- United States

- /

- Marine and Shipping

- /

- NYSE:ZIM

The Bull Case for ZIM Integrated Shipping Services (ZIM) Could Change Following Turkish Ban on Israeli-Linked Vessels

Reviewed by Simply Wall St

- On August 22, 2025, ZIM Integrated Shipping Services Ltd. reported it had received a notice from Turkish Port Authorities that, under a new regulation, vessels owned, managed, or operated by Israeli-related entities are prohibited from berthing at Turkish ports, prompting immediate vessel rerouting.

- This regulatory change not only disrupts ZIM’s operations in Turkey but also highlights the heightened geopolitical risks now facing global shipping networks.

- We’ll examine how Turkey’s immediate ban on Israeli-linked vessels affects ZIM’s regional logistics and the broader investment narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

ZIM Integrated Shipping Services Investment Narrative Recap

To own shares in ZIM Integrated Shipping Services, you generally need to believe in the company’s ability to ride out volatile trade conditions while capturing upside from fleet modernization and trade route diversification. The Turkish port restrictions serve as a clear reminder of how political risk can impact ZIM’s operational flexibility, but at this stage, they appear to have a manageable effect on the company’s most important short-term catalyst, resilience across its network and trade lanes. However, they further underscore ongoing geopolitical and regulatory risks, which remain ZIM’s biggest challenge right now. In light of these developments, ZIM’s August announcement regarding the expansion of its LNG-powered vessel fleet stands out, as it shows a continued effort to boost cost efficiency and meet future environmental standards. While not directly tied to the Turkey ban, this move is a clear part of the broader push for operational agility, which is vital if the company is to navigate sudden regulatory changes and still capture value from shifting global trade flows. Yet, contrasted with ZIM’s flexible fleet strategy, there’s something in the company’s exposure to regional regulation that investors should be alert to...

Read the full narrative on ZIM Integrated Shipping Services (it's free!)

ZIM Integrated Shipping Services is projected to have $4.9 billion in revenue and $61.6 million in earnings by 2028. This reflects an annual revenue decline of 16.8% and a decrease in earnings of $1.94 billion from current earnings of $2.0 billion.

Uncover how ZIM Integrated Shipping Services' forecasts yield a $13.83 fair value, a 3% upside to its current price.

Exploring Other Perspectives

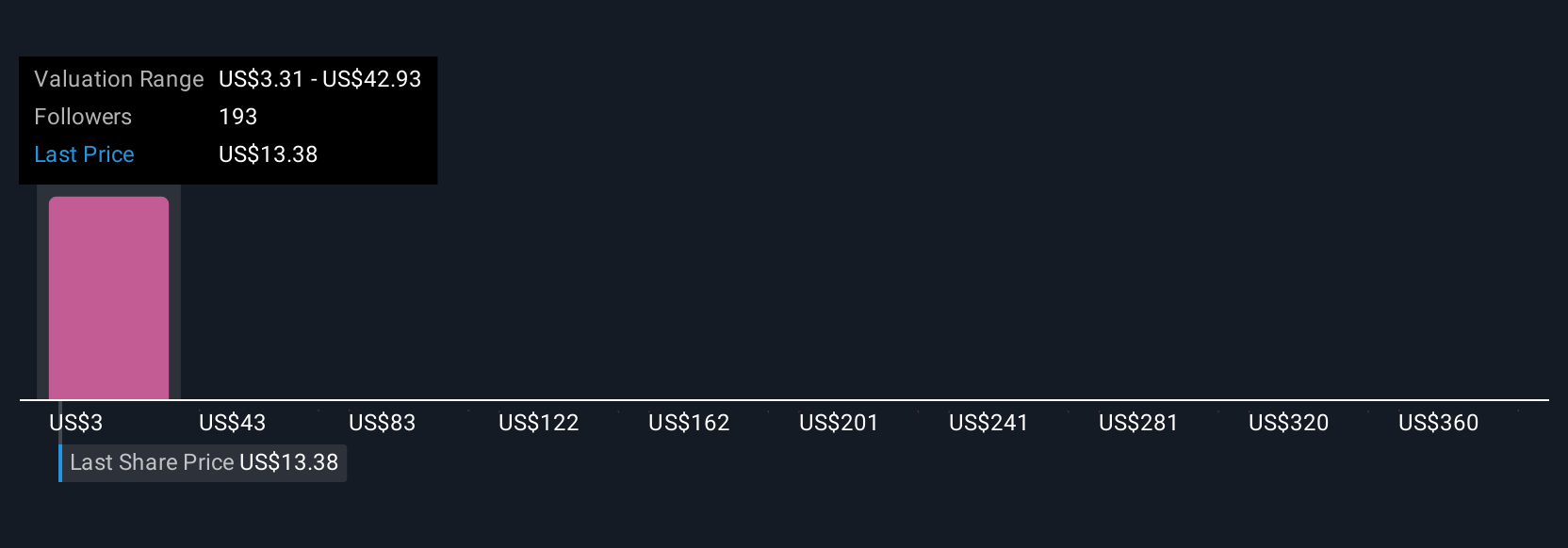

Thirty Simply Wall St Community fair value estimates for ZIM range widely from US$3.31 up to US$399.47, highlighting mixed opinion among private investors. Many are weighing the impact of new regional restrictions and ongoing regulatory uncertainty, inviting you to explore further viewpoints on ZIM’s future.

Explore 30 other fair value estimates on ZIM Integrated Shipping Services - why the stock might be worth less than half the current price!

Build Your Own ZIM Integrated Shipping Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ZIM Integrated Shipping Services research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ZIM Integrated Shipping Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ZIM Integrated Shipping Services' overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 30 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZIM Integrated Shipping Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZIM

ZIM Integrated Shipping Services

Provides container shipping and related services in Israel and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives