- United States

- /

- Marine and Shipping

- /

- NYSE:ZIM

ZIM Integrated Shipping Services (ZIM) Is Down 7.2% After Analysts Cut Earnings and Revenue Forecasts – What's Changed

Reviewed by Sasha Jovanovic

- Recently, ZIM Integrated Shipping Services experienced a substantially sharper decline relative to the broader market after projections showed its upcoming earnings per share and revenue would fall significantly versus last year.

- Analyst forecast revisions and notable shifts in earnings expectations signal possible short-term trends, with industry-wide macroeconomic challenges weighing on sentiment toward ZIM.

- We will consider how these downward earnings revisions and evolving analyst outlooks impact ZIM's broader investment narrative going forward.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

ZIM Integrated Shipping Services Investment Narrative Recap

For shareholders to remain confident in ZIM Integrated Shipping Services, they need to believe the company’s emphasis on fleet modernization, route diversification, and operational agility can offset pronounced earnings volatility and tough macroeconomic setbacks. The latest news of expected sharp earnings and revenue declines puts direct pressure on near-term sentiment, intensifying the importance of ZIM’s cost discipline as a key catalyst, while also highlighting the biggest risk: sustained industry overcapacity and weakened freight rates. Despite the recent earnings forecast revisions, the impact on ZIM’s core investment story is material, as weaker results underscore how fragile the sector’s recovery can be.

One recent announcement especially relevant to this is ZIM’s second-quarter results, which showed a steep year-on-year drop in net income from US$371.3 million to just US$22.8 million. This sharp decline amplifies concerns over persistent industry headwinds and macroeconomic uncertainty, reminding investors that the company's ability to manage costs and retain pricing power could be tested further if market softness continues.

By contrast, investors should be aware that ZIM’s exposure to volatile trade routes could...

Read the full narrative on ZIM Integrated Shipping Services (it's free!)

ZIM Integrated Shipping Services is expected to generate $4.9 billion in revenue and $61.6 million in earnings by 2028. This outlook is based on a projected annual revenue decline of 16.8% and a significant decrease in earnings from the current $2.0 billion, representing a drop of $1.94 billion.

Uncover how ZIM Integrated Shipping Services' forecasts yield a $13.26 fair value, a 4% upside to its current price.

Exploring Other Perspectives

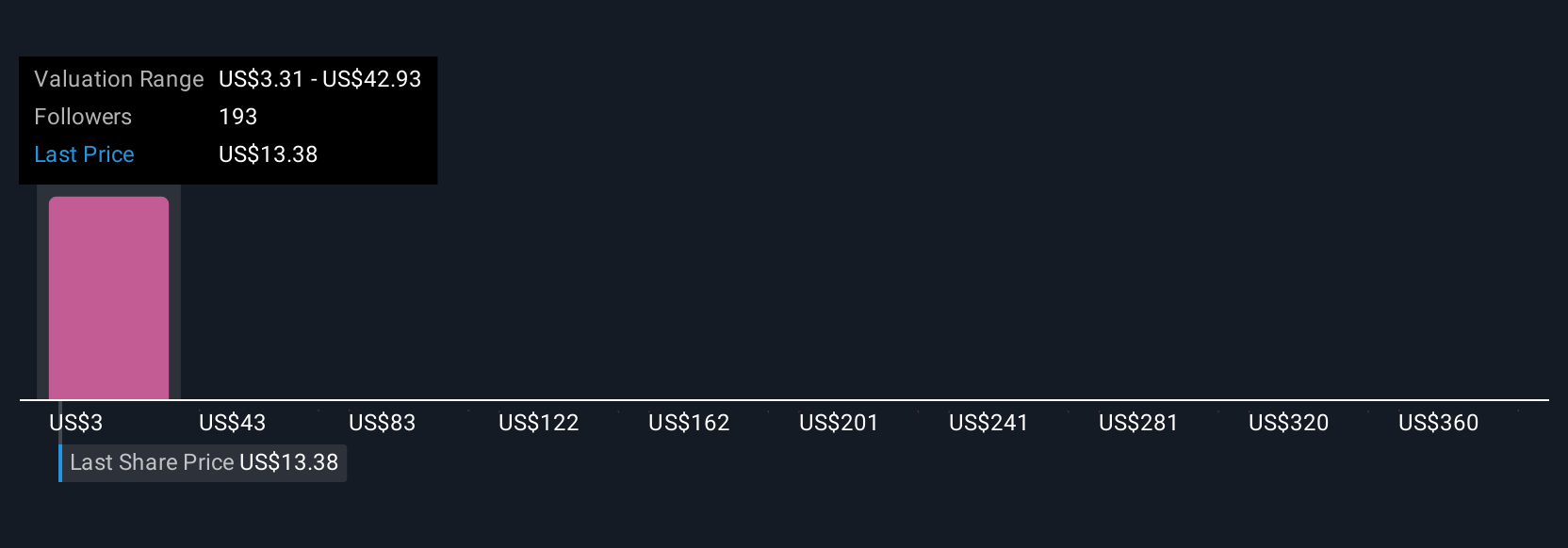

Simply Wall St Community members produced 33 individual fair value estimates for ZIM ranging from US$3.24 to US$452.35 per share. While some see deep value, baseline analyst forecasts continue to warn of persistent earnings pressure and industry cyclicality, giving you plenty of perspectives to weigh.

Explore 33 other fair value estimates on ZIM Integrated Shipping Services - why the stock might be worth less than half the current price!

Build Your Own ZIM Integrated Shipping Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ZIM Integrated Shipping Services research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ZIM Integrated Shipping Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ZIM Integrated Shipping Services' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZIM Integrated Shipping Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZIM

ZIM Integrated Shipping Services

Provides container shipping and related services in Israel and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives