- United States

- /

- Transportation

- /

- NYSE:UBER

Serve Robotics’ Chicago Expansion Could Be a Game Changer for Uber Technologies (UBER)

Reviewed by Sasha Jovanovic

- Recently, Serve Robotics Inc. announced the launch of its autonomous sidewalk robot delivery service in the Chicago metro area, the latest milestone in its partnership with Uber Eats to expand contact-free delivery options to more neighborhoods across the U.S.

- This expansion not only demonstrates the scalability of robotics within Uber Eats' network but also underscores Uber’s broader push toward autonomous technology and innovative delivery solutions.

- We’ll now explore how Uber’s increased adoption of autonomous delivery, exemplified by the Chicago launch, affects its long-term investment case.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Uber Technologies Investment Narrative Recap

To be a shareholder in Uber Technologies, you need to believe that the company can successfully scale its multi-modal platform and generate sustained profit growth, even as it invests heavily in autonomous technologies. The expansion of Serve Robotics’ sidewalk delivery service in Chicago aligns with Uber’s push toward autonomous delivery, but it does not meaningfully change the short-term focus on achieving profitable unit economics in autonomous operations or address persistent legal and regulatory risks, which remain top of mind for most investors.

Uber’s recent collaboration with ALDI, expanding grocery selection nationwide and introducing SNAP payments, stands out as a meaningful move for growing the Delivery segment. While this broadens Uber's user base and helps deepen engagement, key catalysts for long-term growth, the profitability challenge of lower-margin segments and integration complexity continues to be a critical watchpoint.

Yet with rapid innovation and continued expansion, investors should not ignore growing legal challenges that...

Read the full narrative on Uber Technologies (it's free!)

Uber Technologies' outlook anticipates $71.2 billion in revenue and $9.7 billion in earnings by 2028. This implies an annual revenue growth rate of 14.6% but a decrease in earnings of $2.9 billion from the current $12.6 billion.

Uncover how Uber Technologies' forecasts yield a $107.62 fair value, a 10% upside to its current price.

Exploring Other Perspectives

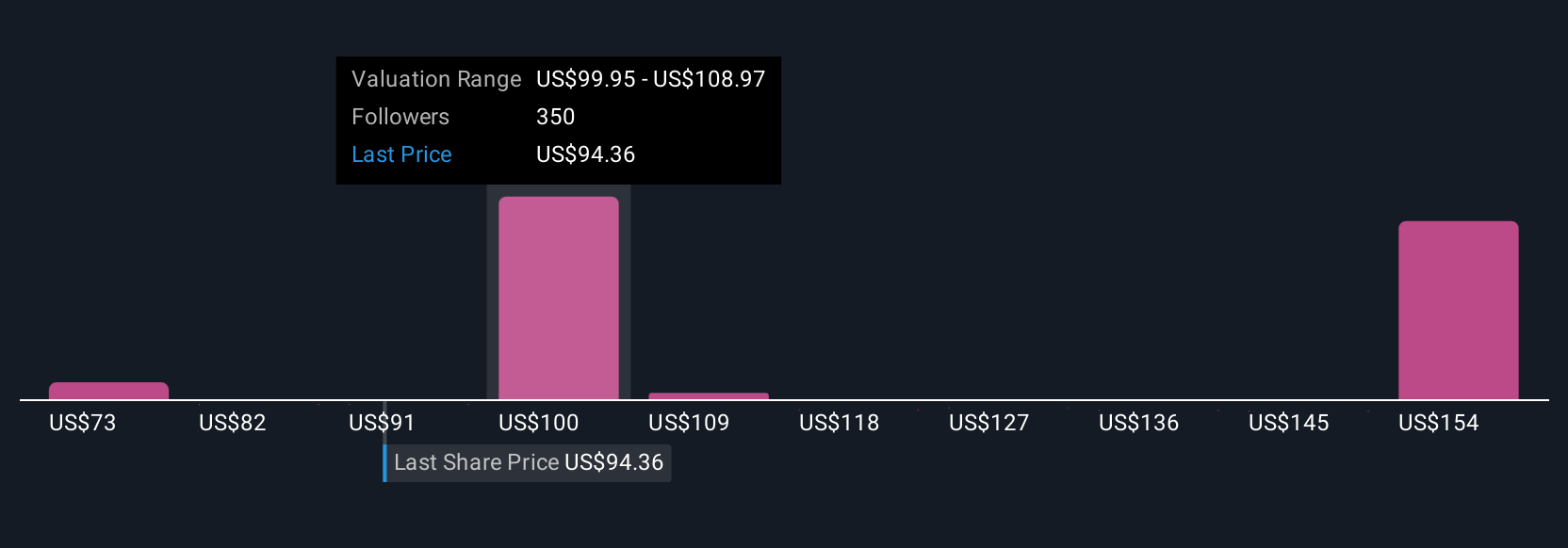

Fair value estimates from 57 Simply Wall St Community members range from US$72.92 to US$159.69, highlighting wide divergence. As Uber invests in autonomous partnerships, opinions differ on the pace of achieving sustainable profit, underscoring the importance of reviewing multiple viewpoints.

Explore 57 other fair value estimates on Uber Technologies - why the stock might be worth 25% less than the current price!

Build Your Own Uber Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Uber Technologies research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Uber Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Uber Technologies' overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Very undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion