- United States

- /

- Electric Utilities

- /

- NasdaqGS:AEP

Is AEP’s Recent Rally Justified After $54 Billion Investment Plan Announcement?

Reviewed by Bailey Pemberton

Are you mulling over what to do with American Electric Power Company stock after its recent climb? You are not alone. Whether you already hold shares or are sizing up a new position, the journey of this utility giant is hard to ignore. Over the past week, AEP notched a 2.6% gain, and the momentum stretches even further, with a 30-day return of 8.0%, a year-to-date rally of 27.3%, and an impressive 57.3% over three years. Each bump up in price is catching more eyes and sparking debates on whether the stock’s growth story is still in the early innings or if caution is the wiser play.

Some of this optimism is drawing from broad market shifts in the utility sector, as investors look for stable, dividend-paying companies amid changing economic winds. Recent news around infrastructure investments and clean energy mandates has also contributed to changing perceptions of risk and opportunity for AEP. Yet price is only one side of the story. At $117.04 per share, the real question is how the current valuation stacks up against the company’s fundamentals.

That is where things get interesting. Using six key valuation checks, AEP scores a 3, meaning it appears undervalued in half of the areas we track. But numbers rarely tell the whole story in isolation. Next, we will dig into the nitty-gritty of how analysts and investors commonly assess valuation. Be sure to stick around, though, as we will ultimately explore a deeper, possibly more insightful way to think about what “value” really means for AEP shareholders.

Approach 1: American Electric Power Company Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) is a valuation method that estimates the intrinsic value of a stock by projecting future dividend payments and discounting them back to today’s dollars. This approach is especially relevant for companies like American Electric Power Company, which have a consistent record of dividend payouts.

For AEP, the annual dividend per share currently stands at $4.05. The company maintains a payout ratio of approximately 70 percent, meaning a majority of its earnings are returned to shareholders each year. Return on equity is a healthy 10.4 percent, and the expected long-term dividend growth rate is set at 3.08 percent, capped to avoid overestimation. This balance between maintaining stable dividends and supporting modest growth is typical for regulated utilities like AEP.

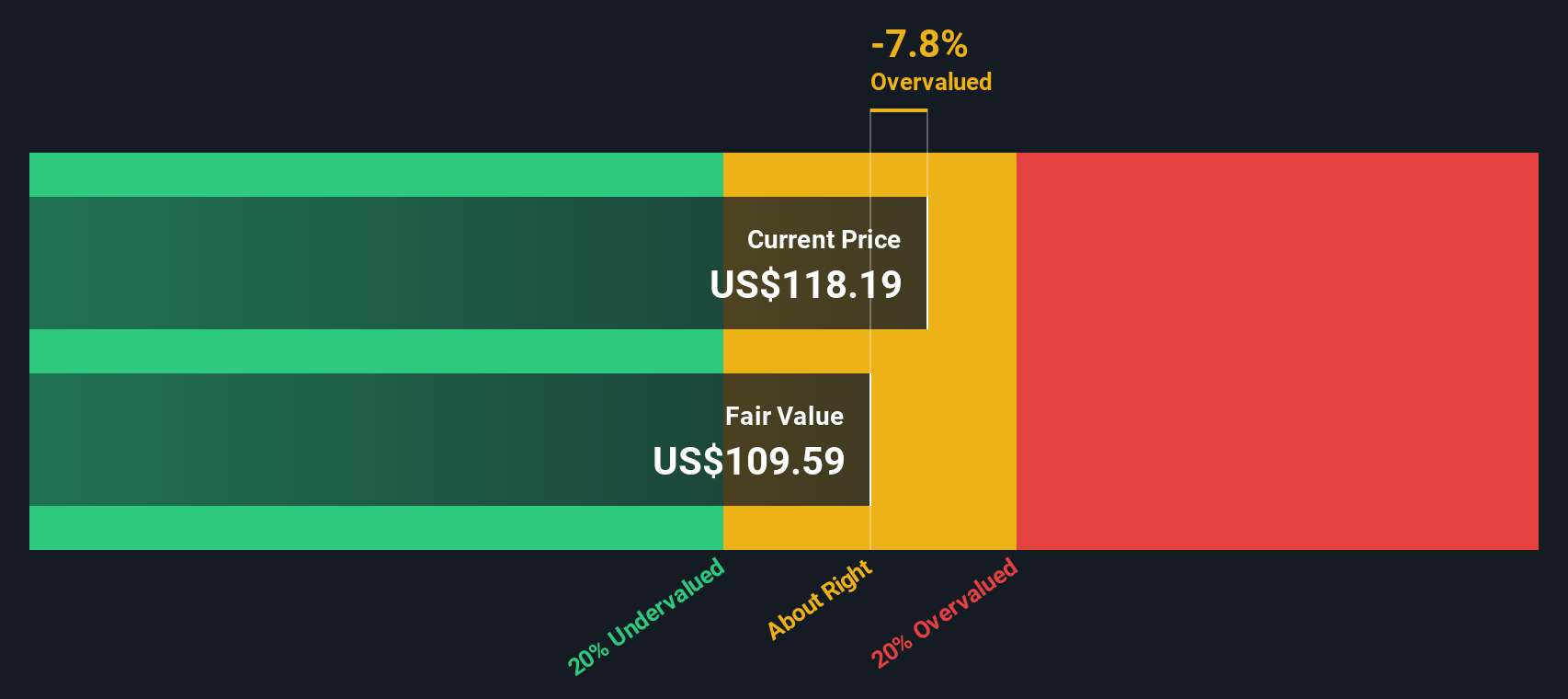

Using these inputs, the DDM calculates an intrinsic value of $109.64 per share. With the current market price at $117.04, the DDM suggests the stock is about 6.8 percent overvalued. While this does not represent a dramatic divergence, it implies that much of AEP’s future dividend potential is already reflected in the stock’s price.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out American Electric Power Company's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: American Electric Power Company Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like American Electric Power Company, as it directly relates a company’s share price to its earnings power. For investors, it serves as a yardstick for comparing how much they are paying for the company’s recent profits, helping them gauge if the stock is priced fairly versus other businesses or industry norms.

What qualifies as a “normal” or “fair” PE ratio often hinges on expectations for growth and underlying risks. Higher growth companies may warrant a higher PE, as investors are willing to pay a premium for future earnings expansion. Conversely, companies facing uncertainty or slower prospects usually command lower multiples.

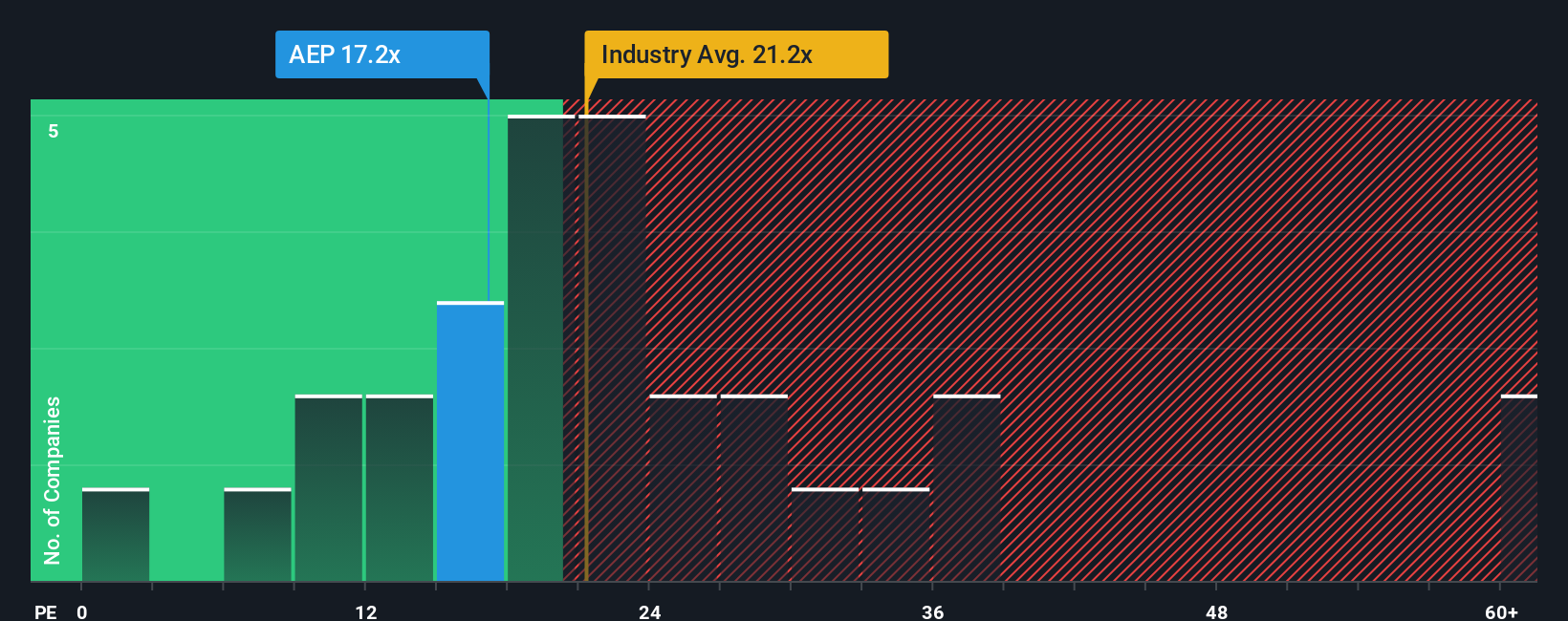

Currently, American Electric Power Company trades at a PE ratio of 17.15x. This is below both the industry average of 21.14x and the peer average of 21.51x. This suggests the stock is priced more modestly than many of its competitors in the Electric Utilities sector. However, instead of relying purely on these external benchmarks, the proprietary “Fair Ratio” from Simply Wall St offers a more tailored assessment. This metric considers specific factors like AEP’s earnings growth profile, profit margins, sector dynamics, company size, and risk exposures to derive an expectation of what the PE should be for this business.

For AEP, the Fair Ratio is calculated at 20.53x. Because this value is grounded in a holistic view of the company, it often delivers a more nuanced and reliable yardstick than raw industry comparisons. With the actual PE ratio only slightly below the Fair Ratio and well within the threshold for significant mispricing, AEP shares appear to be trading at close to fair value based on earnings.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your American Electric Power Company Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story about a company. It links your assumptions about American Electric Power Company’s future (like growth or risks) with a clear financial forecast and fair value estimate. Instead of just crunching numbers, Narratives help you blend your views about the business with the numbers behind it, providing a more dynamic, personal way to value stocks.

With Narratives, you can easily build and compare your perspective with those from millions of investors on Simply Wall St’s Community page. This tool shows you how your forecasted revenue, earnings, and margins turn into a fair value, and helps you decide whether to buy or sell by seeing how that value compares with today’s share price. Even better, Narratives update automatically as new news or earnings come in, so your insights stay relevant.

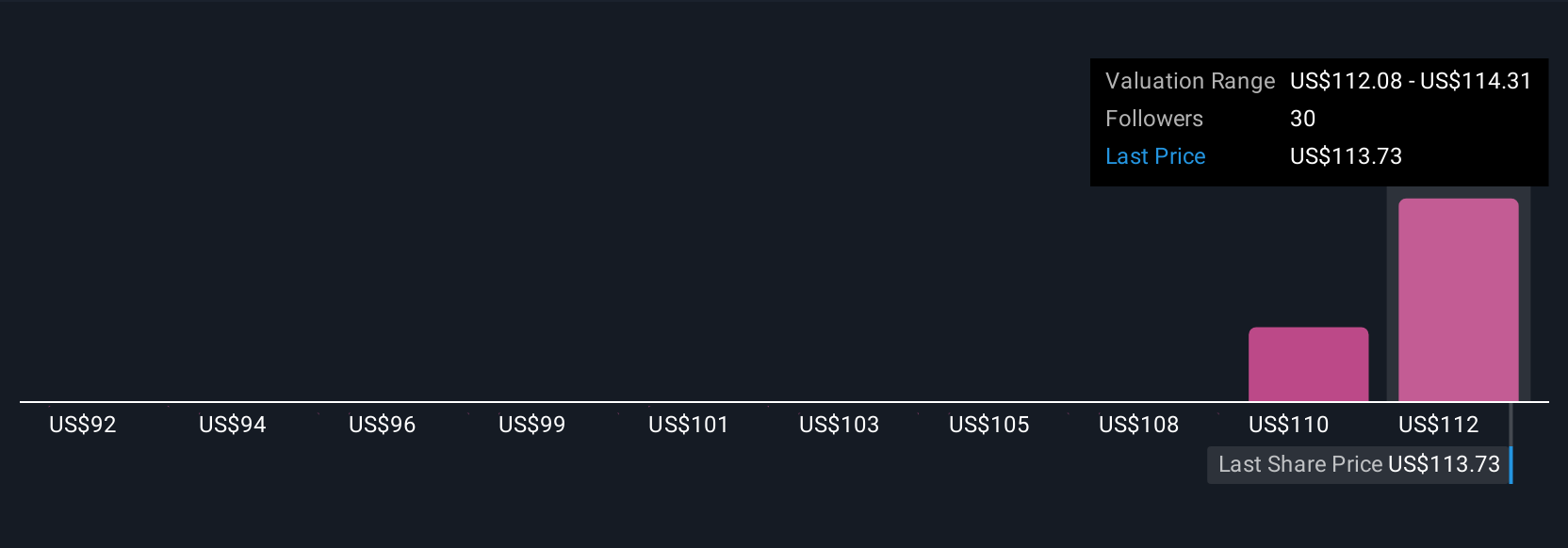

For example, some American Electric Power Company Narratives reflect optimism about the company’s $54 billion investment plans and growing commercial demand, while others take a more cautious stance, flagging regulatory risk, supply chain concerns, or modest profit margins. This range of views means you can see why the highest current Narrative values the stock near $130, while the lowest sees fair value closer to $100.

Do you think there's more to the story for American Electric Power Company? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AEP

American Electric Power Company

An electric public utility holding company, engages in the generation, transmission, and distribution of electricity for sale to retail and wholesale customers in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives