- United States

- /

- Water Utilities

- /

- NasdaqGS:ARTN.A

3 Leading Dividend Stocks To Consider With Up To 5.6% Yield

Reviewed by Simply Wall St

As U.S. markets experience a slight rebound with the S&P 500 and Nasdaq Composite snapping a four-day losing streak, investors continue to navigate economic uncertainties and policy impacts from the current administration. In this environment, dividend stocks can offer stability and potential income, making them an attractive option for those looking to balance growth with regular returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.43% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.77% | ★★★★★★ |

| FMC (NYSE:FMC) | 6.07% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.07% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.76% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.55% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.96% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.32% | ★★★★★★ |

| Virtus Investment Partners (NYSE:VRTS) | 4.97% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.20% | ★★★★★★ |

Click here to see the full list of 143 stocks from our Top US Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Artesian Resources (NasdaqGS:ARTN.A)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Artesian Resources Corporation, with a market cap of $335.78 million, operates through its subsidiaries to provide water, wastewater, and other services in Delaware, Maryland, and Pennsylvania.

Operations: Artesian Resources Corporation generates revenue primarily from its Regulated Utility segment, which accounts for $98.93 million, while also earning $6.97 million from non-utility services.

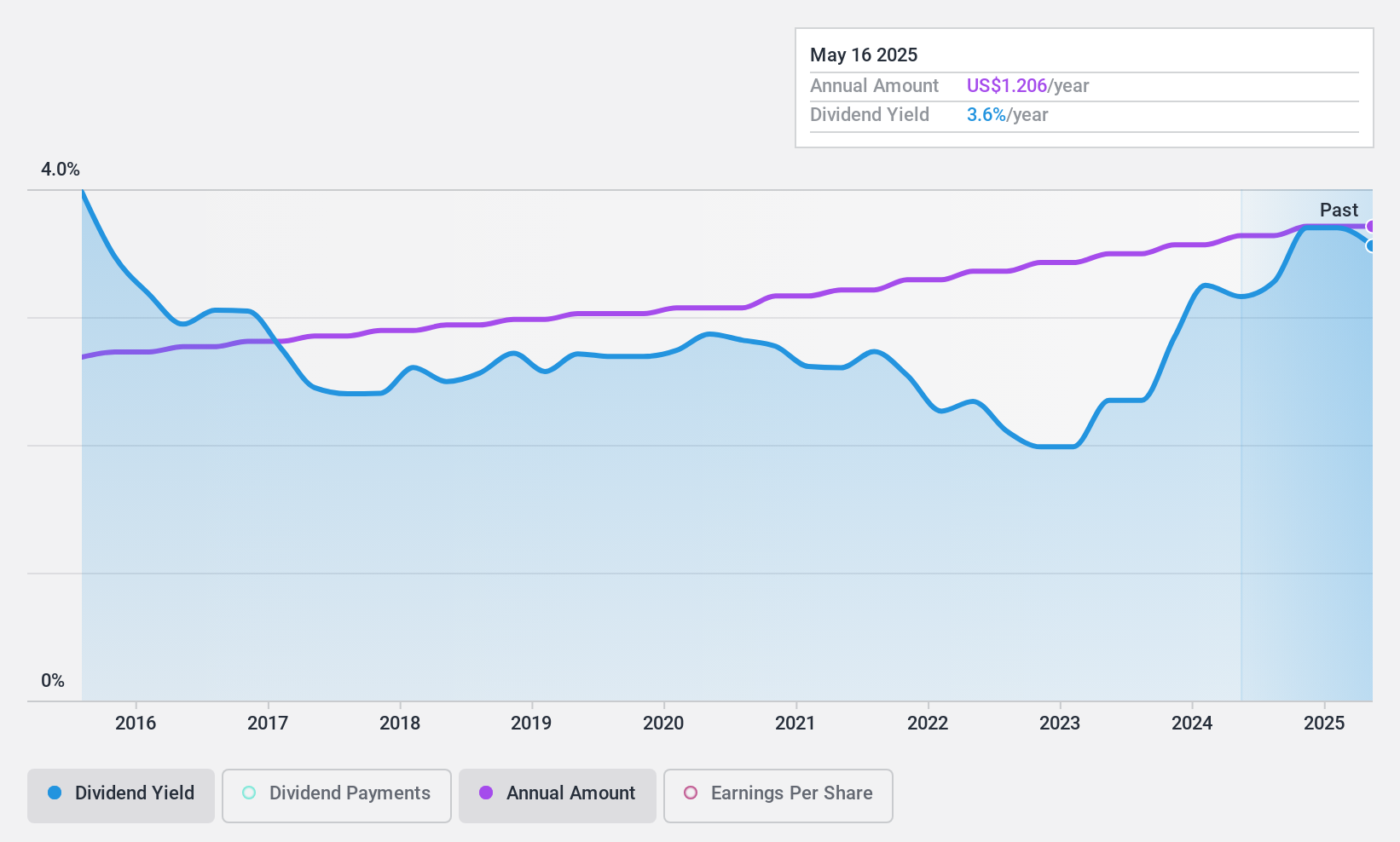

Dividend Yield: 3.7%

Artesian Resources offers a consistent dividend history with 129 consecutive quarterly payments, though its current yield of 3.73% falls short compared to top-tier US dividend payers. The company's dividends have grown steadily over the past decade, but they are not well covered by free cash flows despite a reasonable payout ratio of 60.1%. Recent executive changes include the interim appointment of Nicholle R. Taylor as CEO during Dian C. Taylor's leave, which could impact future strategic decisions.

- Unlock comprehensive insights into our analysis of Artesian Resources stock in this dividend report.

- Our valuation report unveils the possibility Artesian Resources' shares may be trading at a premium.

Haverty Furniture Companies (NYSE:HVT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Haverty Furniture Companies, Inc. is a specialty retailer of residential furniture and accessories in the United States with a market cap of $378.02 million.

Operations: Haverty Furniture Companies, Inc. generates revenue primarily through its home furnishings retailing segment, which accounted for $722.90 million.

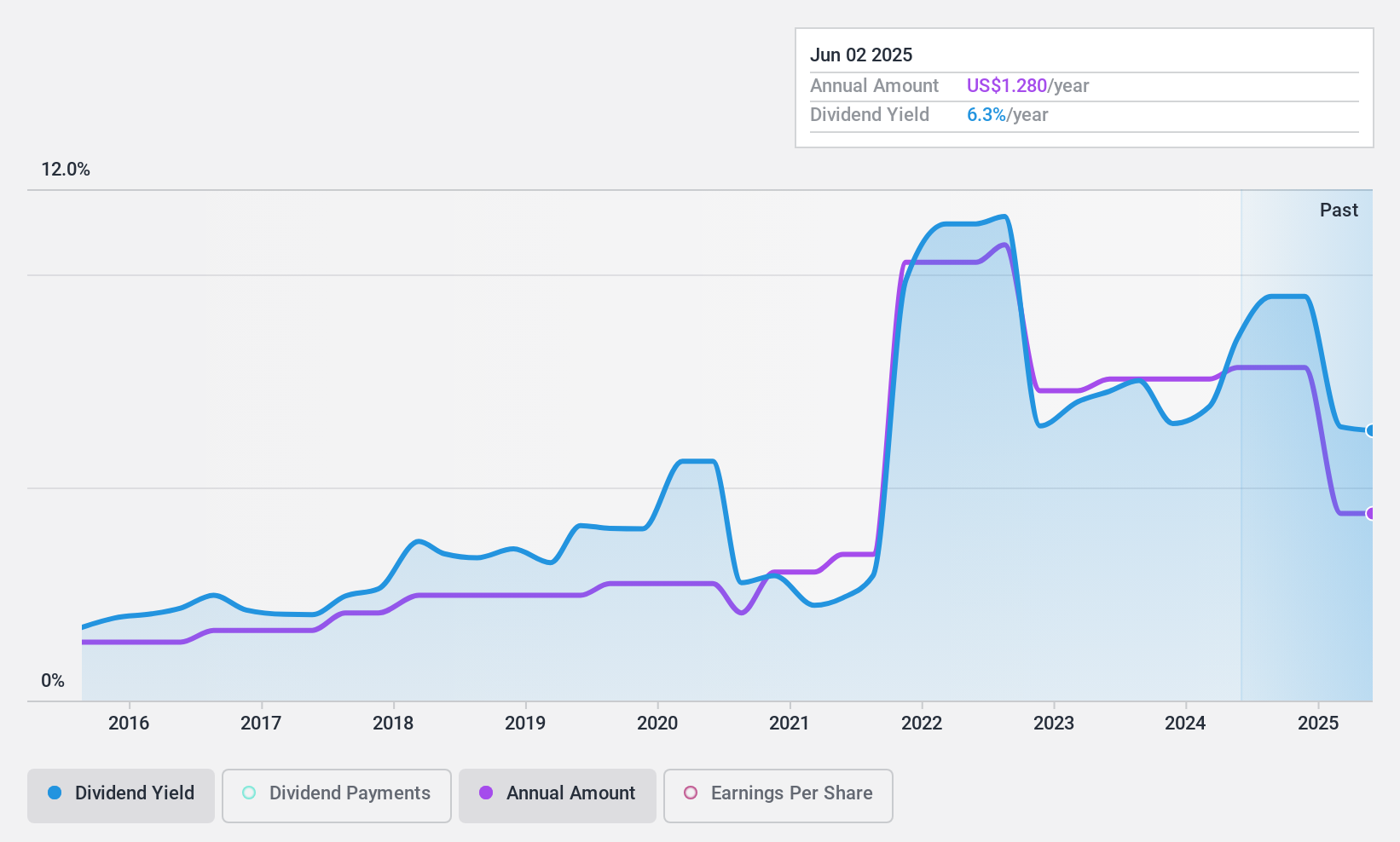

Dividend Yield: 5.7%

Haverty Furniture Companies has announced a quarterly dividend of US$0.32 per share, yet its dividends have been volatile over the past decade. Despite trading at 40.1% below estimated fair value, the high payout ratio of 105.9% suggests earnings do not adequately cover dividends, though cash flows do provide coverage with a cash payout ratio of 78.3%. Recent financial results show declining sales and net income year-over-year, which may affect future dividend sustainability.

- Click here and access our complete dividend analysis report to understand the dynamics of Haverty Furniture Companies.

- Upon reviewing our latest valuation report, Haverty Furniture Companies' share price might be too pessimistic.

Merck (NYSE:MRK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Merck & Co., Inc. operates as a global healthcare company with a market cap of approximately $231.28 billion.

Operations: Merck & Co., Inc.'s revenue is primarily derived from its Pharmaceutical segment, which accounts for $57.40 billion, and its Animal Health segment, contributing $5.88 billion.

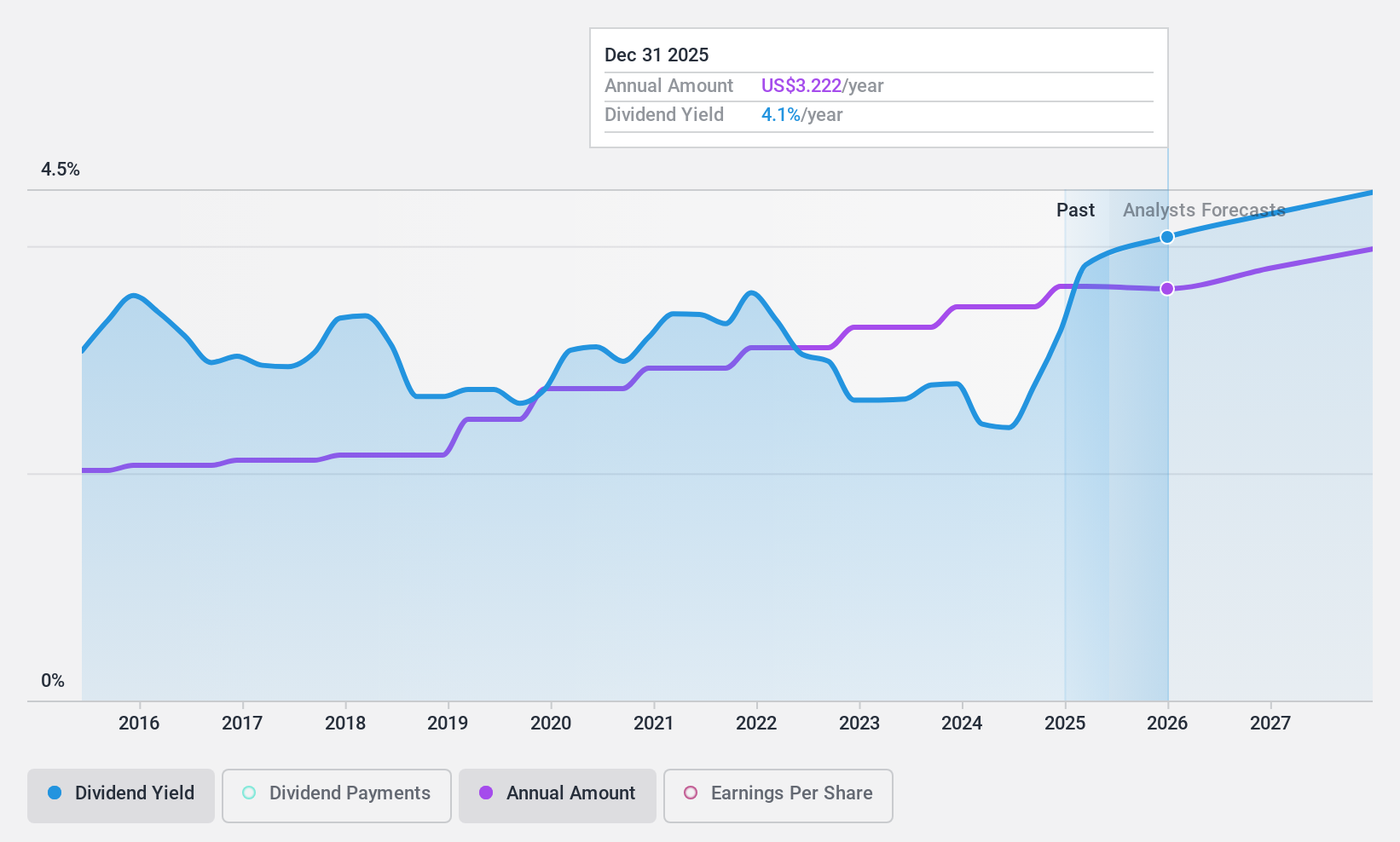

Dividend Yield: 3.6%

Merck's dividend, covered by both earnings (45.7% payout ratio) and cash flows (55.2% cash payout ratio), has been stable and growing over the past decade. Despite trading at 63% below estimated fair value, its dividend yield of 3.63% is lower than top-tier US payers. Recent developments include FDA priority review for KEYTRUDA in head and neck cancer treatment, European approval for WELIREG in RCC, and a class action lawsuit alleging misleading revenue projections impacting stock price stability.

- Click to explore a detailed breakdown of our findings in Merck's dividend report.

- In light of our recent valuation report, it seems possible that Merck is trading behind its estimated value.

Taking Advantage

- Delve into our full catalog of 143 Top US Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARTN.A

Artesian Resources

Provides water, wastewater, and other services in Delaware, Maryland, and Pennsylvania.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion