- United States

- /

- Transportation

- /

- NYSE:UNP

Union Pacific (UNP): Assessing Valuation After Major Labor Deal Secures Workforce Stability

Reviewed by Kshitija Bhandaru

Union Pacific (UNP) just reached a new five-year contract with its locomotive engineers, bringing meaningful wage increases and enhanced benefits. This agreement follows a year of multiple successful labor ratifications across the company.

See our latest analysis for Union Pacific.

Union Pacific's latest labor deal brings a welcome dose of stability on the heels of a pivotal year, as the company navigates shifting freight demand, cost pressures, and ongoing integration efforts related to its Norfolk Southern acquisition. While headwinds like increased tariffs and softer consumer markets have weighed on recent revenue, the stock’s three-year total shareholder return of 31% quietly rewards patient investors. This suggests momentum is steady but not surging.

If you’re wondering which other companies are attracting insider confidence and rapid growth, now’s an opportunity to explore fast growing stocks with high insider ownership.

But with shares trading just under analysts’ average price targets and the company delivering steady, not spectacular, returns, investors must decide if there is real upside ahead or if markets have already taken the growth story into account.

Most Popular Narrative: 7.8% Undervalued

With Union Pacific’s last close at $236.80 and the most closely followed narrative calculating fair value at $256.92, analysts see a meaningful upside beyond current trading levels. The fair value hinges on how future efficiency upgrades and new facilities translate into sustained profitability.

Union Pacific is implementing multiple efficiency enhancements, such as energy management systems for locomotives and optimization tools. These initiatives are expected to improve operational efficiency and net margins. The company is expanding capacity with new infrastructure, such as facilities in Houston and Phoenix, which could support future growth and positively impact revenue.

Are these operational changes enough to propel Union Pacific to new highs? The key to this bold projection is a mix of aggressive growth ambitions, robust margin expectations, and assumptions about the future profit multiple. Want to see what fuels this fair value? Dive deeper to uncover the numbers driving this narrative.

Result: Fair Value of $256.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent trade policy uncertainty and potential declines in consumer demand could threaten both Union Pacific’s revenue growth and long-term margin stability.

Find out about the key risks to this Union Pacific narrative.

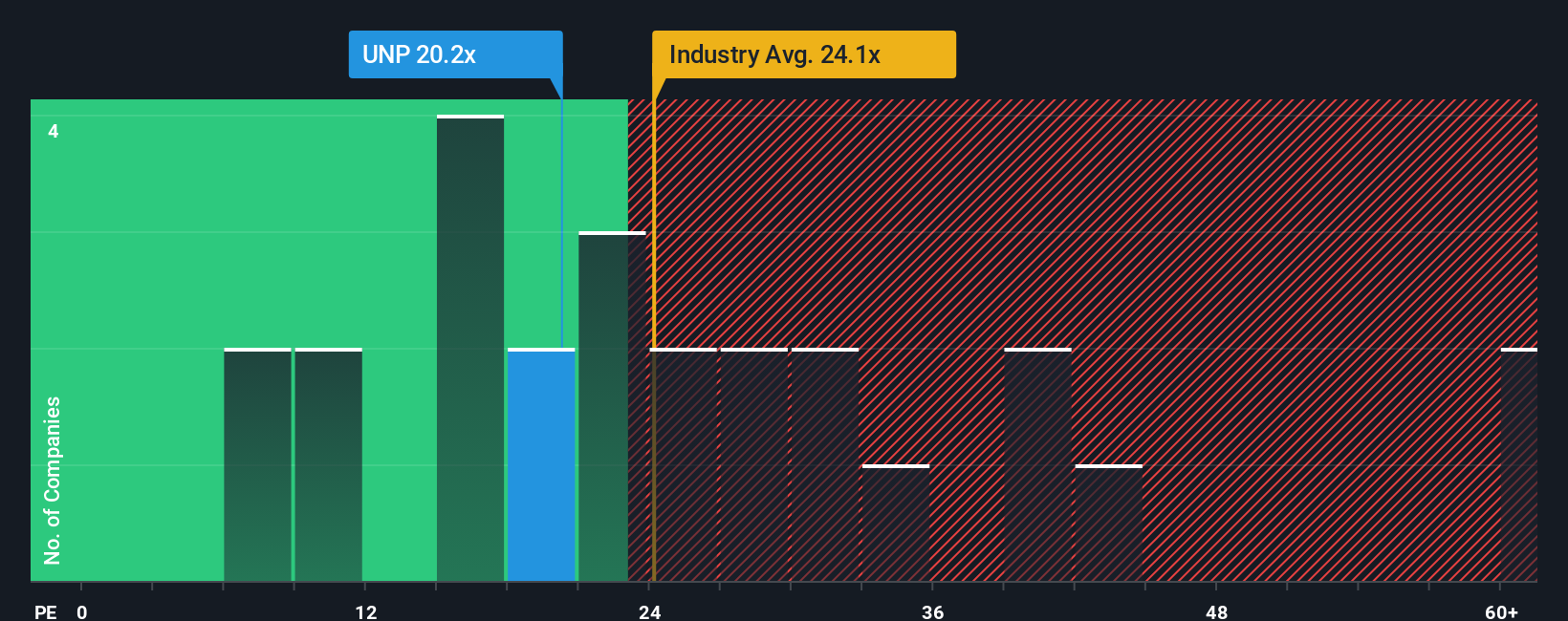

Another View: Valuing Union Pacific Against Peers

While analyst models see Union Pacific as undervalued, the market’s main yardstick, its price-to-earnings ratio of 20.2x, tells a different story. This is higher than its peer average of 17.6x and also sits above the “fair ratio” of 19.3x, which hints at some valuation risk compared to similar companies. Is the market too optimistic, or do the company’s future initiatives justify this premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Union Pacific Narrative

If you’d rather rely on your own analysis or approach things with a fresh perspective, crafting your own forecast takes just a few minutes, and you can Do it your way.

A great starting point for your Union Pacific research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Expanding your opportunities is just a click away. Make smarter decisions by checking out these top-performing strategies before the market spots them first:

- Capitalize on the artificial intelligence boom and uncover emerging tech companies by checking out these 24 AI penny stocks that are poised for significant growth.

- Tap into stable income streams by finding these 19 dividend stocks with yields > 3% companies that consistently deliver higher-than-average yields.

- Leap ahead in digital innovation with these 78 cryptocurrency and blockchain stocks as they transform global finance and pave new investment frontiers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNP

Union Pacific

Through its subsidiary, Union Pacific Railroad Company, operates in the railroad business in the United States.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives