Key Takeaways

- Accelerating demand for AI-driven electricity and premium long-term contracts positions Constellation for significant revenue, earnings, and margin expansion beyond market expectations.

- First-mover advantages in nuclear deployment, grid modernization, and product innovation grant strong pricing power, diversified growth, and persistent outperformance over competitors.

- Constellation Energy faces revenue and margin pressures from distributed renewables, efficiency gains, aging nuclear assets, limited diversification, and growing competition within evolving energy markets.

Catalysts

About Constellation Energy- Produces and sells energy products and services in the United States.

- While analyst consensus expects data center growth from AI to drive increased electricity demand, the accelerating pace and magnitude of power requirements for hyperscale and AI workloads are likely being underestimated, with Constellation already achieving long-term contracts and advanced negotiations that position it to capture market share at higher prices, setting the stage for revenue and EBITDA expansion well beyond current forecasts.

- Whereas analysts broadly believe the Calpine acquisition will be accretive, they may be significantly undervaluing the strategic benefit of pairing flexible gas with nuclear to secure and extend 20-year+ carbon-free PPAs at premium rates, especially as the demand for firm, dispatchable clean energy intensifies, leading to persistently higher earnings, improved margins, and a step-change in free cash flow.

- Constellation's first-mover advantage in new nuclear deployment and uprates-supported by streamlined bipartisan policy, regulatory fast-tracking, and unique access to real estate, infrastructure, and workforce-positions the company to commission new zero-carbon capacity years ahead of peers, unlocking durable topline growth and multi-decade offtake agreements at a time when replacement costs and scarcity premiums are rising rapidly.

- Major tailwinds from global decarbonization and electrification, combined with surging ESG capital flows and tightening fossil fuel retirements, will drive a persistent scarcity of baseload clean energy assets, granting Constellation outsize pricing power and long-term margin expansion as premium valuations and capital allocations shift more aggressively toward proven nuclear platforms.

- The company is leveraging grid modernization, AI-driven demand management, and emergent clean products (such as hydrogen and time-matched 24/7 carbon-free offerings) to not only lower operating costs but also create new recurring revenue streams, meaningfully boosting both future net margins and diversified earnings in ways the market has not yet priced in.

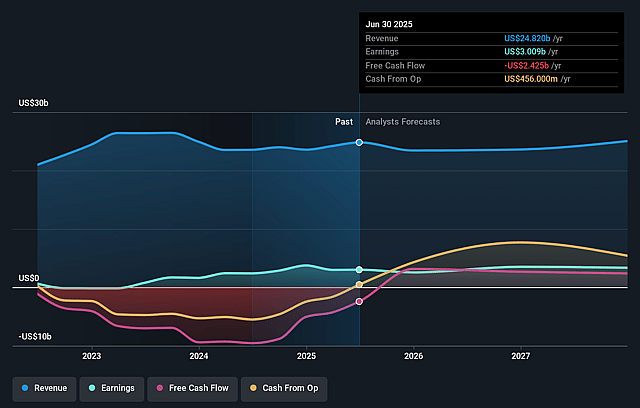

Constellation Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Constellation Energy compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Constellation Energy's revenue will grow by 5.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 12.1% today to 18.8% in 3 years time.

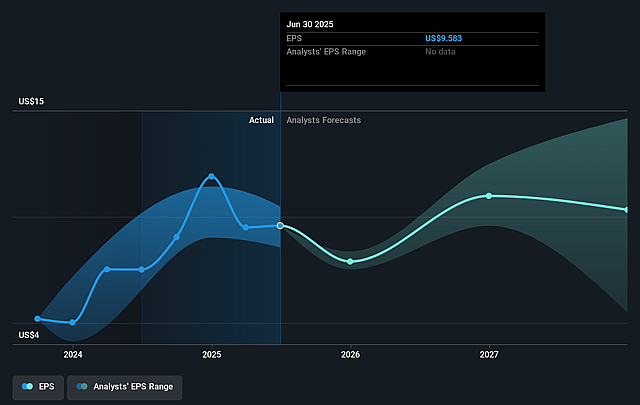

- The bullish analysts expect earnings to reach $5.4 billion (and earnings per share of $15.5) by about September 2028, up from $3.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 27.5x on those 2028 earnings, down from 31.2x today. This future PE is greater than the current PE for the US Electric Utilities industry at 19.9x.

- Analysts expect the number of shares outstanding to decline by 0.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Constellation Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerating adoption of distributed energy resources such as rooftop solar and home battery storage could reduce demand for centrally generated electricity, leading to lower long-term revenue growth for Constellation Energy despite its large-scale generation focus.

- Rising energy efficiency standards and increasing deployment of smart grid technologies may drive down per-capita electricity consumption, thereby suppressing future demand and placing downward pressure on revenue and earnings.

- Heavy dependence on an aging nuclear fleet exposes Constellation to mounting maintenance and refurbishment costs, which may compress net margins and strain free cash flow as plants require more capital over time to stay operational and safe.

- Limited geographic diversification means Constellation's revenue stream remains particularly vulnerable to adverse regional regulatory changes or increased localized competition, potentially undermining revenue stability and predictability.

- The continued rapid growth of renewables, coupled with advances in low-cost energy storage, threatens to lower wholesale power prices and diminish the value proposition of baseload nuclear generation, placing pressure on realized pricing and potentially eroding long-term earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Constellation Energy is $393.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Constellation Energy's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $393.0, and the most bearish reporting a price target of just $184.05.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $28.7 billion, earnings will come to $5.4 billion, and it would be trading on a PE ratio of 27.5x, assuming you use a discount rate of 6.8%.

- Given the current share price of $300.82, the bullish analyst price target of $393.0 is 23.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.