- United States

- /

- Transportation

- /

- OTCPK:DIDI.Y

How Strong Revenue Growth and Analyst Optimism at DiDi Global (DIDI.Y) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- JPMorgan recently gave DiDi Global an Overweight rating after the company reported a 10.9% increase in second-quarter revenue, even as it posted a net loss due to a one-time provision related to a shareholder lawsuit.

- This combination of strong revenue performance and renewed analyst confidence is drawing attention to DiDi’s operational resilience despite ongoing challenges.

- We’ll explore how DiDi Global’s robust revenue growth and positive analyst outlook influence its investment narrative going forward.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is DiDi Global's Investment Narrative?

To believe in DiDi Global as a shareholder, you have to buy into the story of a company executing solid revenue growth while managing ongoing volatility in profits and a complex regulatory backdrop. This quarter’s 10.9% revenue jump, paired with JPMorgan’s Overweight rating, could be seen as fresh evidence of operational strength after a temporary setback from a one-off legal provision. That’s a new twist for anyone watching for signs of short-term momentum or policy headwinds as the main drivers of risk and upside. Previously, attention was squarely on DiDi’s path back to consistent profitability and whether revenue growth would hold up against macro and sector-specific challenges. With this news, renewed analyst confidence might refocus the short-term catalyst on improved sentiment and stronger trading, while the biggest risk now sits more with ongoing legal and regulatory complexities rather than just the earnings dip alone.

But even with rising optimism, potential legal and regulatory bumps remain a concern investors should track.

Exploring Other Perspectives

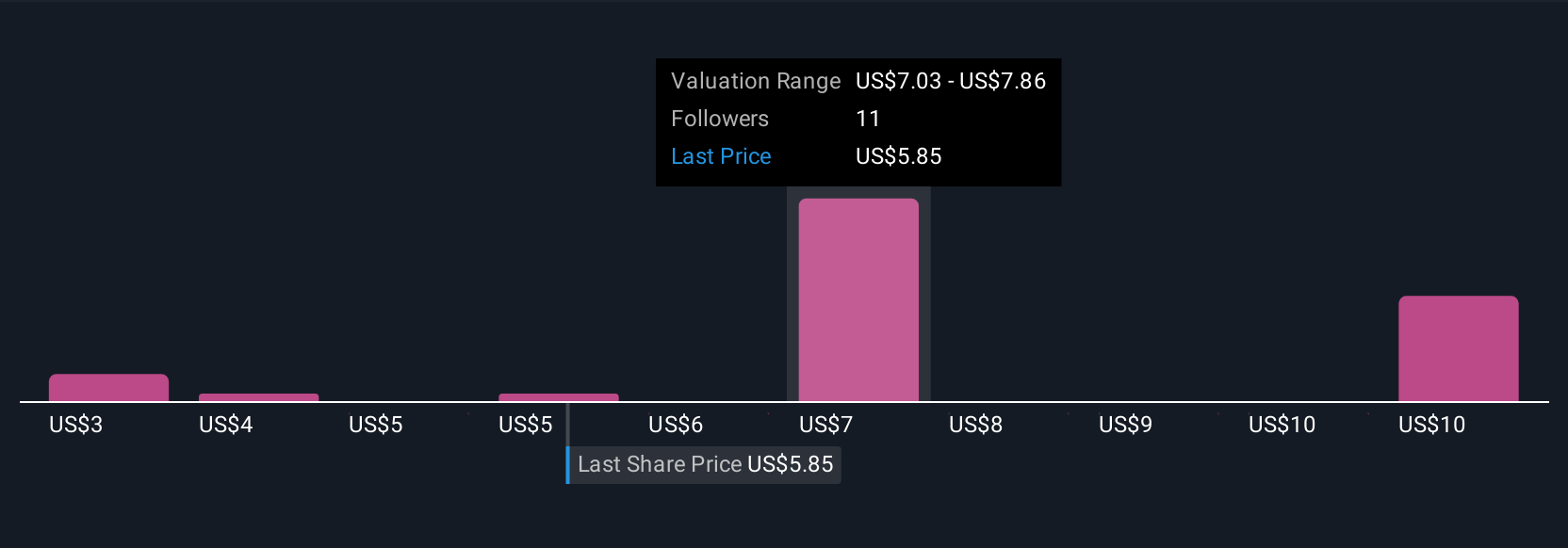

Explore 5 other fair value estimates on DiDi Global - why the stock might be worth less than half the current price!

Build Your Own DiDi Global Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DiDi Global research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free DiDi Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DiDi Global's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:DIDI.Y

DiDi Global

Operates a mobility technology platform that provides various mobility and other services in the People's Republic of China, Brazil, Mexico, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives