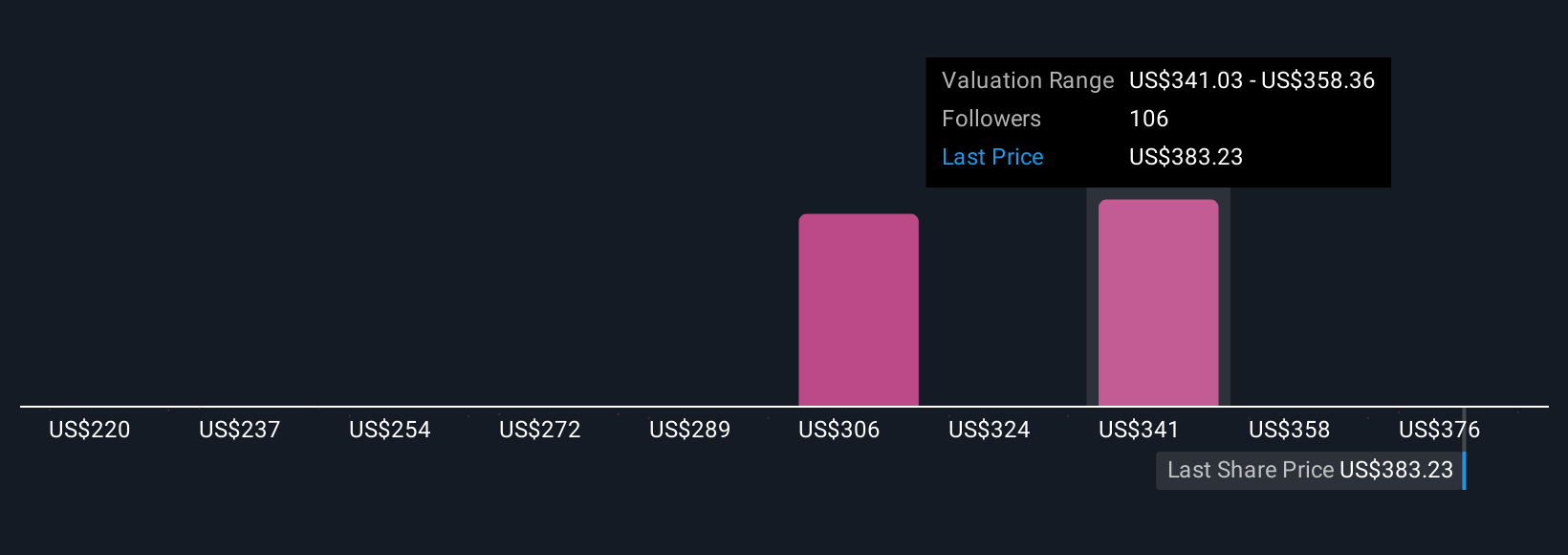

Fifteen member-authored fair value estimates from the Simply Wall St Community span US$219.78 to US$355.25 per share. These wide-ranging perspectives contrast with ongoing risks around regulatory and operational costs for Constellation’s aging nuclear fleet, inviting you to explore alternative views on what could shape future performance.

Explore 15 other fair value estimates on Constellation Energy - why the stock might be worth as much as $355.25!

Build Your Own Constellation Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Constellation Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Constellation Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Constellation Energy's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CEG

Constellation Energy

Produces and sells energy products and services in the United States.

Proven track record with limited growth.

Similar Companies

Market Insights

Community Narratives