- United States

- /

- Transportation

- /

- NYSE:UBER

Does Uber’s Expanded Robotaxi Rollout in Dallas and Abu Dhabi Change The Bull Case For Uber (UBER)?

Reviewed by Sasha Jovanovic

- Uber Technologies has recently expanded its autonomous footprint by launching Avride all‑electric robotaxis for selected UberX and Comfort trips across a 9‑square‑mile area of Dallas, while also rolling out fully driverless WeRide robotaxi operations on its platform in Abu Dhabi and deepening automation partnerships in delivery and business travel.

- Taken together, these moves show Uber pushing harder into autonomy across both mobility and delivery, aiming to reshape its cost base and service mix while responding to pressure from competitors such as Waymo.

- We’ll now examine how Uber’s push into robotaxis, especially the Avride rollout in Dallas, could influence the company’s existing investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Uber Technologies Investment Narrative Recap

To own Uber, you need to believe its global ride hailing and delivery platform can keep scaling profitably while it experiments with autonomy. The Avride robotaxi launch in Dallas and fully driverless WeRide rollout in Abu Dhabi signal faster movement into AVs, but they do not yet change the key near term catalyst, which remains execution on profitable growth, or the biggest risk, which is heavy AV spend before clear unit economics.

The new global collaboration with Starship Technologies on autonomous sidewalk deliveries ties directly into this autonomy story, extending Uber’s automation push into last mile logistics. Together with Avride and WeRide, it shows Uber trialing multiple AV modalities across rides and delivery, which could influence how investors weigh the upside of automation against concerns about capital intensity and execution risk in its broader investment case.

However, investors should also be aware that Uber’s growing autonomous ambitions could concentrate risk if AV timelines or economics do not unfold as expected...

Read the full narrative on Uber Technologies (it's free!)

Uber Technologies' narrative projects $71.2 billion revenue and $9.7 billion earnings by 2028. This requires 14.6% yearly revenue growth and an earnings decrease of $2.9 billion from $12.6 billion today.

Uncover how Uber Technologies' forecasts yield a $111.06 fair value, a 27% upside to its current price.

Exploring Other Perspectives

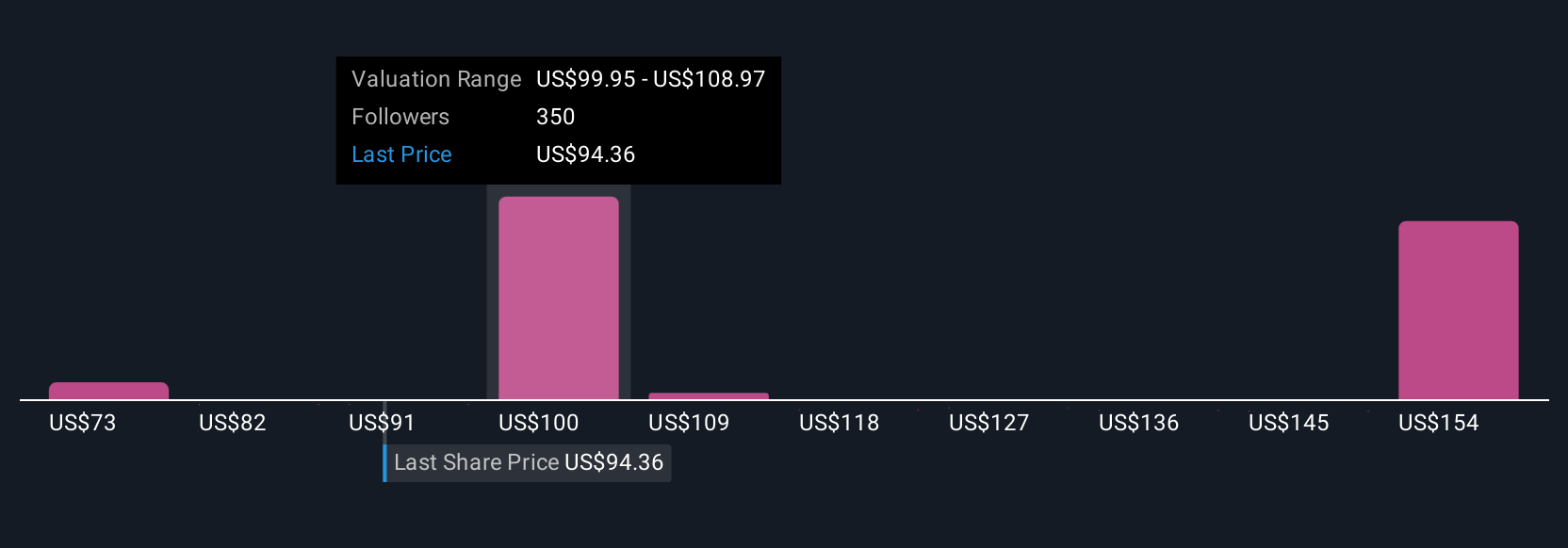

Fifty six fair value estimates from the Simply Wall St Community span roughly US$75 to about US$168 per share, showing how far apart individual outlooks can be. As you weigh these views against Uber’s heavier push into autonomous mobility and delivery, it is worth considering how much AV execution risk you are comfortable tying to the company’s future performance.

Explore 56 other fair value estimates on Uber Technologies - why the stock might be worth 14% less than the current price!

Build Your Own Uber Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Uber Technologies research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Uber Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Uber Technologies' overall financial health at a glance.

No Opportunity In Uber Technologies?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Very undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026