- United States

- /

- Transportation

- /

- NYSE:RXO

Why Are Insider Buys and Cost Cuts Reshaping Confidence in RXO’s (RXO) Recovery Narrative?

Reviewed by Sasha Jovanovic

- Following a period of challenging results, RXO, Inc. recently reported third-quarter earnings, showing sales of US$1.42 billion and a significantly narrower net loss of US$14 million compared to a year earlier.

- These results were accompanied by prominent insider share purchases and a positive analyst upgrade, highlighting renewed leadership confidence and optimism about the company’s ability to recover from margin pressures.

- We'll explore how recent insider buying, paired with new cost-saving measures, may influence RXO's investment outlook and analyst expectations.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

RXO Investment Narrative Recap

To own RXO shares, an investor has to believe in the company’s ability to turn margin pressures and transportation cost spikes into long-term growth through technology and operational discipline. While RXO’s Q3 results showed losses narrowing and sales improving, the immediate catalyst remains a sustained recovery in shipment volume, something recent margin headwinds and soft demand have yet to materially improve. The most significant risk today is ongoing weakness in freight demand, especially from key higher-margin verticals like automotive.

Among recent announcements, RXO’s new US$30 million cost-reduction initiative stands out as a targeted response to escalating purchase costs and compressed margins. These efforts, focused on automation and real estate optimization, are intended to help RXO stabilize short-term performance as leadership signals confidence with insider buying, even as industry-wide freight softness remains a headwind.

In contrast, investors should keep in mind ongoing freight demand weakness and sector exposure, especially as recovery in the critical automotive vertical remains uncertain…

Read the full narrative on RXO (it's free!)

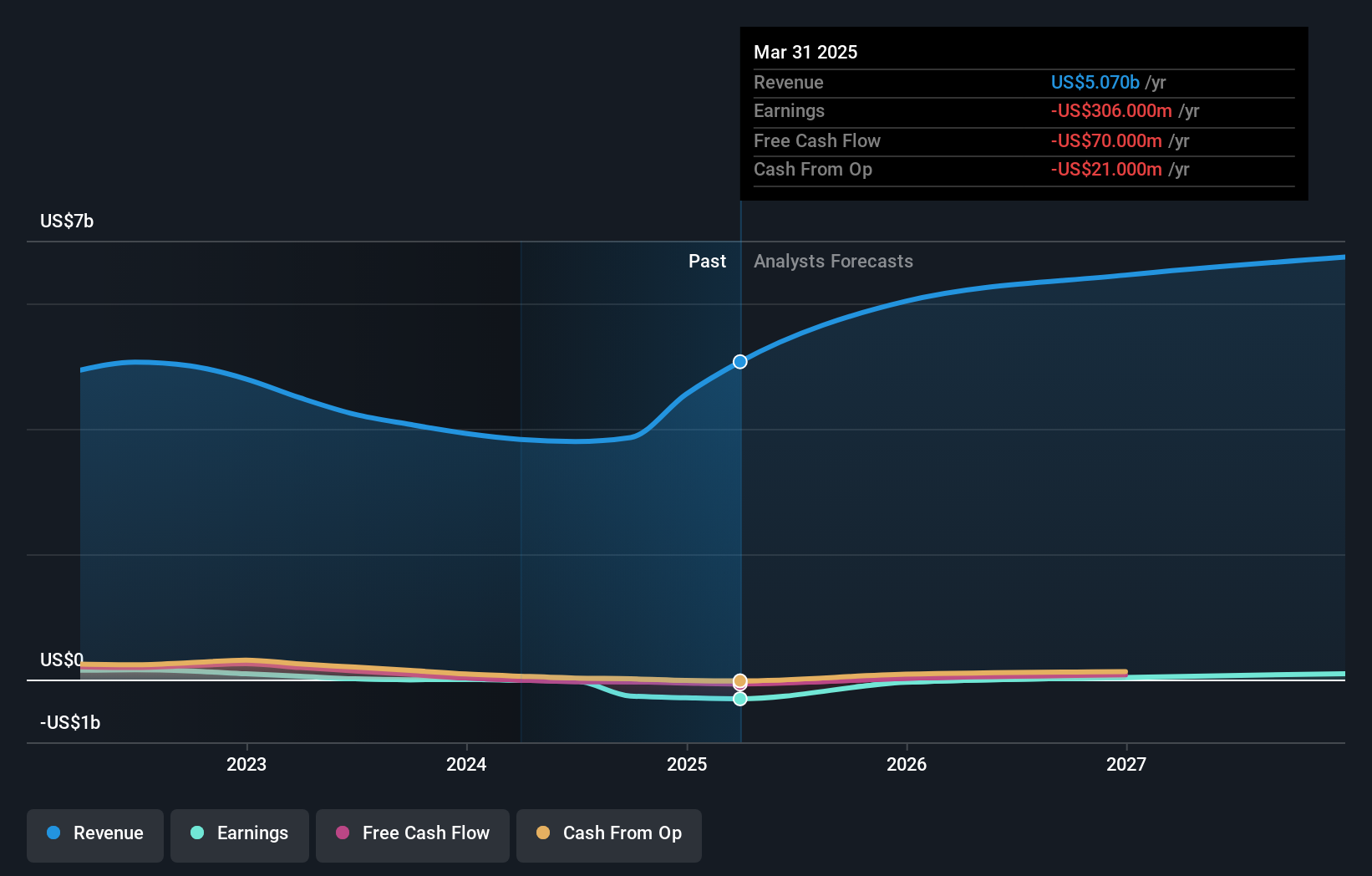

RXO's narrative projects $6.9 billion revenue and $132.5 million earnings by 2028. This requires 7.3% yearly revenue growth and a $440.5 million earnings increase from -$308.0 million currently.

Uncover how RXO's forecasts yield a $15.67 fair value, a 44% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate RXO’s fair value between US$14.24 and US$15.67 based on two separate analyses. Against the backdrop of uncertain freight market recovery, investor views highlight how performance risks can reshape expectations.

Explore 2 other fair value estimates on RXO - why the stock might be worth just $14.24!

Build Your Own RXO Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RXO research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free RXO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RXO's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RXO

RXO

Engages in truck brokerage business in the United States, Canada, Mexico, Asia, and Europe.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives