- United States

- /

- Marine and Shipping

- /

- NYSE:ZIM

ZIM Integrated Shipping Services (NYSE:ZIM) Up 8% Despite Broader Market's 3% Dip

Reviewed by Simply Wall St

ZIM Integrated Shipping Services (NYSE:ZIM) experienced a notable 8% rise in its share price over the past month. This comes amidst a broader market that has recently been fluctuating due to investor concerns over tariffs and economic data. While indexes like the Dow and the S&P 500 have wavered between gains and losses, potentially impacted by recent tariff announcements, ZIM's share performance stands out. The broader market saw a 3% drop over the last week, but investments in ZIM bucked this trend, reflecting perhaps its unique positioning in the shipping industry. Globally, shipping and transport sectors can often react independently from general market trends, influenced by their own supply-demand dynamics and notwithstanding broader economic pressures. As the market continues to digest economic forecasts and tariff news, ZIM's price movement suggests a resilience possibly driven by sector-specific factors rather than just general market sentiment.

Click to explore a detailed breakdown of our findings on ZIM Integrated Shipping Services.

Over the last year, ZIM Integrated Shipping Services achieved a total shareholder return of 127.51%, a performance significantly outpacing the US Shipping industry, which returned 2.9%, and the broader US market, which returned 13.1%. This remarkable performance can be attributed to several strategic financial moves and partnerships. A standout event was the announcement of a special dividend of approximately $100 million (US$0.84 per share) alongside a regular cash dividend of around $340 million (US$2.81 per share) in November 2024. This move not only provided substantial shareholder value but also signaled strong financial health amidst challenging market conditions.

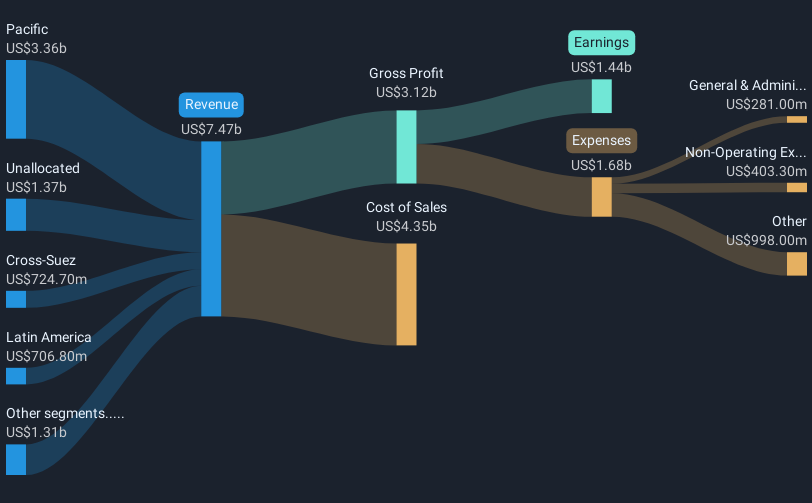

Furthermore, ZIM's financial turnaround was underscored by its substantial earnings achievement over the past year. From Q1's net income of US$90.3 million, the company progressed to reporting a net income of US$1.12 billion in Q3 2024. Additionally, the long-term operational cooperation agreement with MSC for Asia-US trades, announced in September 2024, is poised to enhance operational efficiencies, potentially bolstering future returns.

- Understand the fair market value of ZIM Integrated Shipping Services with insights from our valuation analysis—click here to learn more.

- Gain insight into the risks facing ZIM Integrated Shipping Services and how they might influence its performance—click here to read more.

- Already own ZIM Integrated Shipping Services? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZIM Integrated Shipping Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZIM

ZIM Integrated Shipping Services

Provides container shipping and related services in Israel and internationally.

Excellent balance sheet, good value and pays a dividend.