- United States

- /

- Electric Utilities

- /

- NasdaqGS:CEG

How the Clean Power Rally Shapes Constellation Energy’s Value After Sharp 2025 Surge

Reviewed by Bailey Pemberton

If you are holding Constellation Energy stock or considering adding it to your portfolio, you are probably watching the powerful rally in disbelief. In the last week alone, the stock shot up 5.7%, which comes right after a robust 24.2% gain over the past month. Taking a step back, the surge is even more impressive, with a year-to-date return of 52.9% and a staggering 363% jump over the last three years. After this kind of performance, it is natural to ask if there is still room for growth, or if the market is already pricing in all the optimism.

Behind these moves, there has been increasing investor enthusiasm around the energy transition, which has shined a spotlight on companies like Constellation Energy. Renewables and grid modernization are in the headlines, and Constellation, positioned well in these arenas, is benefiting from a broader market rerating of utility-type businesses with a clean energy focus. Still, with all the excitement, questions around valuation become even more important for would-be buyers and current holders.

According to our assessment, Constellation Energy is undervalued on just 1 out of 6 standard valuation checks, giving it a value score of 1. On paper, that might suggest the stock is not a bargain right now, or does it? In the next section, we will break down these traditional valuation approaches, and later, explore a fresh perspective on finding real value in stocks like Constellation.

Constellation Energy scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Constellation Energy Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and discounting them back to today. For Constellation Energy, the DCF uses a two-stage Free Cash Flow to Equity approach. The company's most recent Free Cash Flow (FCF) stands at a negative $2.60 billion, reflecting significant recent investments or other one-time factors.

Analyst forecasts show a sharp improvement ahead. Over the next several years, FCFs are expected to rebound, with estimates reaching $2.92 billion in 2026 and then growing further. By 2029, projected FCF rises to $4.40 billion, and projections up to 2035 also point to solid growth as future estimates gradually flatten out with maturing growth.

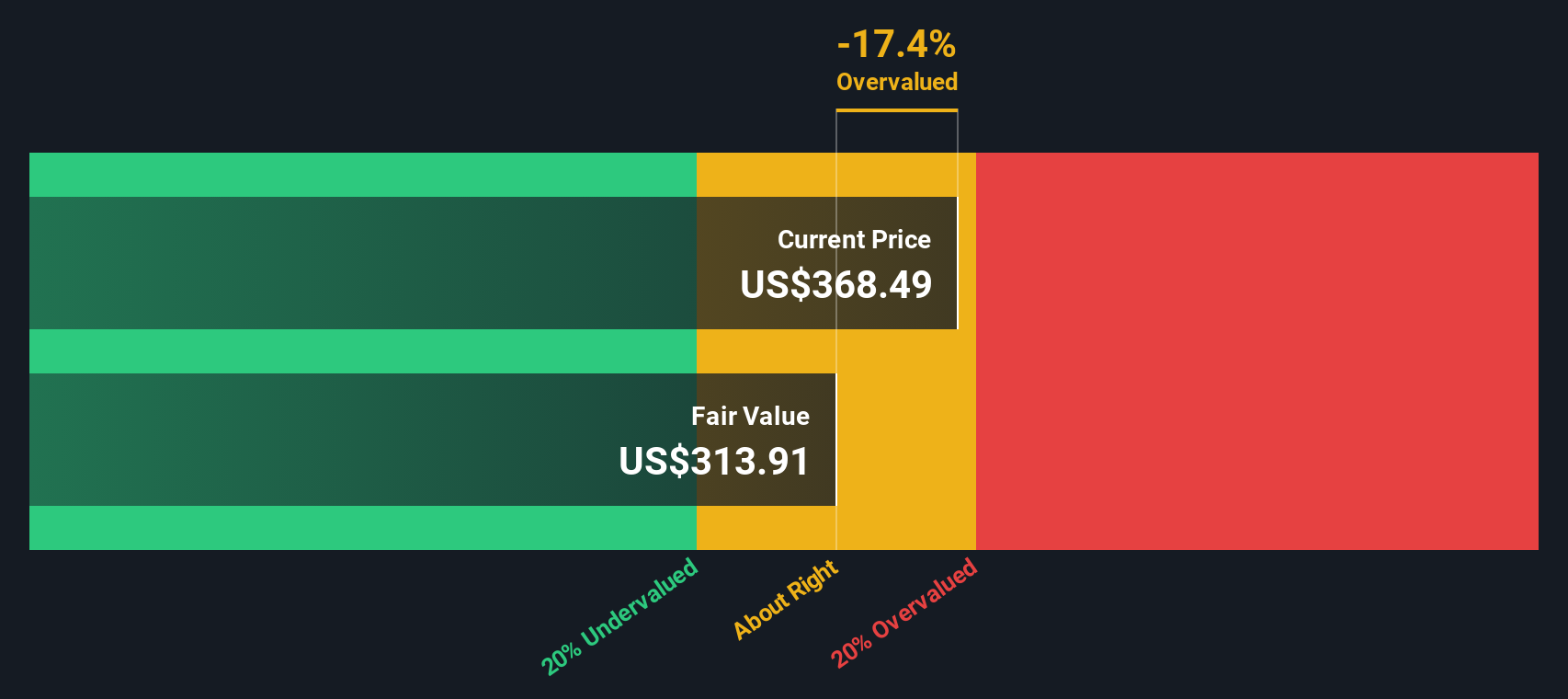

Taking these projections into account, the model arrives at an intrinsic value of $313.91 per share. Compared to the current share price, this implies the stock is roughly 18.2% overvalued.

In short, while Constellation Energy's DCF outlook is robust and long-term growth prospects are positive, the current market price is running ahead of estimated fair value according to this key metric.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Constellation Energy may be overvalued by 18.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Constellation Energy Price vs Earnings

For profitable companies, the price-to-earnings (PE) ratio is often considered a strong valuation tool because it directly compares a company’s share price with its earnings, highlighting how much investors are willing to pay for each dollar of profit. Growth expectations and risk play a significant role in what constitutes a "normal" PE ratio. The higher a company’s expected growth or profitability, or the lower its perceived risk, the more investors are typically willing to pay, leading to a higher PE multiple.

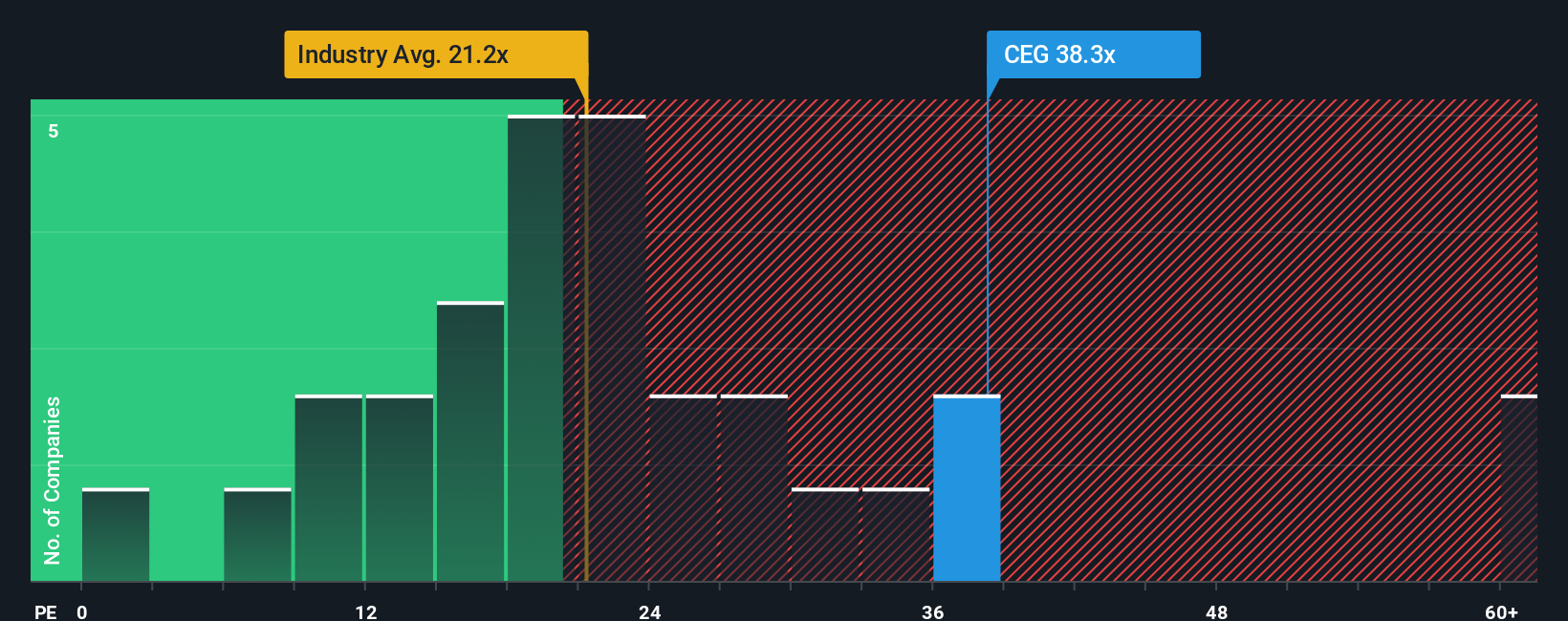

Constellation Energy’s current PE ratio stands at 38.5x. This is well above the average PE ratio for Electric Utilities, which is 21.3x, and also above the peer group average of 23.0x. At first glance, this might suggest the stock is trading at a premium relative to the sector.

However, Simply Wall St’s proprietary "Fair Ratio" provides a more tailored benchmark. It calculates what a reasonable PE would be for Constellation by factoring in not just the industry but also the company’s earnings growth outlook, risk profile, profit margins, and market cap. For Constellation Energy, the Fair Ratio is 38.9x, which is almost identical to its current multiple. This approach helps sidestep the limitations of looking only at industry or peer averages, giving a more holistic view of value based on the company’s unique circumstances.

Since the actual PE and Fair Ratio are nearly the same, Constellation Energy’s shares appear fairly valued through the lens of the PE ratio.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Constellation Energy Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative brings together your view of a company’s story—why it could win or lose in its unique environment—with the numbers behind it, including your assumptions for fair value and projections for future revenue, earnings, and margins.

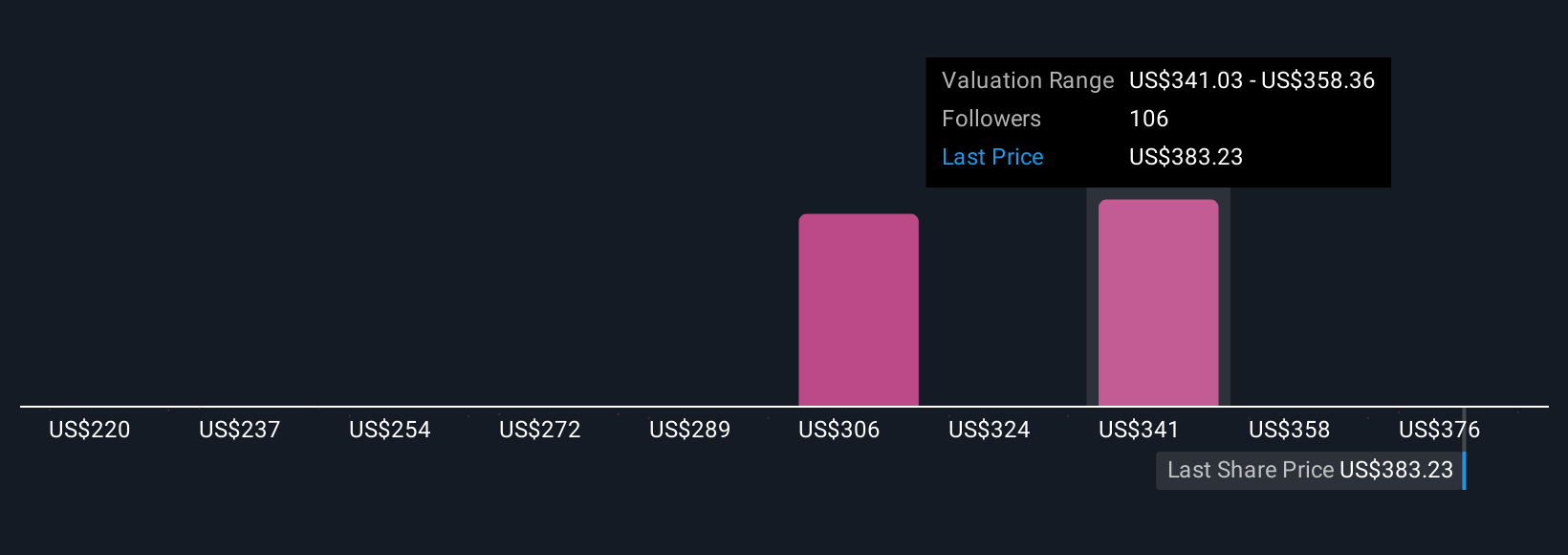

Narratives convert these perspectives into a structured financial forecast, connecting your expectations directly to a fair value estimate. On Simply Wall St’s platform, millions of investors easily build and compare Narratives in the Community page, using them as a dynamic tool to help decide when a stock is worth buying or selling, based on the gap between Fair Value and the current Price.

Whenever new information like news or earnings appears, Narratives update automatically, so your view always reflects the latest reality. For Constellation Energy, for example, some investors' Narratives expect a price target as high as $393, confident in long-term clean power demand, while others see risk and set targets as low as $184.05. This diversity empowers you to weigh competing stories, make your own call, and invest with conviction.

Do you think there's more to the story for Constellation Energy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CEG

Constellation Energy

Produces and sells energy products and services in the United States.

Proven track record with limited growth.

Similar Companies

Market Insights

Community Narratives