- United States

- /

- Marine and Shipping

- /

- NYSE:NMM

Assessing Navios Maritime Partners After 28% Drop and Industry Supply Chain Shifts in 2025

Reviewed by Bailey Pemberton

Thinking about what to do with Navios Maritime Partners? You are certainly not alone. With the stock making big moves over the past few years, plenty of investors are sitting on the sidelines, wondering whether to hold, buy more, or head for the exits. Despite dipping 0.9% over the last week and falling 10.3% in the past month, the bigger picture tells a different story. The stock is still up 78% over three years and has delivered an eye-popping 597.1% over five years. That kind of long-term strength deserves a closer look, especially in a market where global shipping trends and evolving supply chain dynamics continue to shift perceptions of risk and return.

Now, the short-term pain cannot be ignored, with a 28.3% decline over the past year and a 5.5% drop year-to-date. Still, some of those declines are tied to volatility related to broader market uncertainties, not anything fundamentally broken in the company itself. So, does this create opportunity or signal a red flag?

If you are evaluating Navios Maritime Partners from a value perspective, it stands out with a valuation score of 4 out of 6, indicating it is undervalued based on the majority of common checks analysts use. But how do these valuation models compare, and is there an even better way to get a clear view of what the stock is really worth? That is exactly where we are headed next.

Why Navios Maritime Partners is lagging behind its peers

Approach 1: Navios Maritime Partners Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today. This approach aims to capture the present worth of all money the business is expected to generate, adjusted for the time value of money.

For Navios Maritime Partners, analysts have adopted a 2 Stage Free Cash Flow to Equity model to evaluate the company's true worth. At present, the last twelve months of Free Cash Flow stands at -$229 million. However, forward-looking estimates show a substantial turnaround, with annual free cash flows projected to reach $262 million by 2035, based on both analyst forecasts and extrapolations. By 2026, the company is expected to generate $45 million in free cash flow, accelerating to over $159 million by 2030, and ultimately exceeding $261 million at the decade mark.

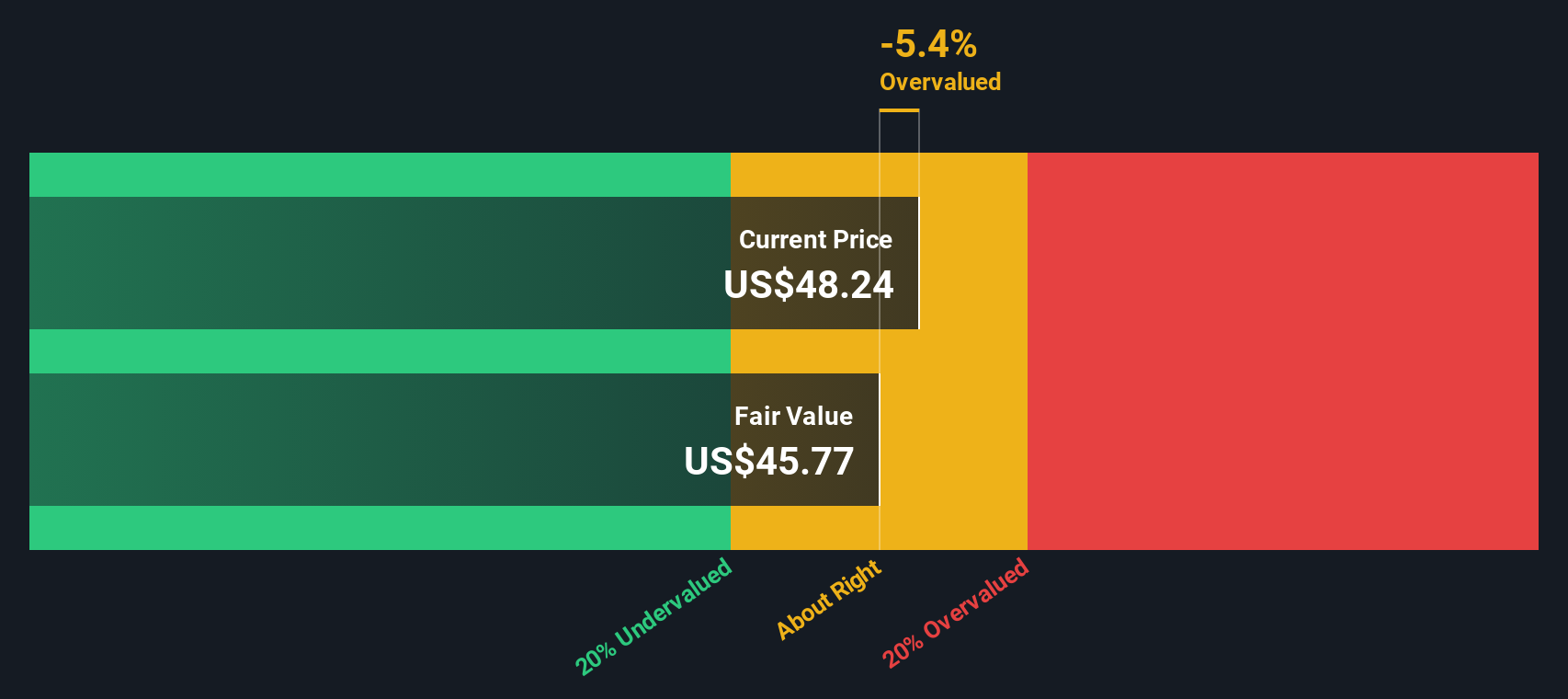

Running these projections through the DCF model results in an intrinsic value estimate of $44.68 per share. With this figure just 1.7% above the current market price, the stock appears priced roughly in line with its projected fundamentals, neither meaningfully under or overvalued.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Navios Maritime Partners's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Navios Maritime Partners Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies because it relates a company’s share price to its net earnings, providing investors with a quick snapshot of how much they are paying for each dollar of profit. This makes it especially relevant for companies like Navios Maritime Partners that have demonstrated sustained earnings, as it helps investors gauge whether the stock is priced attractively compared to its earnings power.

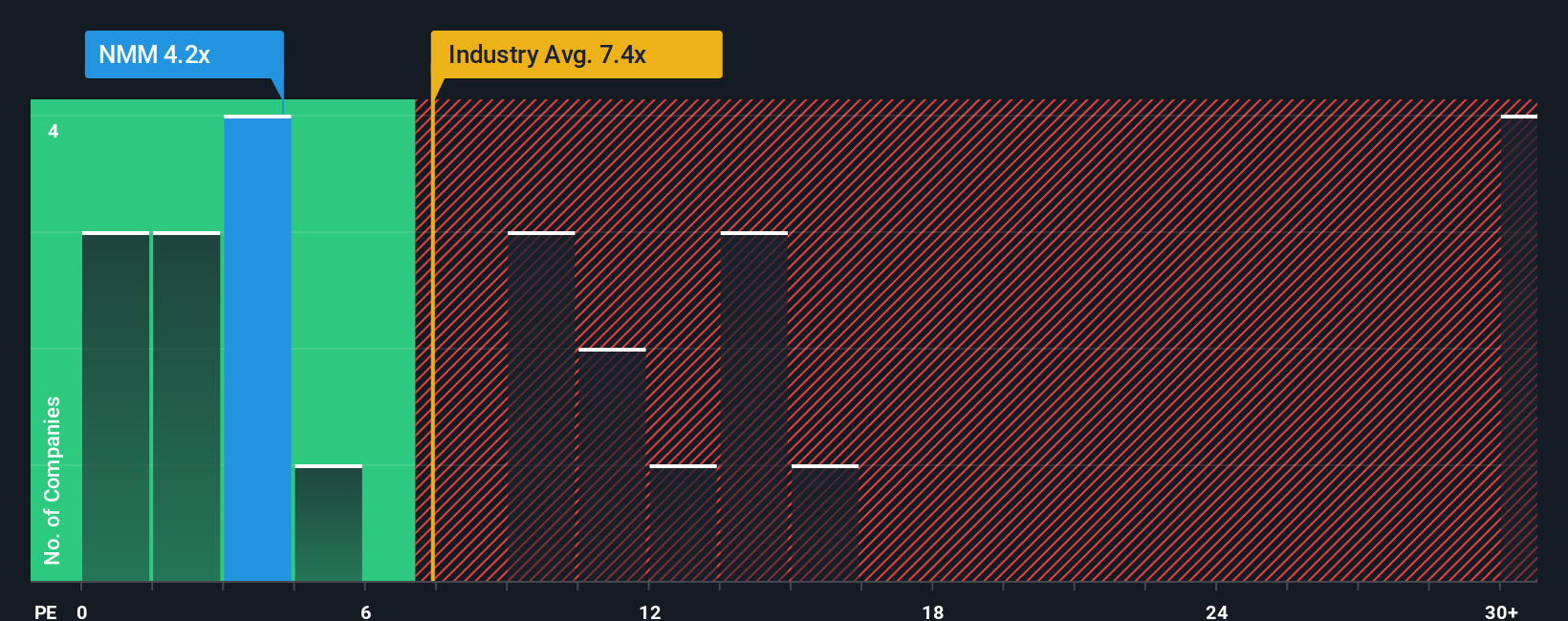

What constitutes a “normal” or “fair” PE ratio is influenced by growth prospects and risk. Fast-growing companies with consistent profitability and lower perceived risk often command higher PE ratios. Mature or riskier firms typically trade at lower multiples. For Navios Maritime Partners, the current PE ratio sits at 4.27x, noticeably below both the industry average of 7.89x and the peer average of 5.78x.

To go further than just comparing company and industry averages, Simply Wall St developed the “Fair Ratio” metric. This proprietary measure considers not just typical benchmarks, but also factors like earnings growth, profit margin, market cap, and risk profile. This gives a more tailored view of what a reasonable valuation should be for Navios Maritime Partners, considering its unique circumstances.

Based on this methodology, the Fair Ratio for Navios Maritime Partners is 11.81x, significantly above the current PE of 4.27x. Because the difference between the Fair Ratio and the actual PE ratio is substantial, this suggests the stock is undervalued when adjusting for its growth profile and risk factors.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Navios Maritime Partners Narrative

Earlier, we mentioned there is an even better way to understand a stock's true value. Let us introduce you to Narratives. A Narrative is a simple, story-driven approach that allows you to connect your perspective on the company's future, such as your views on revenue growth, margins, or industry trends, to a clear financial forecast and an estimated fair value for the stock.

On Simply Wall St’s Community page, anyone can create and share their own Narrative. This makes it a highly accessible tool used by millions of investors. Narratives help translate your beliefs into numbers, enabling you to see how your assumptions about Navios Maritime Partners compare with the market and other investors. When you input your Narrative, the platform compares your calculated fair value to the current price, giving you immediate clarity on whether you think the stock is a buy, hold, or sell for your strategy.

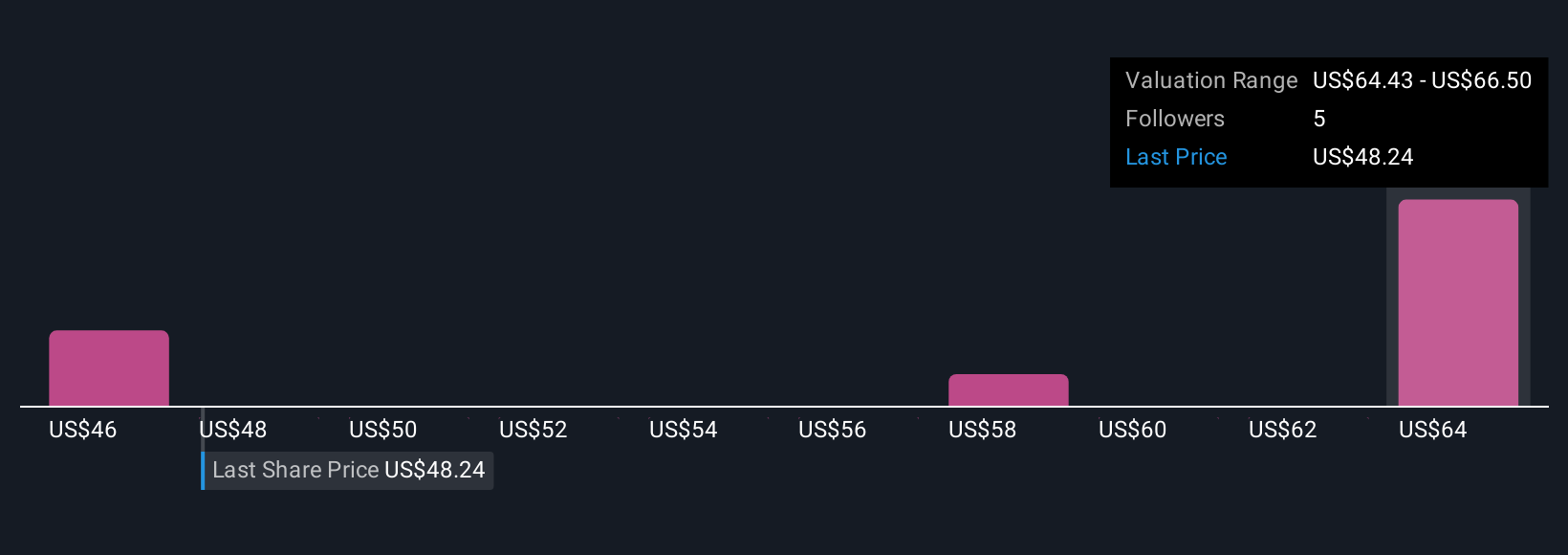

Narratives stay up-to-date automatically as fresh news or earnings releases are published, so your outlook stays relevant without extra effort. For example, some investors see future resilience in Navios due to investments in fleet renewal and shifting trade, valuing the stock at $66.5 per share. Others worry that overcapacity and costly expansion could pull fair value much lower. Whichever way you see the story unfolding, building your own Narrative lets you invest with confidence and logic rather than just headlines or ratios.

Do you think there's more to the story for Navios Maritime Partners? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Navios Maritime Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NMM

Navios Maritime Partners

Owns and operates dry cargo vessels in Asia, Europe, North America, and Australia.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives