- United States

- /

- Transportation

- /

- NYSE:UBER

While Uber (NYSE:UBER) is Predicted to Double Revenues in 2 years, an Abrupt end of the Pandemic may Lower Deliveries Income

Uber Technologies, Inc. (NYSE:UBER) is trading back to pre-pandemic levels, however the company's fundamentals have significantly improved, and it seems that Uber is well underway into their high growth phase. Today we will review what analysts are projecting for the company, insider activities and possible catalysts.

Even though analyst estimates are biased and may not come manifest, their average can give us a picture of the direction in which the company is heading.

See our latest analysis for Uber Technologies

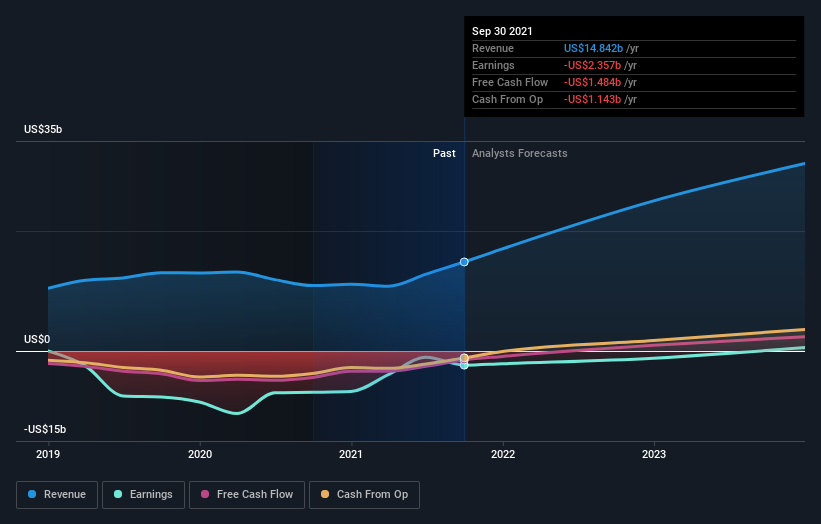

Looking at the estimates below, we see that Uber is expected to increase revenues to US$31b, which is almost double from the current level.

More importantly, the company is expected to become profitable after 2023. If they succeed, this will be a real validation of their business model and a strong signal that Uber is good for investors.

We can see how the company's income is projected to look as per analysts estimates.

The average price target is currently US$67.2, implying an upside of 98%.

Keep in mind that analysts do not have a consensus on the target, and their estimates are fairly wide. Currently, the most bullish analyst values Uber Technologies at US$82 per share, while the most bearish prices it at US$34.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. The analysts are definitely expecting Uber Technologies' growth to accelerate, with the forecast 52% annualized growth to the end of 2022 ranking favorably alongside historical growth of 14% per annum over the past five years.

By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 11% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Uber Technologies to grow faster than the wider industry.

We can also turn to insiders to get an estimate of the sentiment within the company.

In the last 12 months, Uber insiders sold shares at US$53.46 and US$60.12, while an insider bought Uber shares on the 15th November at US$44.92. It seems that at least one insider considers the current price to have upside potential and possibly some catalysts in the near term.

You can view our ownership analysis for Uber here.

Finally, catalysts are important for rising investors' confidence. It seems likely that Uber will benefit from a possible shift of mood as the pandemic possibly meets an abrupt end and economies push for total re-opening.

Unfortunately, this could also have a negative effect, since a significant portion of last quarter's revenue came from deliveries - which can stagnate if consumers change their preferences after the pandemic, as well as a result from the developing competitive landscape in food delivery services.

The Bottom Line

Uber is estimated to double revenues in the next 2 years, and possible breakeven after 2023.

A significant catalyst for the stock, could be the signaling of the end of the pandemic, however that could subtract a portion of the delivery revenues.

The current price possibly reflects these uncertainties, however the price target implies a 98% upside for Uber.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives