- United States

- /

- Airlines

- /

- NYSE:UP

Wheels Up (UP): Losses Widen 21.3% Annually, Challenging Bullish Margin Narratives

Reviewed by Simply Wall St

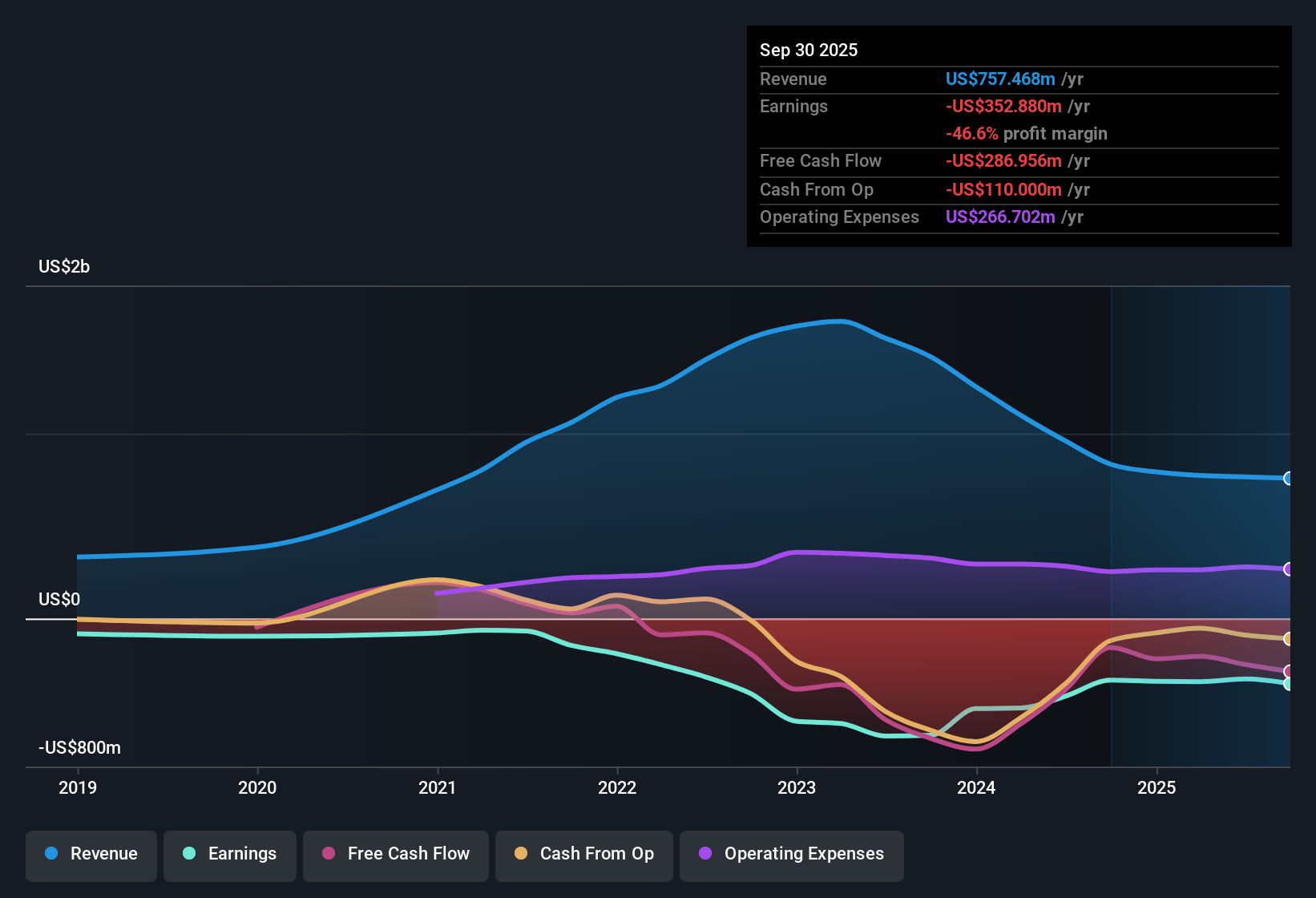

Wheels Up Experience (UP) remains unprofitable, with losses widening at an annual rate of 21.3% over the past five years. Margins have shown no signs of recovery, and profitability is still in the red. With a Price-to-Sales Ratio of 1.1x, the company trades at a premium compared to both its peers (0.4x) and the industry average (0.5x), which further underscores caution around its current valuation.

See our full analysis for Wheels Up Experience.The next section puts these earnings numbers head-to-head with the most widely followed market narratives to see where investor sentiment is confirmed and where it might be tested.

Curious how numbers become stories that shape markets? Explore Community Narratives

Negative Equity Weighs Down Balance Sheet

- The company currently reports negative equity on its balance sheet, highlighting that liabilities exceed total assets.

- What is surprising is that, despite the equity shortfall, recent filings show no substantial insider selling. This suggests leadership is retaining their stakes even as risk increases.

- Negative equity intensifies downside risk and typically signals persistent operating losses.

- The lack of insider selling provides scant comfort, since ongoing losses continue to erode shareholder value.

Losses Escalate While Margins Stagnate

- Losses have grown at a significant 21.3% annual rate over the past five years, and margin performance has not shown any improvement during this period.

- Critics highlight that the ongoing rise in losses, combined with stagnant margins, challenges any possibility of a near-term turnaround.

- Margins remaining in the red, year after year, heavily supports the bearish case that cost structures remain out of control.

- The absence of margin progress, even as the company pursues various restructuring efforts, undermines the view that operational fixes are taking hold.

Premium Valuation Despite Industry Lows

- Wheels Up trades at a 1.1x Price-to-Sales Ratio, much higher than both its peer average of 0.4x and the North American Airlines industry average of 0.5x. This indicates a substantial premium compared to the market.

- The prevailing analysis notes that, in light of persistent unprofitability, this premium valuation stands out. Market caution is likely to persist until there is clear evidence of financial improvement.

- Ongoing negative profitability makes the premium difficult to justify when compared directly against the broader sector.

- Until margin or loss trajectories change, valuation multiples are expected to remain a source of tension for prospective investors.

See what other investors are saying about Wheels Up in the full breakdown. Discover where the debate gets heated in the Consensus Narrative. 📊 Read the full Wheels Up Experience Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Wheels Up Experience's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Wheels Up’s growing losses, negative equity, and lack of margin improvement highlight serious balance sheet stress and persistent financial health concerns.

If you want to put your capital into businesses with stronger fundamentals, discover companies with more resilient finances and lower risk by checking out our solid balance sheet and fundamentals stocks screener (1979 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Wheels Up Experience might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UP

Wheels Up Experience

Provides private aviation services in the United States and internationally.

Moderate risk with weak fundamentals.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>