- United States

- /

- Transportation

- /

- NYSE:UBER

The Bull Case For Uber Technologies (UBER) Could Change Following Retail Delivery Partnership With Hibbett

Reviewed by Sasha Jovanovic

- Hibbett, Inc. announced a partnership with Uber Technologies, Inc. to bring nearly 900 of its retail stores nationwide onto the Uber Eats platform, enabling on-demand delivery of athletic wear, sneakers, and accessories across the U.S.

- This collaboration highlights Uber Eats’ push to become a broader retail destination, leveraging its technology to increase convenience and expand well beyond food delivery.

- We’ll explore how Uber’s expansion into retail delivery with Hibbett could reshape its growth plans and product diversification strategy.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Uber Technologies Investment Narrative Recap

To be an Uber shareholder, you need conviction in the company's ability to expand its core platform into new markets and services, using partnerships like Hibbett to fuel growth in Delivery and cross-platform engagement. While this latest retail collaboration broadens Uber Eats’ reach, it does not materially shift the short-term focus for investors: the primary catalyst remains the commercialization of autonomous vehicles, while the central risk continues to be the heavy costs and uncertainty tied to AV scaling and profitability.

Among recent developments, Uber’s US$375 million investment in Avride, a key autonomous vehicle partner, directly impacts the AV catalyst by supporting future robotaxi launches and integrating advanced technologies into the Uber platform. This move underscores Uber’s high-stakes commitment to being at the forefront of AV innovation, adding urgency to the question of when, or if, such investments can deliver scaled profits and sustainable cost advantages.

In contrast, investors should watch for warning signs if commercialization delays or cost overruns begin to...

Read the full narrative on Uber Technologies (it's free!)

Uber Technologies' narrative projects $71.2 billion revenue and $9.7 billion earnings by 2028. This requires 14.6% yearly revenue growth and a $2.9 billion decrease in earnings from $12.6 billion today.

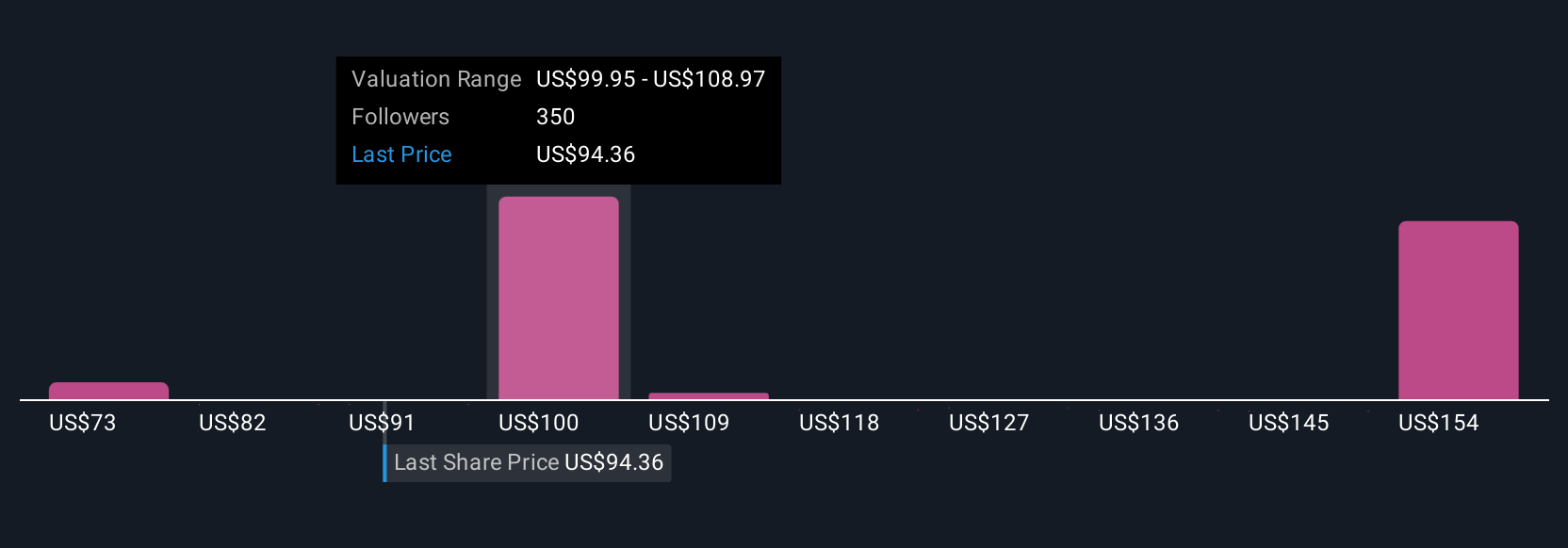

Uncover how Uber Technologies' forecasts yield a $108.52 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members posted 56 fair value estimates for Uber, spanning from US$75.00 to US$170.63 per share. While opinions widely differ, many are watching the timeline and costs of autonomous vehicle partnerships to assess Uber’s future operating margins and free cash flow. Explore more viewpoints and see how your assessment aligns.

Explore 56 other fair value estimates on Uber Technologies - why the stock might be worth as much as 85% more than the current price!

Build Your Own Uber Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Uber Technologies research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Uber Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Uber Technologies' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives