- United States

- /

- Transportation

- /

- NYSE:UBER

Uber Technologies (UBER) Margin Compression Tests Bullish Valuation Narrative After FY 2025 Results

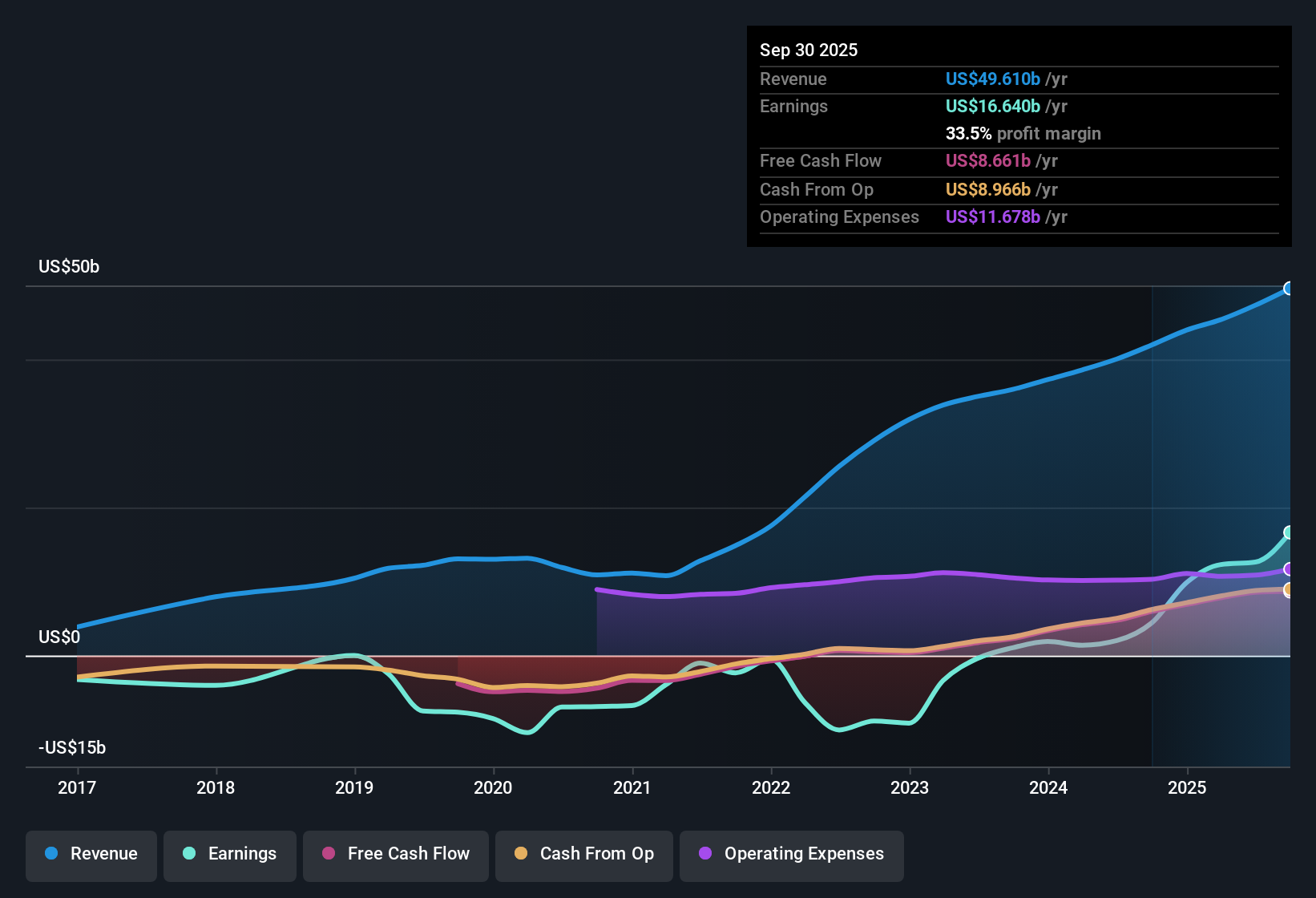

Uber Technologies (UBER) closed out FY 2025 with Q4 revenue of US$14.4b and basic EPS of US$0.14, alongside net income of US$296m, capping a year where trailing twelve month revenue reached US$52.0b and EPS came in at US$4.82. Over recent quarters, the company has seen revenue move from US$11.5b in Q1 2025 to US$13.5b in Q3 and then US$14.4b in Q4. Quarterly EPS shifted from US$0.85 in Q1 to US$3.18 in Q3 before landing at US$0.14 in the latest period, setting up a results season that puts the focus squarely on how sustainably Uber can defend its margins.

See our full analysis for Uber Technologies.With the latest numbers on the table, the next step is to see how they line up against the dominant stories around Uber's growth, profitability and risk profile that investors have been trading on over the past year.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Ease Back From 22.4% To 19.3%

- Over the last 12 months, Uber's net margin sat at 19.3%, compared with 22.4% in the prior year, alongside trailing revenue of US$52.0b and net income of US$10.1b.

- Bears often focus on profitability pressure, and the margin step down to 19.3% gives that concern a concrete data point, yet:

- Trailing earnings still grew 2% with net income of about US$10.1b, which shows profits remain positive even with lower margins.

- Quarterly net income in FY 2025 ranged from US$296m in Q4 to US$6.6b in Q3, underlining how results can swing while the full year still ends solidly profitable.

Revenue Forecast At 10.7% Versus Market 10.2%

- Revenue is forecast to grow about 10.7% per year, which is slightly above the 10.2% forecast for the broader US market, set against trailing 12 month revenue of around US$52.0b.

- Supporters of a bullish view point to these growth numbers, and the figures largely back that up but with some nuance:

- Earnings are forecast to grow at roughly 6.8% per year, which is below the 15.6% forecast for US market earnings, so revenue strength does not automatically translate into faster profit growth.

- Over the last year, earnings growth of 2% and the margin move from 22.4% to 19.3% show that profit expansion has been more modest than the multi year trend of 68.7% per year.

P/E Of 15.5x Versus 40.8x Industry

- At a share price of US$75.21, the stock trades on a P/E of 15.5x, compared with 40.8x for the US Transportation industry and 56.9x for peers, alongside a DCF fair value of about US$194.00 and an average analyst price target of US$106.32.

- What really stands out for bullish investors is how these valuation markers stack against the fundamentals:

- The gap between the US$75.21 share price and the DCF fair value of roughly US$194.00, plus the analyst target of US$106.32, aligns with the data showing a 41.4% implied upside from analysts.

- At the same time, margins easing to 19.3% and forecast earnings growth of 6.8% mean that any value case has to be weighed against slower profit expansion than the wider market forecast of 15.6% earnings growth.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Uber Technologies's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Uber's easing net margins and slower forecast earnings growth compared to the broader US market highlight that profit momentum is not keeping pace with revenue expectations.

If that gap between revenue strength and profit growth makes you cautious, check out our 81 resilient stocks with low risk scores to focus on companies where earnings quality and stability take center stage right away.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

EU#1 - From German Startup to EU’s Biggest Company

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Amazon - A Fundamental and Historical Valuation

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

The "Sleeping Giant" Stumbles, Then Wakes Up

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.