- United States

- /

- Transportation

- /

- NYSE:UBER

Uber Technologies (NYSE:UBER) Partners With Cheddar's For On-Demand Delivery Pilot

Reviewed by Simply Wall St

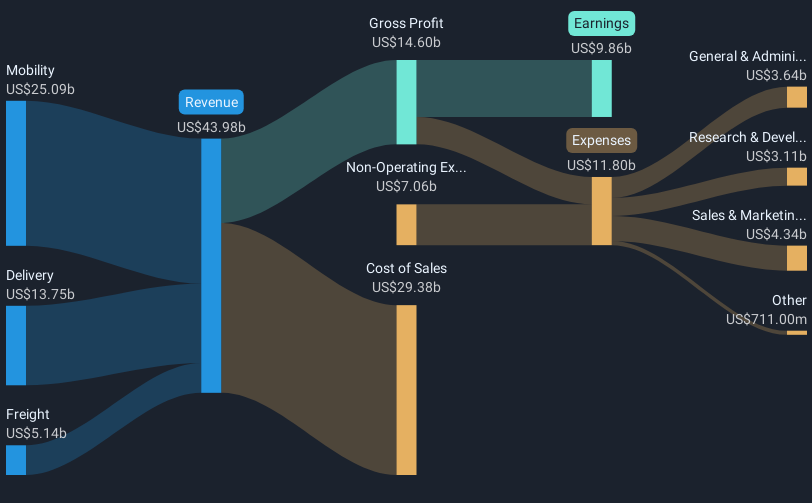

Uber Technologies (NYSE:UBER) recently experienced a strong total shareholder return of 22% over the last quarter, coinciding with several key developments. The company's partnership with Darden Restaurants for on-demand delivery with Cheddar's Scratch Kitchen and an agreement to integrate Uber Direct with HungerRush may have bolstered investor confidence. These strategic partnerships indicate Uber's continued expansion into diverse delivery services, complementing its robust quarterly earnings report, which showed significant growth in sales and net income. Meanwhile, broader market trends also showed gains, with the market up 3% in the last week, reflecting positive sentiment.

Uber Technologies (NYSE:UBER) has delivered a substantial total shareholder return of 164.40% over the past five years. This performance stands out, especially considering its earnings growth surpassing that of the broader Transportation industry, which contracted significantly last year. Uber's expansion into autonomous vehicles and fleet electrification has been a key driver, aiming to boost revenues and reduce costs. The launch of the Uber One membership program is strengthening customer loyalty and recurring revenue, contributing to net margin improvements. Strategic penetration into less dense areas has also enhanced user growth without proportionately increasing costs, further supporting revenue growth.

Additionally, Uber's substantial share buyback plan, which saw the repurchase of over 17 million shares, signals strong confidence in the company's valuation. Collaborations, such as with NVIDIA for AI and autonomous technology advancements, emphasize Uber's commitment to innovation and operational efficiency. While the company has faced ongoing legal issues and insurance cost challenges, its focus on technological advancement and market expansion indicates efforts toward long-term sustainability and profitability.

Our valuation report unveils the possibility Uber Technologies' shares may be trading at a discount.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with solid track record.