Last Update24 Sep 25Fair value Increased 1.18%

Consensus analyst price targets for Constellation Energy were raised to $355.25, with robust electricity demand, strong cash flow, accelerating AI-driven power needs, and anticipated growth from the Calpine acquisition cited as key drivers, partially offset by valuation concerns, resulting in a modest upward revision in fair value.

Analyst Commentary

- Bullish analysts highlight robust electricity demand growth and strong cash flow generation as key drivers supporting the industry and Constellation’s leadership position.

- The acceleration of AI adoption has materially increased power demand, positioning independent power producers like Constellation as early winners in a transformative “Power revolution.”

- Recent adjusted Q2 results showed 14% year-over-year earnings growth, providing fundamental support for upward price target revisions.

- Anticipated growth through the planned acquisition of Calpine further supports analysts’ positive outlook on future earnings and scale.

- Some Bearish analysts express caution over relative valuation concerns and prefer IPP peers that do not require securing major hyperscaler contracts to justify risk-adjusted returns.

What's in the News

- All 21 of Constellation Energy's nuclear reactors operated at a 98.8% capacity factor during the summer, demonstrating exceptional reliability and outperformance versus industry averages through ongoing investment and maintenance.

- The company is investing further to increase output from existing nuclear plants and plans to restart the Crane Clean Energy Center, potentially adding up to 2,000 MW of additional clean baseload capacity.

- Constellation repurchased 1,099,580 shares for $404 million in Q2 2025, bringing total buybacks under the current authorization to 17,179,145 shares (5.36% of shares outstanding).

- The company was dropped from multiple Russell growth indices, including the Russell 3000 Growth, Russell 1000 Growth, Russell 3000E Growth, and Russell Top 200 Growth indices.

Valuation Changes

Summary of Valuation Changes for Constellation Energy

- The Consensus Analyst Price Target remained effectively unchanged, moving only marginally from $351.10 to $355.25.

- The Consensus Revenue Growth forecasts for Constellation Energy has significantly risen from 2.5% per annum to 6.5% per annum.

- The Future P/E for Constellation Energy has significantly fallen from 37.16x to 27.20x.

Key Takeaways

- Long-term, higher-margin contracts driven by demand for carbon-free power and new energy solutions are improving revenue growth and diversifying earnings.

- Federal support and strategic investments in nuclear energy are enhancing cash flow stability, capacity, and overall financial strength.

- Heavy dependence on regulated nuclear and centralized assets, shifting market dynamics, and customer concentration heighten long-term regulatory, operational, and revenue risks for the company.

Catalysts

About Constellation Energy- Produces and sells energy products and services in the United States.

- Growing demand for carbon-free, reliable power from large-scale customers such as data centers (Meta, Microsoft) and corporates (Comcast)-driven by digitalization, electrification, and decarbonization goals-is creating new, longer-term, higher-margin contracts with price premiums, likely resulting in significant revenue and earnings growth as more transactions close.

- Bipartisan political support for nuclear energy, exemplified by recent federal legislation and executive orders, has expanded and extended nuclear production tax credits (PTC) and zero-emission credits (ZEC), securing protected, higher-margin cash flows and increasing earnings visibility for at least the next decade.

- Acceleration of customer interest in time-matched, 24/7 carbon-free energy solutions is positioning Constellation to lock in longer-duration and higher-premium contracts across a broadening industrial base, supporting improved net margins and diversified revenues beyond volatile wholesale markets.

- Strategic investments and progress in nuclear plant restarts (Crane Clean Energy Center), upgrades (900MW in engineering), and selective M&A (Calpine acquisition) provide visible avenues for substantial capacity additions and operational synergies, enhancing EBITDA and free cash flow over the medium to long term.

- Sustained focus from institutional investors on ESG-aligned, emissions-free utilities is likely to reduce Constellation's cost of capital and support share price appreciation, especially as the company's clean energy profile strengthens through federally backed credits and continued expansion of nuclear and renewable assets.

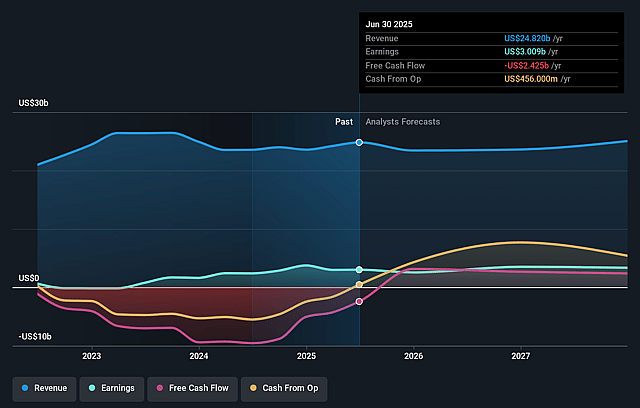

Constellation Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Constellation Energy's revenue will grow by 2.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.1% today to 13.4% in 3 years time.

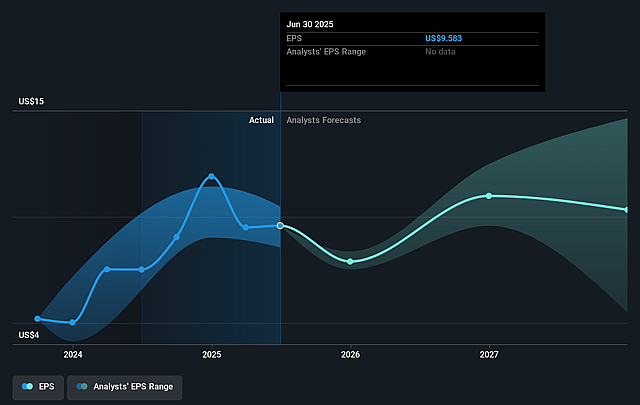

- Analysts expect earnings to reach $3.6 billion (and earnings per share of $11.28) by about September 2028, up from $3.0 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $5.1 billion in earnings, and the most bearish expecting $1.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 37.2x on those 2028 earnings, up from 31.2x today. This future PE is greater than the current PE for the US Electric Utilities industry at 19.9x.

- Analysts expect the number of shares outstanding to decline by 0.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Constellation Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Constellation Energy's heavy reliance on regulated nuclear assets exposes it to rising long-term regulatory compliance, operational, and eventual decommissioning costs, which could erode net margins and free cash flow as nuclear fleets age and capital requirements mount.

- Accelerated penetration and cost competitiveness of distributed energy resources (like rooftop solar and batteries) may reduce demand for centralized utility-scale generation, threatening the company's long-term revenue growth and potentially stranding legacy assets.

- The company's focus on large, long-term contracts with hyperscalers and major data center customers risks concentration and exposure to evolving customer preferences, grid localization trends, or potential regulatory backlash, making revenue streams less predictable.

- Increasing grid interconnection complexity and infrastructure bottlenecks-highlighted in the text by dependence on external utility actions and regulatory approvals-could delay new project completion, defer revenue realization, and add cost uncertainty to growth investments.

- Sustained growth in utility-scale renewables or abrupt market/pricing changes from market redesigns, capacity market reforms, or reduced state/federal subsidy support could compress wholesale power prices, shrinking earnings and potentially leading to underperformance versus expectations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $351.095 for Constellation Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $393.0, and the most bearish reporting a price target of just $184.05.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $26.7 billion, earnings will come to $3.6 billion, and it would be trading on a PE ratio of 37.2x, assuming you use a discount rate of 6.8%.

- Given the current share price of $300.82, the analyst price target of $351.1 is 14.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.