- United States

- /

- Logistics

- /

- NYSE:ZTO

Is ZTO Express a Bargain After Its 27% Drop and New JD Logistics Collaboration?

Reviewed by Bailey Pemberton

Trying to figure out what to do with ZTO Express (Cayman) stock? You are certainly not alone. Investors have watched the stock price zigzag across timeframes, with a modest loss of 1.7% in the past week balanced by a 5.4% gain over the last month. Year-to-date, ZTO Express (Cayman) remains nearly flat at -0.2%, but the full-year view paints a starker picture, down 27.2% over the last 12 months. The long-term lens is equally revealing, showing a negative return of 13.6% in three years and a 29.1% drop over five years. These declines trace back to evolving competitive dynamics in China’s logistics sector and shifting investor risk appetites. These factors have weighed heavily on the entire market, not just ZTO Express (Cayman).

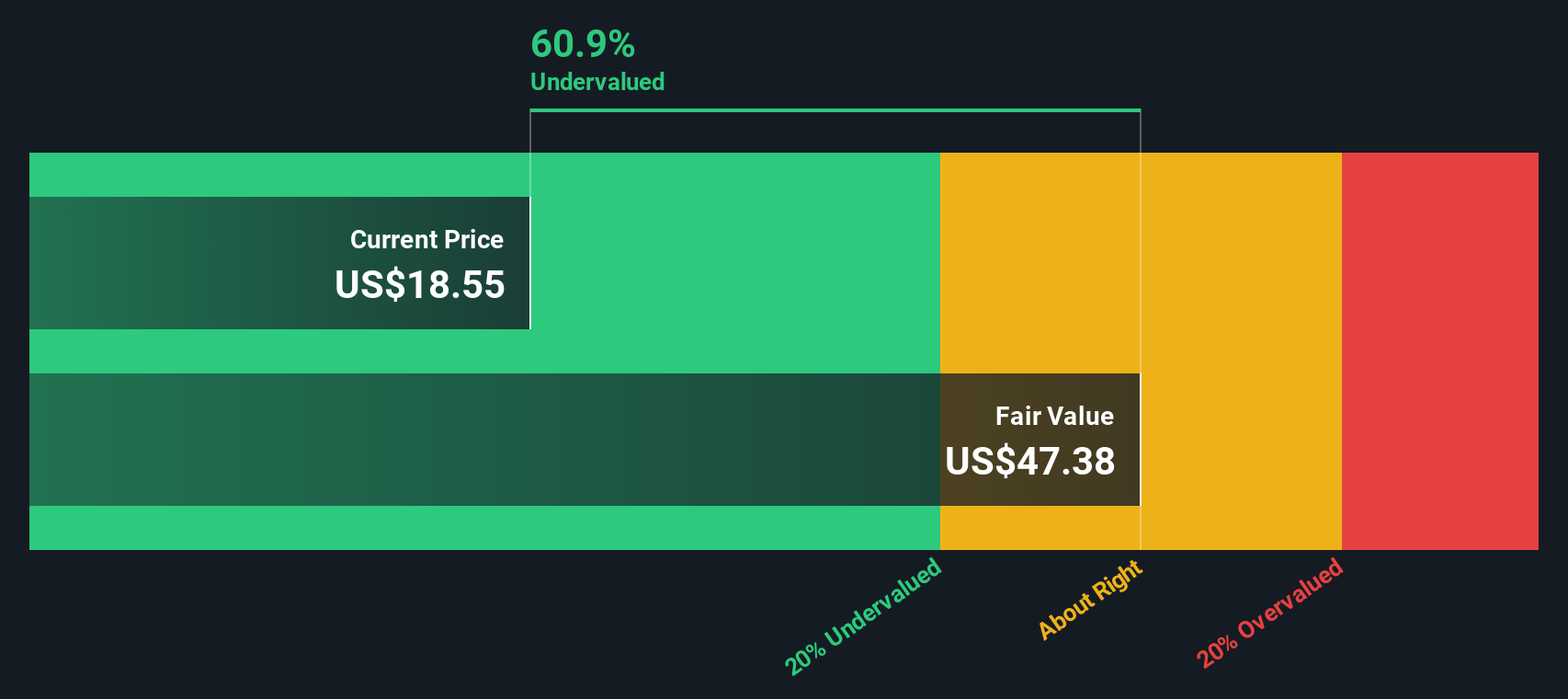

But here is the twist. Despite this choppy ride, every conventional valuation yardstick now flashes the same message: opportunity. ZTO Express (Cayman) currently boasts a valuation score of 6 out of 6, meaning it appears undervalued no matter which metric you choose. In other words, all six of our favorite valuation checks are signaling a potential bargain on the table.

So, is this recent pessimism overdone, or is there more behind the market’s skepticism than meets the eye? Let us dig into the numbers and see how each valuation approach stacks up. Then explore an even better way to understand what ZTO Express (Cayman) is really worth.

Why ZTO Express (Cayman) is lagging behind its peers

Approach 1: ZTO Express (Cayman) Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by estimating a company’s future free cash flows and then discounting those projections back to today’s value. This approach helps investors understand what a business is worth based on the money it is expected to generate in the years ahead.

For ZTO Express (Cayman), the latest twelve months’ free cash flow stood at CN¥3.1 Billion. Analyst forecasts suggest that cash flows could grow each year, reaching CN¥19.1 Billion by 2035. While analysts cover projections for roughly the next five years, further estimates are extrapolated for the remaining period. This long-term growth reflects expectations of significant scaling within the logistics business.

Using this DCF approach, the estimated intrinsic value of ZTO Express (Cayman) is calculated as $46.57 per share. With the model indicating a 59.2% discount compared to the current share price, the stock appears deeply undervalued according to this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ZTO Express (Cayman) is undervalued by 59.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: ZTO Express (Cayman) Price vs Earnings

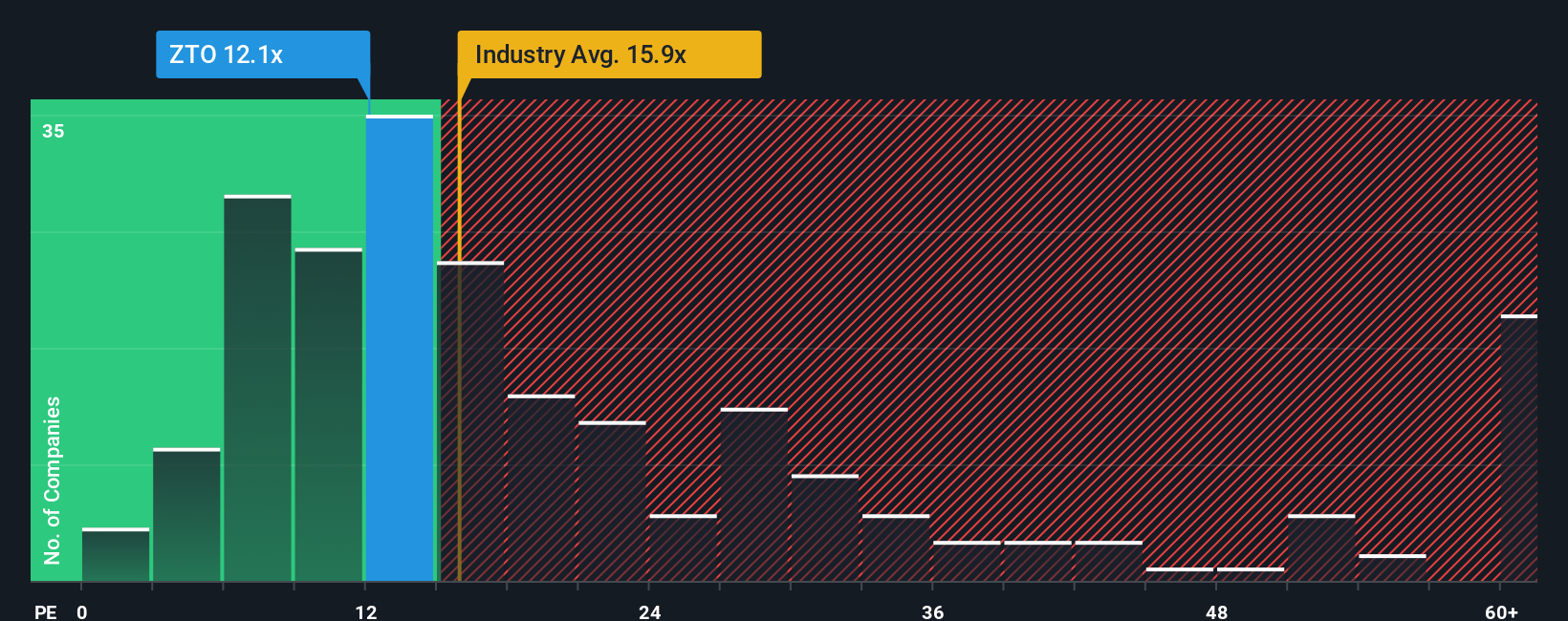

For profitable companies like ZTO Express (Cayman), the Price-to-Earnings (PE) ratio remains the most widely used valuation tool. This metric gives investors a direct line of sight into how much they are paying for a company’s current earnings, making it particularly useful when those earnings are consistent and reliable.

The “right” or fair PE ratio depends on a range of factors. Companies with higher growth rates or lower risk typically trade at higher PE multiples, while those facing headwinds or unique risks often command lower ratios. Comparing across industry peers and sector averages gives important context, but it may not always capture the whole picture.

At the moment, ZTO Express (Cayman) trades at a PE ratio of 12.49x. That is not only lower than the wider Logistics industry average of 16.00x, but also notably below the peer average of 40.31x. These numbers suggest investors are applying a meaningful discount to the company relative to its peers.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio for ZTO Express (Cayman) currently stands at 14.93x. Unlike basic peer or industry comparisons, the Fair Ratio incorporates the company’s earnings growth, profit margins, sector trends, risk factors, and even market cap. By factoring in these details, it produces a more nuanced yardstick for assessing fair value.

With ZTO Express (Cayman) trading at 12.49x against a Fair Ratio of 14.93x, the stock is undervalued according to this tailored benchmark.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ZTO Express (Cayman) Narrative

Earlier we mentioned that there is an even better way to understand value, so let us introduce you to Narratives. Narratives are a simple, powerful framework that starts with your perspective on a company’s story and connects it to the financial forecasts and estimated fair value you believe are most likely.

With Narratives, you are not just looking at numbers in isolation, but tying your view of ZTO Express (Cayman) from management strategy to industry trends to concrete estimates like future revenue, earnings, and margins. This approach brings your research and conviction to life, showing how your outlook translates directly into what you think the company is worth.

Narratives are easy to create and explore within the Simply Wall St Community. Millions of investors use them to make their buy and sell decisions smarter, comparing their own Fair Value estimate with the current share price. The best part? Narratives update automatically as news, earnings, or other information emerges, so your view always stays current and data-driven.

For example, some investors see automation and e-commerce trends cementing ZTO’s long-term profitability and set Fair Value estimates at the highest analyst target of $28.34. Others worry about pricing pressure and competition, arriving at a lower Fair Value closer to $17.79. Which Narrative best matches your outlook on ZTO Express (Cayman)?

Do you think there's more to the story for ZTO Express (Cayman)? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZTO Express (Cayman) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZTO

ZTO Express (Cayman)

Provides express delivery and other value-added logistics services in the People's Republic of China.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives