- United States

- /

- Transportation

- /

- NYSE:YMM

Why Investors Shouldn't Be Surprised By Full Truck Alliance Co. Ltd.'s (NYSE:YMM) 33% Share Price Surge

Full Truck Alliance Co. Ltd. (NYSE:YMM) shares have had a really impressive month, gaining 33% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 31% in the last year.

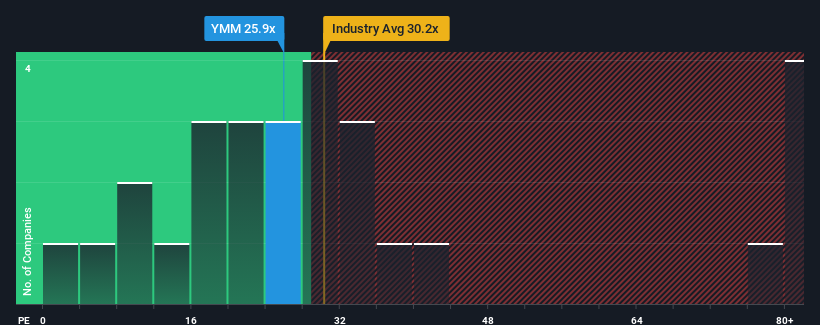

Following the firm bounce in price, given around half the companies in the United States have price-to-earnings ratios (or "P/E's") below 18x, you may consider Full Truck Alliance as a stock to potentially avoid with its 25.9x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for Full Truck Alliance as its earnings have risen in spite of the market's earnings going into reverse. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Full Truck Alliance

How Is Full Truck Alliance's Growth Trending?

In order to justify its P/E ratio, Full Truck Alliance would need to produce impressive growth in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 65%. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 30% each year as estimated by the eleven analysts watching the company. That's shaping up to be materially higher than the 10% each year growth forecast for the broader market.

In light of this, it's understandable that Full Truck Alliance's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Full Truck Alliance's P/E is getting right up there since its shares have risen strongly. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Full Truck Alliance's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Full Truck Alliance that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:YMM

Full Truck Alliance

Operates a digital freight platform that connects shippers with truckers to facilitate shipments across distance ranges, cargo weights, and types in the People’s Republic of China and Hong Kong.

Flawless balance sheet and good value.

Market Insights

Community Narratives