- United States

- /

- Marine and Shipping

- /

- NYSE:NM

Sentiment Still Eluding Navios Maritime Holdings Inc. (NYSE:NM)

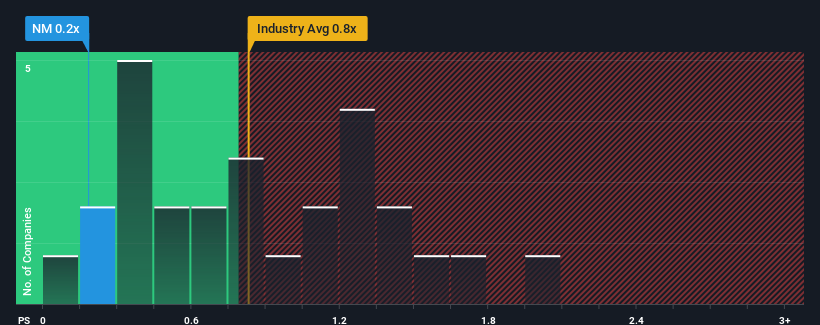

Navios Maritime Holdings Inc.'s (NYSE:NM) price-to-sales (or "P/S") ratio of 0.2x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Shipping industry in the United States have P/S ratios greater than 0.8x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Navios Maritime Holdings

How Navios Maritime Holdings Has Been Performing

Navios Maritime Holdings has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. Those who are bullish on Navios Maritime Holdings will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Navios Maritime Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Navios Maritime Holdings would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 14% last year. Still, lamentably revenue has fallen 47% in aggregate from three years ago, which is disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

It turns out the industry is also predicted to shrink 18% in the next 12 months, mirroring the company's downward momentum based on recent medium-term annualised revenue results.

In light of this, the fact Navios Maritime Holdings' P/S sits below the majority of other companies is unanticipated but certainly not shocking. In general, shrinking revenues are unlikely to lead to a stable P/S long-term, which could set up shareholders for future disappointment regardless. There is still potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Upon examining Navios Maritime Holdings, we found that its recent revenue decline over the past three-year is affecting its P/S ratio more than we initially expected, even though the wider industry is also expected to experience a decline in revenue. There could be some further unobserved threats to revenue preventing the P/S ratio from keeping up with the industry average. One major risk is whether the company can maintain its 'middle of the road' medium-termrevenue growth under these tough industry conditions. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You should always think about risks. Case in point, we've spotted 1 warning sign for Navios Maritime Holdings you should be aware of.

If you're unsure about the strength of Navios Maritime Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Navios Maritime Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NM

Navios Maritime Holdings

Navios Maritime Holdings Inc. operates as a seaborne shipping and logistics company in North America, Australia, Europe, Asia, South America, and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives