- United States

- /

- Transportation

- /

- NYSE:UBER

The Bull Case for Uber Technologies (UBER) Could Change Following Major New Retail and Finance Partnerships for Uber Eats

Reviewed by Simply Wall St

- In recent weeks, Uber Technologies has announced major partnerships with Sephora and Best Buy to expand Uber Eats’ offerings beyond food, while also launching a new collaboration with Pipe to provide restaurant partners fast access to working capital via the Uber Eats Manager platform. These moves position Uber Eats as a broader commerce platform by integrating retail and financial services, offering merchants and consumers a wider range of value-added solutions within the app.

- We'll explore how these broadened retail partnerships and merchant support initiatives may influence Uber's investment narrative, particularly regarding platform diversification and engagement trends.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Uber Technologies Investment Narrative Recap

To own Uber Technologies stock, you need to believe the company can successfully integrate Delivery, Mobility, and new retail verticals into a multi-modal platform, unlocking new revenue streams and sustained user growth. Recent partnerships, like those with Sephora, Best Buy, and fintech firm Pipe, are expanding Uber Eats beyond restaurants, though this latest diversification is not likely to outweigh near-term focus on profitability and pressing risks around capital allocation tied to autonomy initiatives. The biggest catalyst remains proving durable, profitable growth from its core Mobility and Delivery operations, while operational complexity and competition continue to challenge execution.

The September partnership with Pipe stands out as particularly relevant, introducing fast, flexible working capital to Uber Eats restaurant partners directly through the platform. This initiative touches on Uber’s broader effort to boost merchant engagement and platform stickiness, aligning directly with the ongoing catalyst of cross-platform integration and higher user retention, which are central to Uber’s current investment case.

Yet, in contrast to these positive developments, investors should recognize the complexity and risks around Uber’s ongoing efforts to balance operational integration and avoid...

Read the full narrative on Uber Technologies (it's free!)

Uber Technologies is projected to reach $71.2 billion in revenue and $9.7 billion in earnings by 2028. This is based on analysts' estimates of a 14.6% annual revenue growth rate and reflects a $2.9 billion decrease in earnings from current earnings of $12.6 billion.

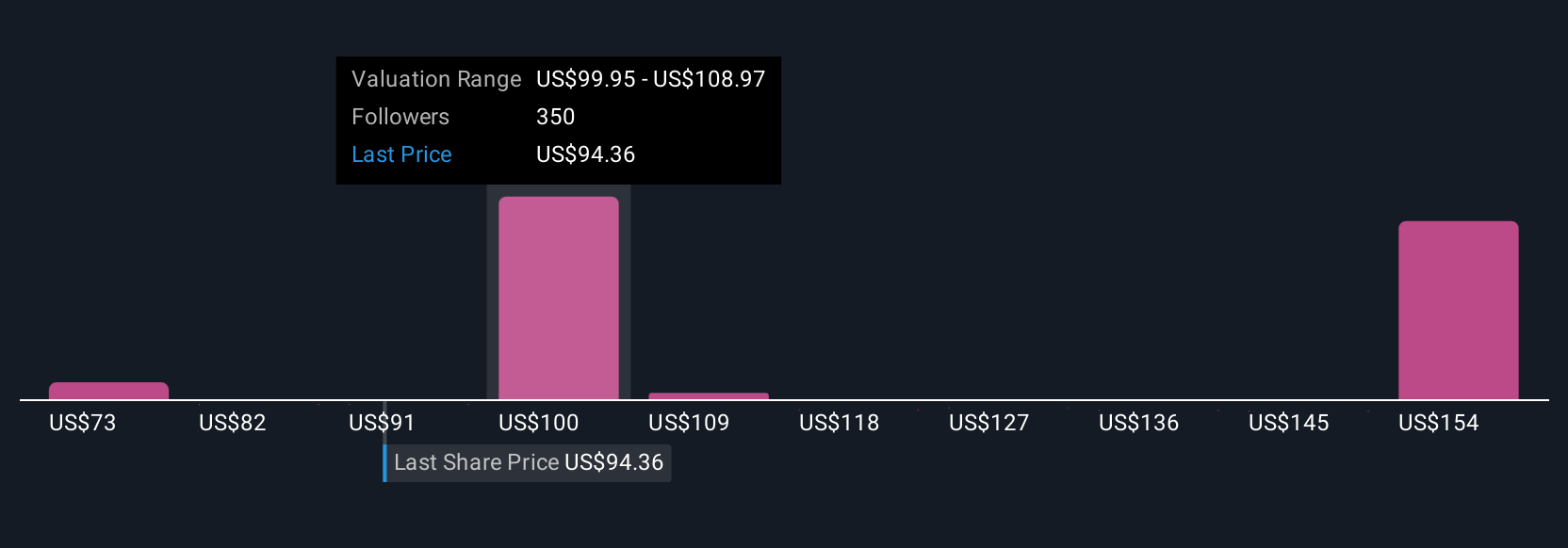

Uncover how Uber Technologies' forecasts yield a $106.43 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community participants, 57 in total, estimated Uber’s fair value anywhere between US$72.92 and US$162.86. Many see opportunities in cross-platform integration driving user engagement, though risks tied to unprofitable AV ambitions give reason for caution and highlight the need to weigh multiple perspectives.

Explore 57 other fair value estimates on Uber Technologies - why the stock might be worth 24% less than the current price!

Build Your Own Uber Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Uber Technologies research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Uber Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Uber Technologies' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 8 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives