Key Takeaways

- Rising adoption of distributed energy and regulatory shifts toward renewables threaten the stability, revenue, and competitiveness of Constellation Energy's nuclear-focused business model.

- Operational costs, compliance demands, and weaker power market dynamics could undermine earnings growth and put increasing financial strain on the company.

- Strong policy support, increased clean energy demand, strategic growth initiatives, and operational discipline position Constellation Energy for sustained earnings growth and enhanced long-term value.

Catalysts

About Constellation Energy- Produces and sells energy products and services in the United States.

- The accelerating adoption of distributed energy resources-including residential and commercial solar, energy storage, and microgrids-is expected to reduce grid reliance on large-scale centralized nuclear generation, undermining the long-term revenue stability of Constellation Energy as customers increasingly defect from traditional supply models.

- Policy and regulatory moves designed to accelerate decarbonization risk favoring wind, solar, and battery storage developers over legacy nuclear operators, and despite recent bipartisan support for nuclear in policy, any pivot in political sentiment or support for nuclear could expose Constellation to abrupt changes in incentives and compliance costs, sharply depressing future net margins and cash flows.

- The company's significant exposure to nuclear power assets brings a persistent threat of rising operational expenses and unpredictable capital requirements, as maintenance, plant upgrades, license extensions, and tightening regulatory scrutiny force heavy reinvestment that could eventually outpace free cash flow, eroding earnings growth and placing the balance sheet under mounting pressure.

- Sustained declines in the cost of renewables and advanced grid technologies like batteries and demand response are likely to compress nuclear's competitiveness, lower nuclear fleet utilization, reduce capacity factors, and thereby weaken gross margins and long-term profitability.

- The heightened reliance on long-term, capacity-linked power purchase agreements may not fully protect Constellation from prolonged periods of low wholesale electricity prices as renewables' grid share rises, leaving the company vulnerable to earnings volatility and an inability to deliver the robust earnings per share growth that underpins current valuation multiples.

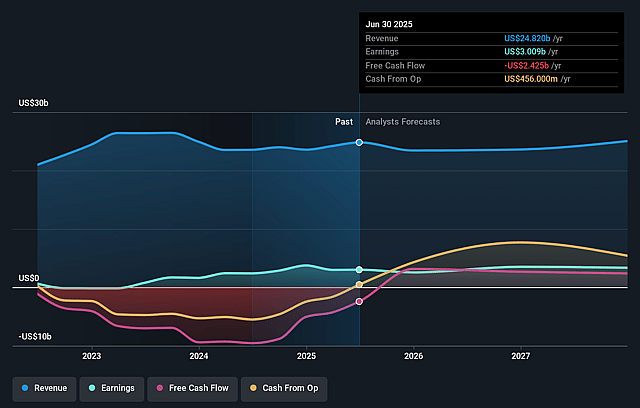

Constellation Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Constellation Energy compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Constellation Energy's revenue will decrease by 4.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 12.1% today to 7.5% in 3 years time.

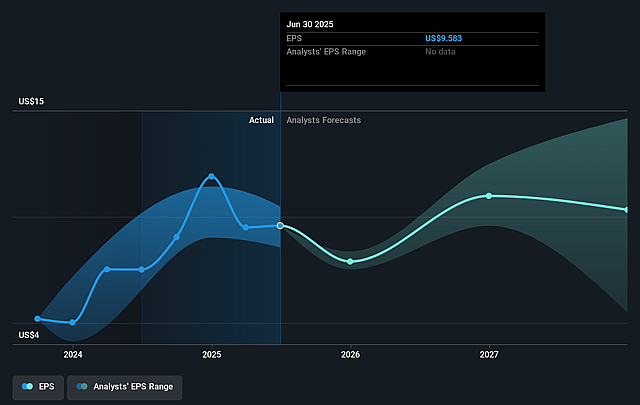

- The bearish analysts expect earnings to reach $1.6 billion (and earnings per share of $5.81) by about September 2028, down from $3.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 55.4x on those 2028 earnings, up from 33.2x today. This future PE is greater than the current PE for the US Electric Utilities industry at 19.9x.

- Analysts expect the number of shares outstanding to decline by 0.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Constellation Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Robust bipartisan policy support and recently passed legislation have solidified and expanded production tax credits for nuclear energy through at least 2032 and introduced new long-term bonus credits, meaning Constellation's nuclear-heavy portfolio will benefit from steady earnings and improved cash flow for years to come.

- There is accelerating and durable customer demand for long-term, firm, carbon-free power, demonstrated by recent multi-decade power purchase agreements with major corporations such as Meta and Microsoft, leading to recurring, predictable revenue streams and supporting net margins.

- The explosion of demand for clean energy from the growing data center and AI sectors, as well as from traditional commercial, industrial, and government customers, is driving higher realized pricing, increased deal flow, and the potential for margin expansion across Constellation's fleet.

- Strategic acquisitions and uprates, including the Calpine natural gas fleet and the planned restart of the Crane Clean Energy Center, will add substantial, firm generation capacity and diversify revenue sources, enabling earnings growth and enhancing free cash flow above current levels.

- Operational excellence with high nuclear fleet capacity factors, successful cost controls, and capital allocation discipline-including ongoing share repurchases and upside from bonus depreciation-enhance overall earnings per share and strengthen the investment-grade balance sheet, positioning the company for sustainable long-term value creation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Constellation Energy is $238.32, which represents two standard deviations below the consensus price target of $351.1. This valuation is based on what can be assumed as the expectations of Constellation Energy's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $393.0, and the most bearish reporting a price target of just $184.05.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $21.6 billion, earnings will come to $1.6 billion, and it would be trading on a PE ratio of 55.4x, assuming you use a discount rate of 6.8%.

- Given the current share price of $320.0, the bearish analyst price target of $238.32 is 34.3% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.