- United States

- /

- Transportation

- /

- NYSE:UNP

Union Pacific (UNP) Valuation: How Upcoming Earnings Could Shift the Outlook for Investors

Reviewed by Simply Wall St

Union Pacific (UNP) is grabbing attention ahead of its upcoming quarterly earnings announcement, as investors look for more evidence of steady year-on-year revenue growth and a continuation of its reliable performance. With similar companies like CSX and FedEx reporting solid numbers this season, there is real curiosity about how Union Pacific will stack up. This interest is heightened by persistent industry challenges and the recent reconfirmation of analyst forecasts.

See our latest analysis for Union Pacific.

Against a backdrop of industry merger news, activist investors, and ongoing debates around rail competition, Union Pacific’s share price has brushed off most turbulence and recently closed at $225.24. Despite softer momentum this year, with a one-year total shareholder return of -4.5%, its impressive 23% total return over three years underscores a longer-term pattern of durable value for shareholders.

If you’re interested in finding standout opportunities beyond the headlines, consider broadening your search and discovering fast growing stocks with high insider ownership.

With shares trading at a discount to analyst price targets and quarterly results approaching, the key question becomes whether Union Pacific is undervalued right now, or if the market has already factored in all of its growth potential.

Most Popular Narrative: 13.9% Undervalued

Union Pacific’s last close of $225.24 sits well below the narrative’s consensus fair value of $261.68, creating a significant value gap and drawing focus to the underlying growth assumptions driving this outlook.

Union Pacific is implementing multiple efficiency enhancements, such as energy management systems for locomotives and optimization tools, which are expected to improve operational efficiency and net margins. The company is expanding capacity with new infrastructure, such as facilities in Houston and Phoenix, which could support future growth and positively impact revenue.

Want to see what’s powering this valuation jump? The optimistic outlook is based on bold operational upgrades and future revenue drivers you will want to explore. See which profit milestones analysts believe are ahead by reading the full narrative for the key details.

Result: Fair Value of $261.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering uncertainty in trade policy or a downturn in key shipping segments could quickly challenge even the most optimistic projections for Union Pacific.

Find out about the key risks to this Union Pacific narrative.

Another View: Looking Beyond the Headline Valuation

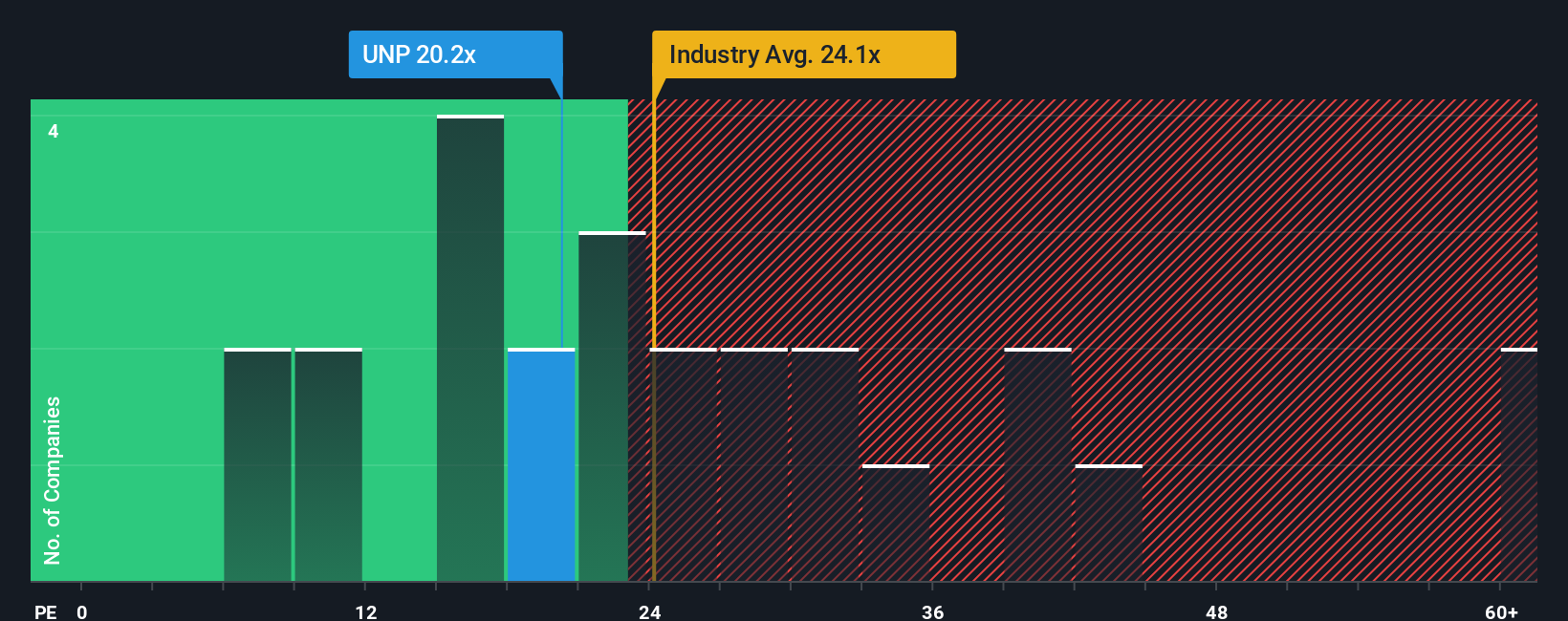

While the current fair value suggests that Union Pacific is undervalued, another angle is to look at its price-to-earnings ratio. The stock trades at 19.3x, slightly above its fair ratio of 19.2x and well below the US Transportation industry average of 27.3x, yet higher than its peer average of 17.6x. This combination points to a complicated picture, highlighting both opportunity and risk for investors trying to judge where the market could gravitate next. Could this narrow gap signal caution or a hidden value?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Union Pacific Narrative

If you see things differently or want to dig into the details yourself, you can shape your own perspective using the same data in just a few minutes, then Do it your way.

A great starting point for your Union Pacific research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Step ahead of the crowd and target investments that fit your style using the Simply Wall St Screener’s best picks.

- Accelerate your portfolio’s growth by seizing opportunities in the market with these 871 undervalued stocks based on cash flows, identifying stocks trading below their potential intrinsic value right now.

- Fuel your search for future tech leaders with these 26 AI penny stocks, zeroing in on companies at the forefront of artificial intelligence innovation.

- Capture consistent income by accessing these 17 dividend stocks with yields > 3%, where you’ll spot high-yield dividend payers offering yields greater than 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNP

Union Pacific

Through its subsidiary, Union Pacific Railroad Company, operates in the railroad business in the United States.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives